Uber has rapidly transformed mobility across the globe through operational excellence, product innovation, and strategic investment in competitors. As Uber continues to expand, the company is leveraging its technology and data platform to transform other businesses that rely on transportation such as meal delivery and freight. With over 15 million trips completed every day and more than 10 billion trips completed since its inception in March 2009,1 Uber has established itself as a dominant player in the transportation realm.

What can marketplace founders and investors learn from Uber’s path to IPO? Here are five drivers that were instrumental to Uber’s success:

- Though unprofitable today, strong unit economics show a clear path to net income: Uber’s payback period is expected to be fewer than 4 months.

- Massively scale the creation of marketplaces through repeatable playbooks and data democratization.

- If you can’t beat them, join them: Opportunistically create value in international markets through partnerships and investments when stand-alone strategy is unviable.

- Drive share of wallet (for riders) and share of income (for drivers) through incremental services.

- You don’t have to be first, but definitely need to be fast.

1. Though unprofitable today, strong unit economics show a clear path to net income: Uber’s payback period is expected to be fewer than 4 months.

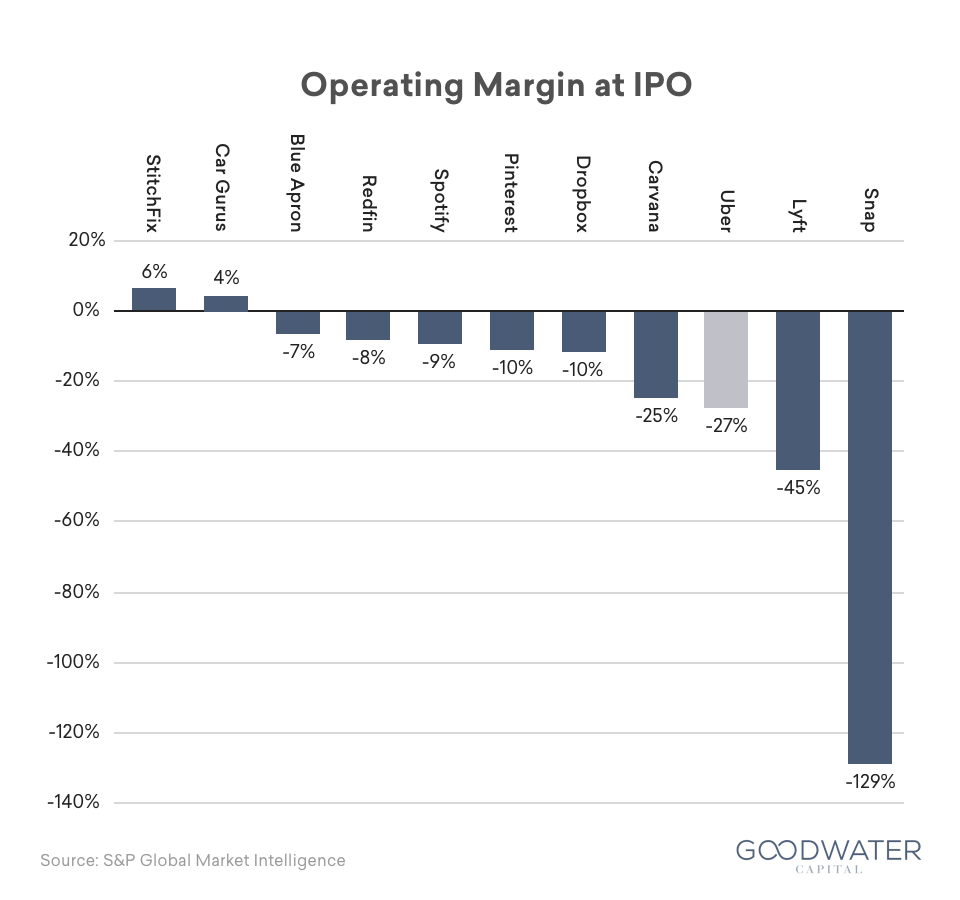

While unprofitable now, Uber’s upfront investment paired with effective execution can fuel future growth and long-term potential for value-creation. In Uber’s case, the company’s operating margin at the time of IPO is at -27%, only higher than that of Lyft and Snap when compared with recent consumer tech IPOs.

