Executive Summary

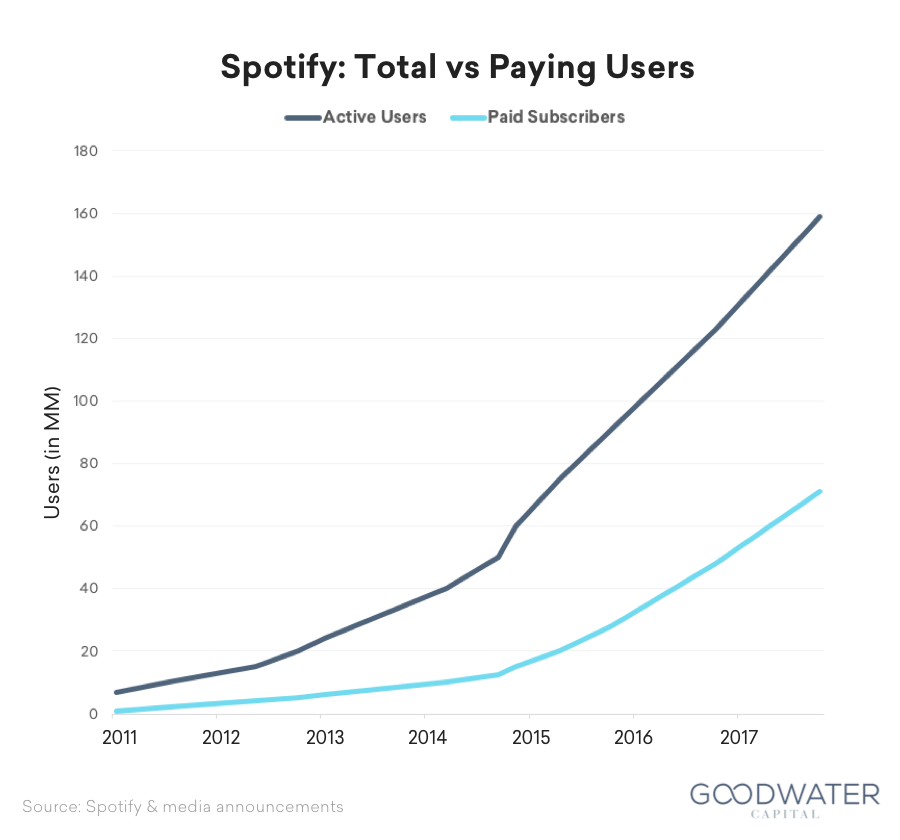

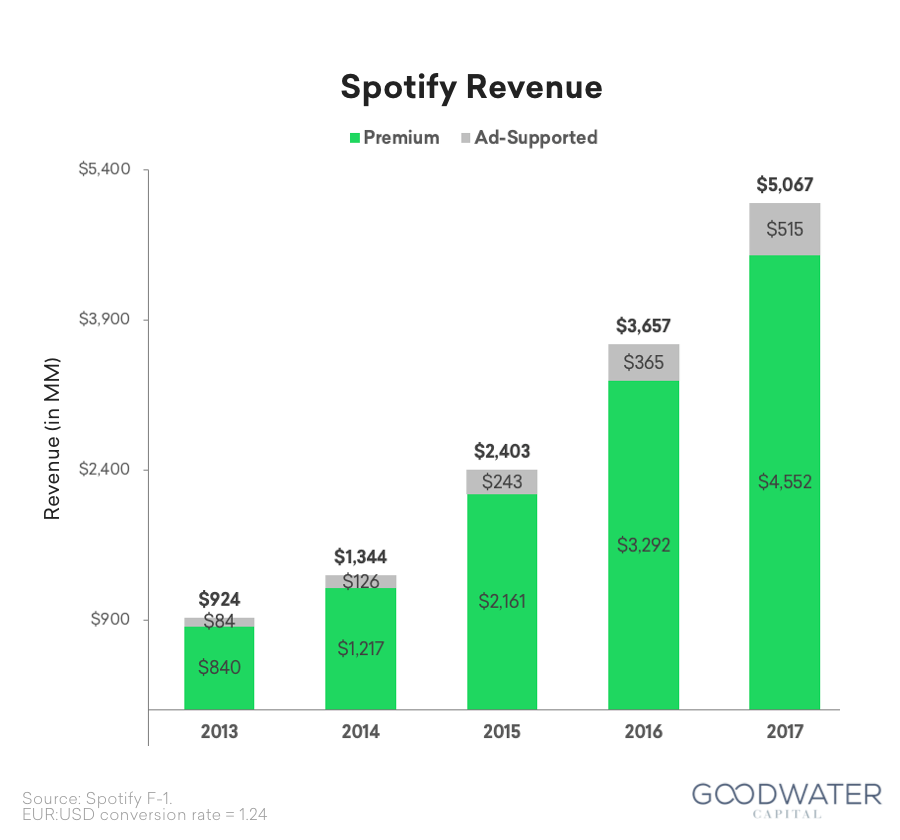

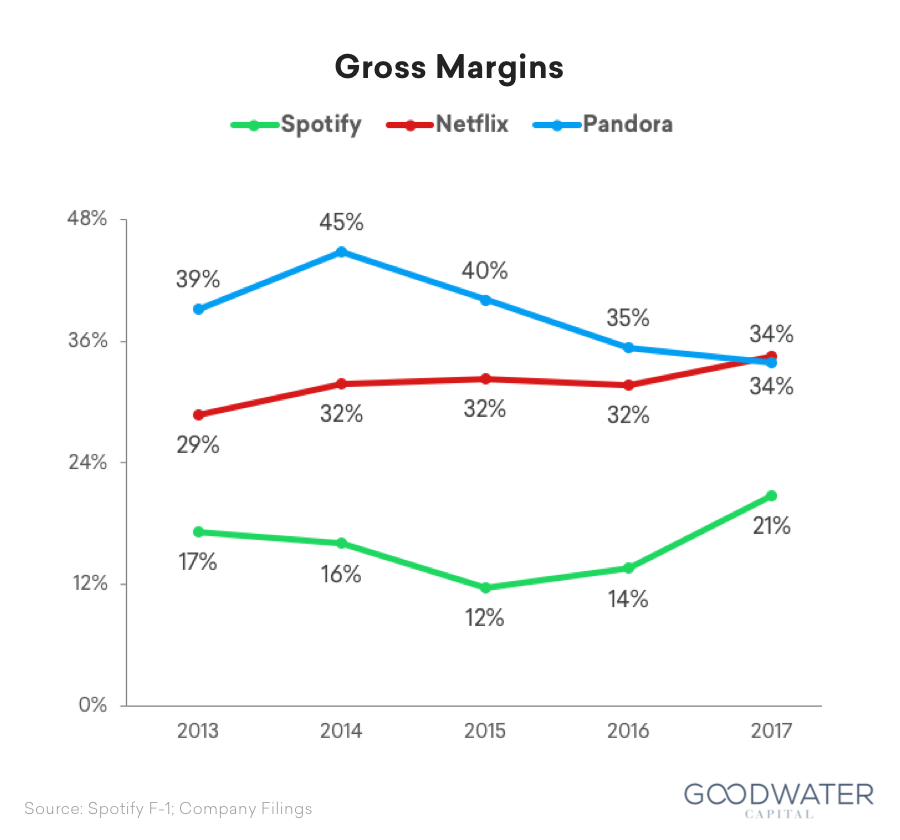

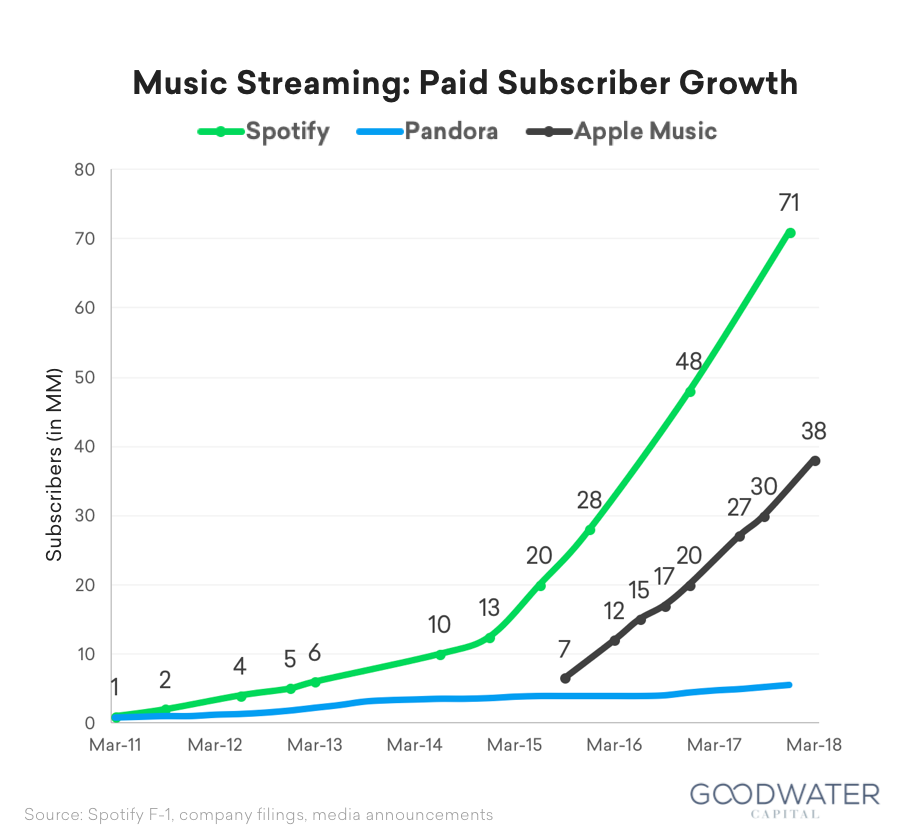

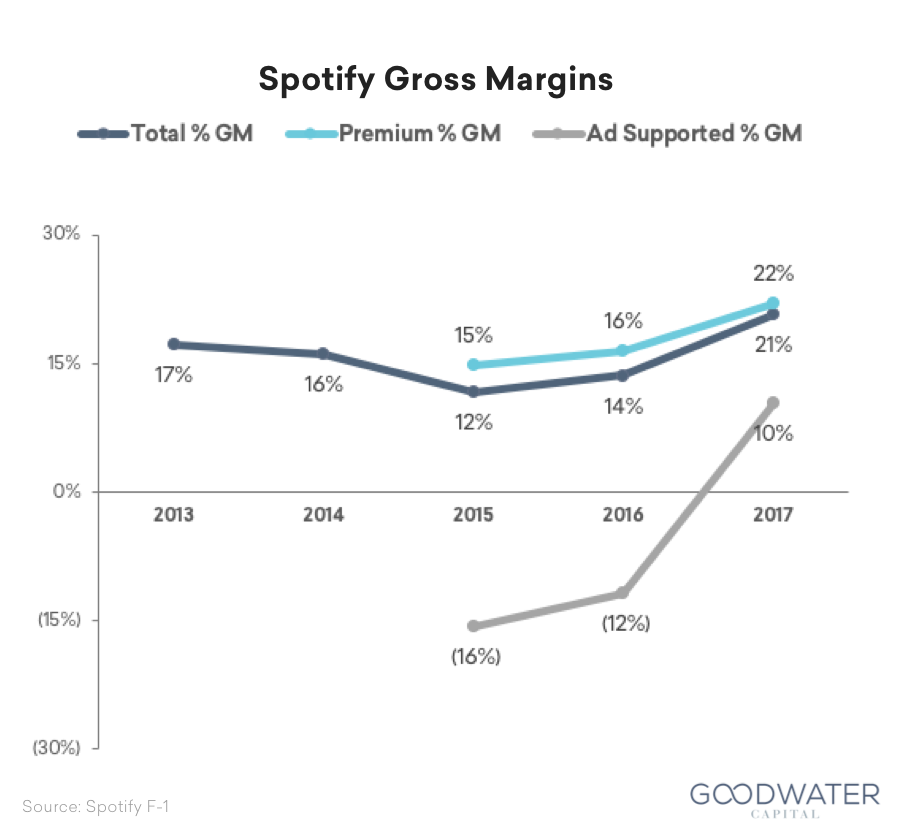

Spotify is the world’s largest music streaming subscription service, and has played