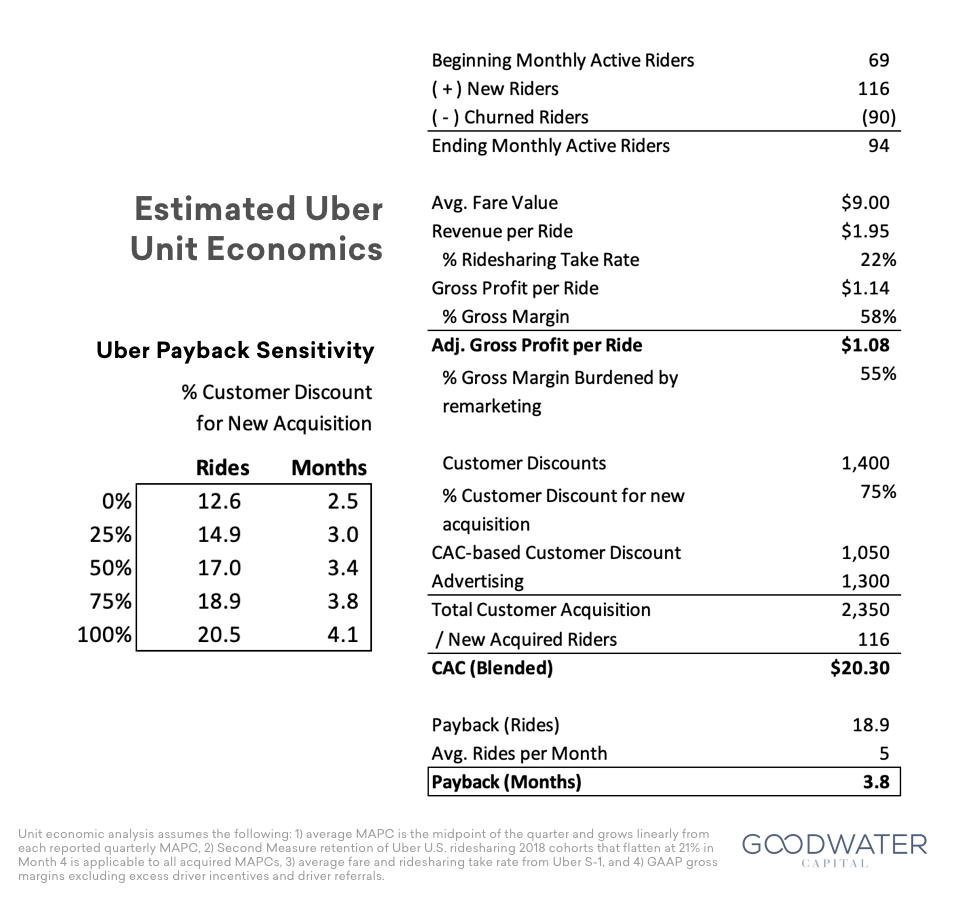

Despite being unprofitable, the company has fundamentally favorable unit economics: our analysis estimates that the potential rider payback period is only 4 months.2 This assessment is primarily based on US ridership retention; if Uber can continue to replicate its laudable domestic retention numbers internationally, there will be more opportunity to create long term value. Today, Uber currently accounts for fewer than 1% of all miles driven globally,3 and only 2% of the population in Uber-occupied countries have used the service before.4 Indeed, there is open-road for Uber to create more value.

2. Massively scale the creation of marketplaces through repeatable playbooks and data democratization.

Uber has scaled impressively, and now operates in over 700 cities throughout 63 countries across the world.5 Uber’s ability to scale rapidly is driven by its methodical, franchise-like approach to expansion, in the form of a repeatable “playbook.” This playbook focuses on growth, strong operations, and managerial autonomy. For each new market, a city general manager is hired, who then hires operations and community managers. Unlike purely digital businesses, having a physical presence in a new market is critical for Uber. The playbook’s strong operational focus creates a robust infrastructure to effectively onboard drivers, verify paperwork, and interact with local officials on the ground. The general managers are given autonomy to shape the playbook to fit the local market’s needs, enabling Uber to rapidly tap supply-rich markets and scale the business.

In addition to a playbook, democratized data-driven decision making is central to Uber’s operations. By aligning the team around the goal of making “transportation as reliable as running water”6 and building dashboards to make large amounts of data accessible to all, Uber empowers all of its employees to effectively make data-informed decisions. These dashboards allow general managers to derive insights that facilitate troubleshooting and adaptation as issues arise in local markets. These quick “on-the-fly”, but informed, decisions enable Uber to expand very quickly and deliberately.

3. If you can’t beat them, join them: Opportunistically create value in international markets through partnerships and investments when stand-alone strategy is unviable.

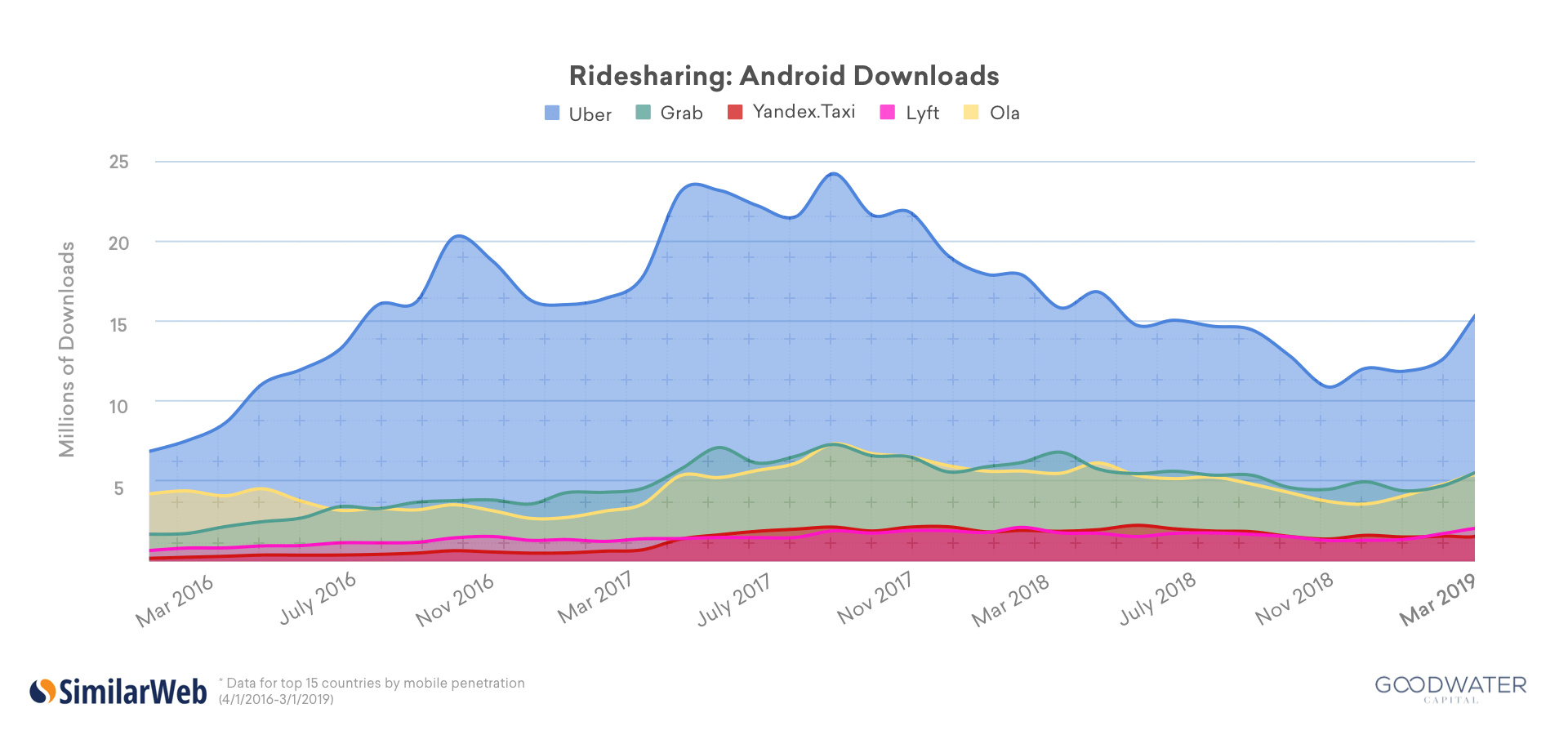

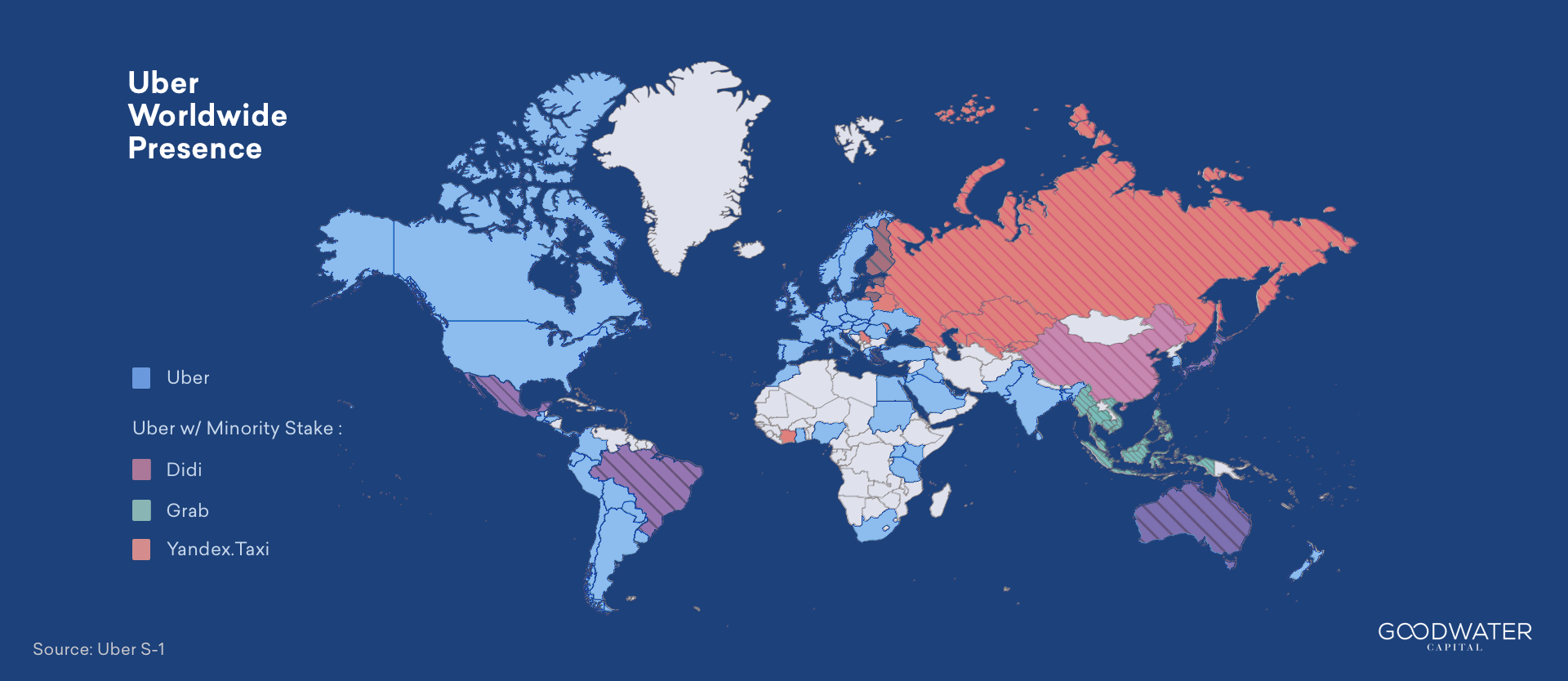

To achieve exponential growth and create value, Uber recognized early that international expansion should be a priority and made Paris its 3rd launch city.7 By leveraging its playbook and aggressively deploying capital, which was facilitated by massive fundraising rounds, Uber expanded quickly across the world. As Austin Geidt, Uber’s Global Head of Expansion, stated when asked about their expansion plans back in 2014: “If we’re not there now, we’ll be there in a week.”8 Although Uber made impressive headway in foreign markets, their success also made them a target. Well-funded local challengers soon replicated and improved upon Uber’s model and quickly pushed the ride-sharing giant out of several large markets such as China and Southeast Asia.9

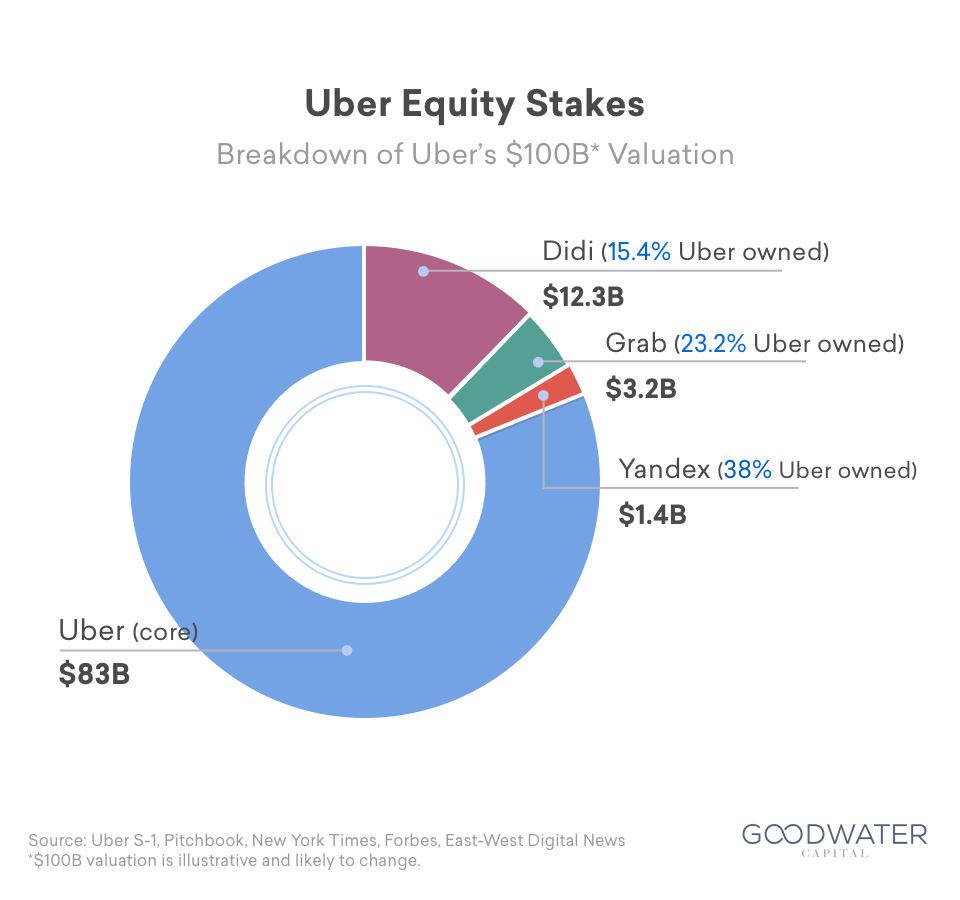

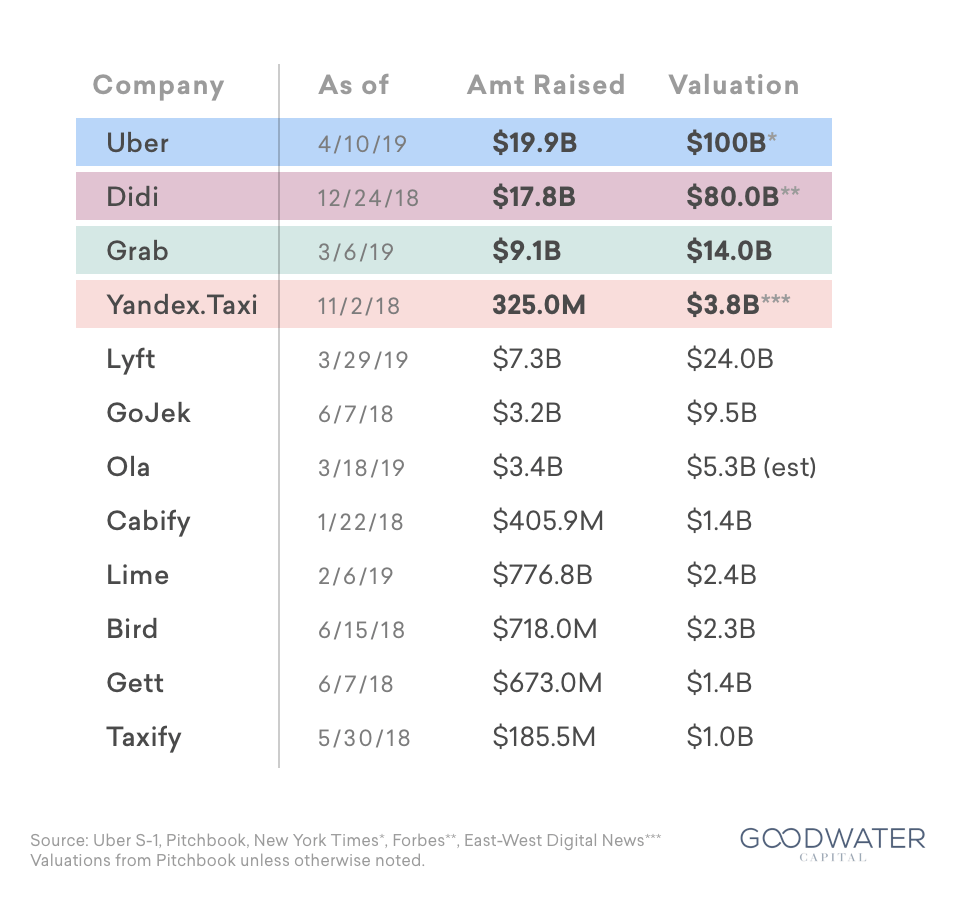

While some may see retreat as a failure, Uber’s early and aggressively sought international position actually provided an opportunity. Instead of completely giving up on markets, Uber used its leverage as an established player to acquire stakes in local competitors. As a result of this shrewd strategy, the company owns 15.4% of Chinese Didi, 38% of Russia’s Yandex Taxi, and 23.2% of Southeast Asia’s Grab.10 As of the end of 2018, Uber holds nearly $18 billion dollars worth of so-called competitors, a number which represents around 20% of Uber’s massive IPO valuation.11

4. Drive share of wallet (for riders) and share of income (for drivers) through incremental services.

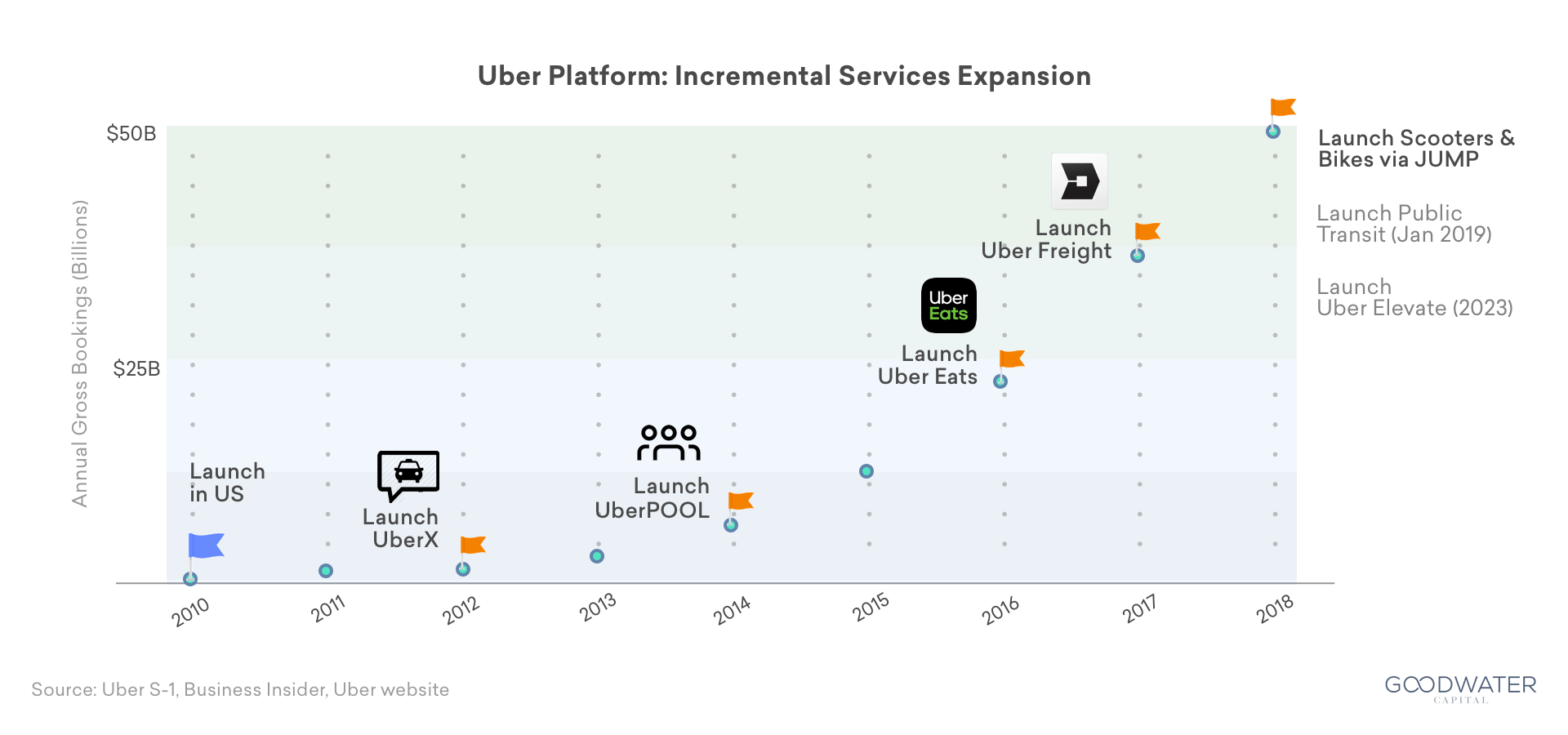

Similar to how an enterprise software suite adds features to entice customers to stay within the ecosystem, Uber has embarked upon a similar strategy with transportation use cases. For example, the company has expanded its mobility services to include New Mobility (scooters and bikes), public transit,12 freight, and even has aerial transport aspirations in the form of “Uber Elevate.”13 By introducing new products that add incremental value for users, Uber creates opportunities to capture a larger share of the consumer wallet, while also retaining and generating additional income for drivers as well.

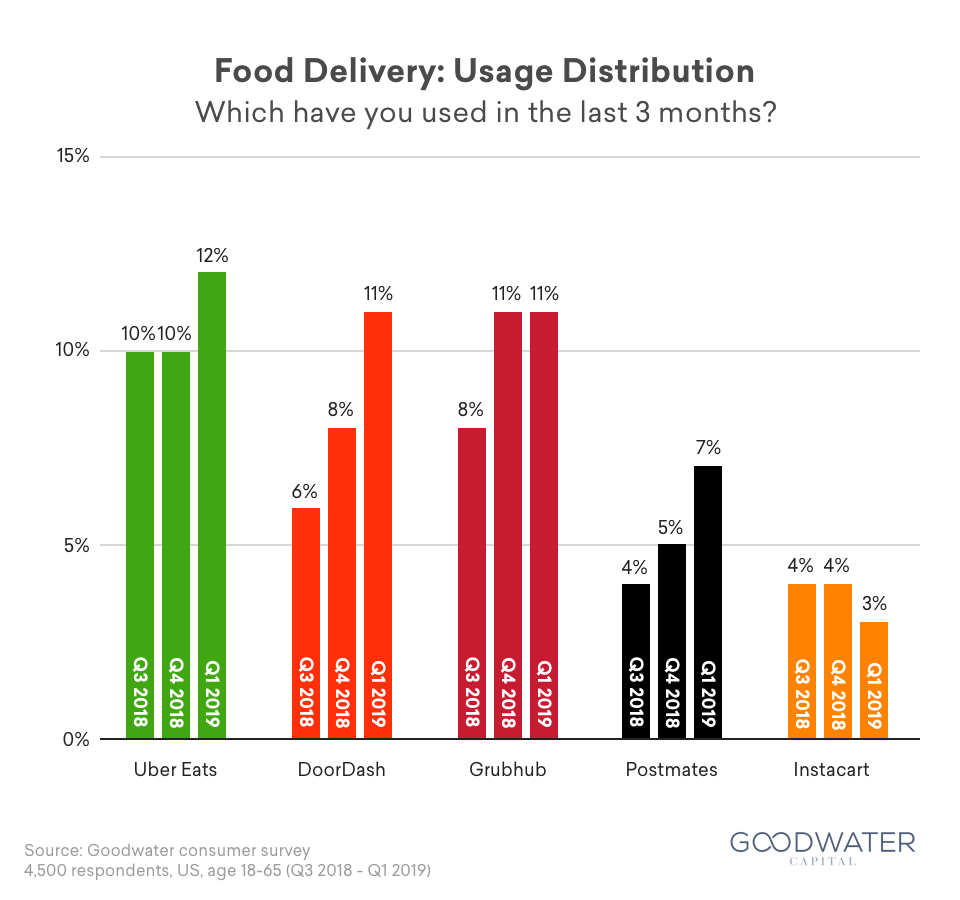

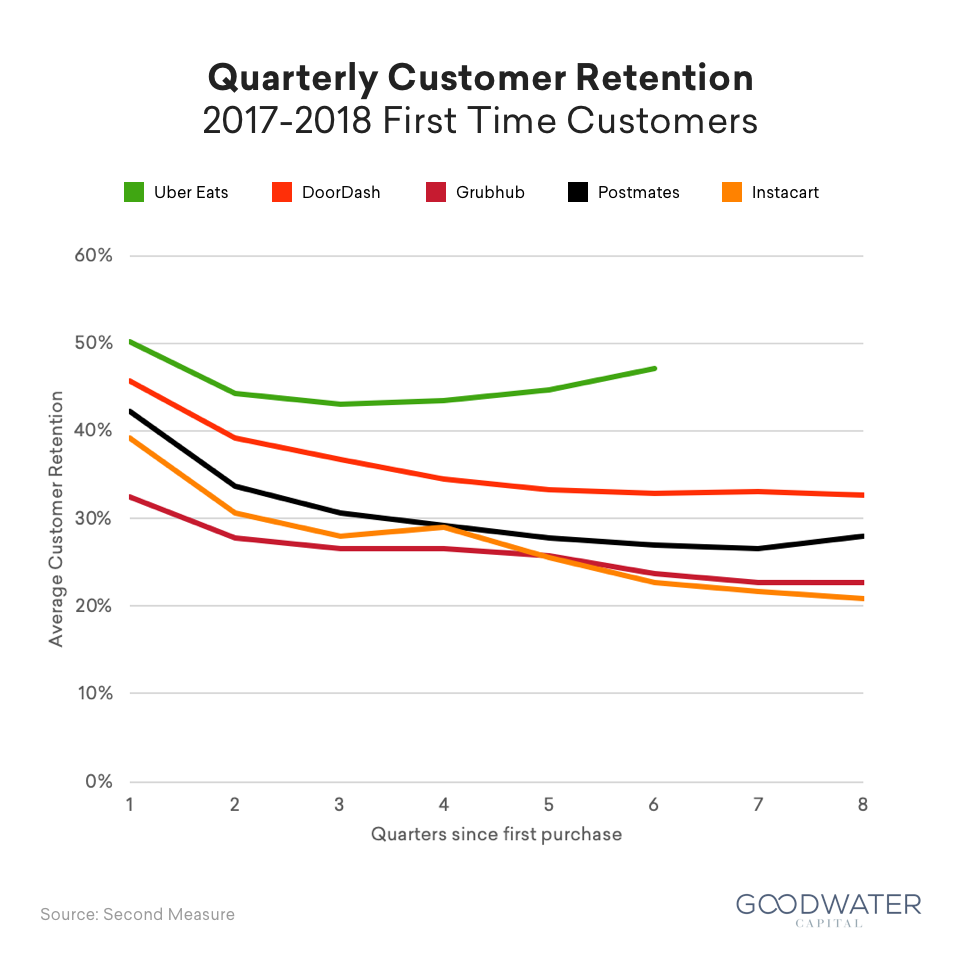

The most notable example of this strategy is Uber Eats. Consumers who utilized both Uber and Uber Eats booked an average of 11.5 trips per month, versus only 4.9 trips for those using only a single Uber service.14 Consumers benefited from an additional convenient service, and drivers gained a new source of trips which generated a more steady stream of bookings throughout the day, which in turn increased the overall supply of drivers.15 With drivers now busier and making more consistent income, they have less reason to dual-app (i.e. drive for a competing service as well). While Goodwater’s consumer survey indicates that Uber Eats is growing more slowly in the US than competing food delivery services, its significantly higher customer retention rate is a strong early indicator of the benefits of adding incremental services to the Uber platform.

5. You don’t have to be first, but definitely need to be fast.

Though Uber is currently the global ridesharing leader, the company was actually a fast follower in the sector. Competitor Lyft and former competitor Sidecar (which shuttered back in 2015) actually pioneered ridesharing as it is known today, which entails using non-professional, non-commercially insured vehicles and drivers. In fact, Uber initially worked exclusively with commercially licensed, insured and regulated entities (known as Black Cars in many areas) before transitioning to the current ridesharing model.16

As a fast follower, Uber executed and expanded rapidly and relentlessly, providing consumers around the world with a convenient and reliable ridesharing experience. The company utilized its playbooks and data-driven decisions to drive operational excellence, leading to market dominance in many regions. In fact, Uber followed a market entry pattern that has proven successful for business entities in the past – Myspace preceded Facebook, Yahoo preceded Google, and Blackberry preceded Apple’s iPhone. Historical patterns of transformation suggest that being first does have its advantages, but entering the market early and iterating quickly is even more vital when it comes to dominating a market.

- Uber, https://www.uber.com/newsroom/company-info/

- Unit economic analysis assumes the following: 1) average MAPC is the midpoint of the quarter and grows linearly from each reported quarterly MAPC, 2) Second Measure retention of Uber U.S. ridesharing 2018 cohorts that flatten at 21% in Month 4 is applicable to all acquired MAPCs, 3) average fare and ridesharing take rate from Uber S-1, and 4) GAAP gross margins excluding excess driver incentives and driver referrals

- UBER S-1, at page vi.

- UBER S-1, at page 2.

- UBER S-1, at page 1 – 2.

- Uber, https://www.uber.com/en-AU/blog/melbourne/transportation-that-is-as-reliable-as-running-water/

- TechCrunch, https://techcrunch.com/2011/12/05/uber-launches-its-first-international-efforts-in-paris/

- Bloomberg, https://www.bloomberg.com/news/articles/2014-11-20/ubers-international-launch-playbook-includes-some-tough-lessons

- TechCrunch, https://techcrunch.com/2022/09/11/uber-global-exits-billions/

- UBER, S-1, at page 108.

- The New York Times, https://www.nytimes.com/2022/09/10/technology/uber-ipo.html; Forbes, https://www.forbes.com/sites/greatspeculations/2018/12/24/is-80-billion-valuation-achievable-for-didi-chuxings-ipo/#5a3cb6636211; EWDN, http://www.ewdn.com/2018/11/02/yandex-taxi-asserts-market-leadership-announces-new-acquisitions/

- Business Insider, https://www.businessinsider.com/uber-public-transit-launches-in-denver-mobile-bus-and-train-tickets-2019-1

- Uber, https://www.uber.com/us/en/elevate/

- UBER S-1, at page 5.

- UBER S-1, at page 8.

- Internet Archive The Wayback Machine, https://web.archive.org/web/20150910144736/https://newsroom.uber.com/2013/04/uber-policy-white-paper-1-0/