a key role in transforming how consumers experience music by offering unprecedented convenience, accessibility, and data-driven personalization to drive discovery and engagement. Founded in 2006 in Sweden, the company has 71 million paying subscribers and 159 million MAUs across 61 markets as of December 31, 20171. From 2015 to 2017, the company increased revenue to over $5 billion (a 45% 2-year compounded annual growth rate) while expanding gross margins from 12% to 21%2. Spotify’s streaming access model reversed the industry’s declining revenue trend, unlocking revenue and adding value for consumers, artists, and all players in the music ecosystem. As Spotify enters a new phase of growth post-IPO, the company will be focused on leveraging data to further enhance its platform, growing its customer base via expansion into new markets, and achieving profitability.

The Market Opportunity

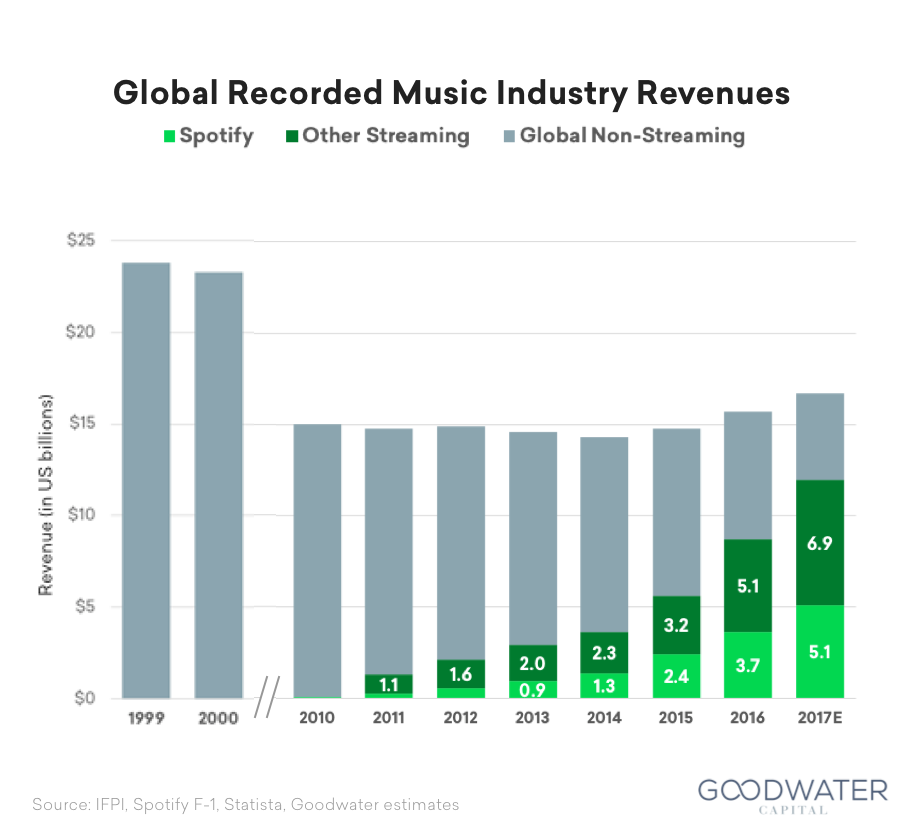

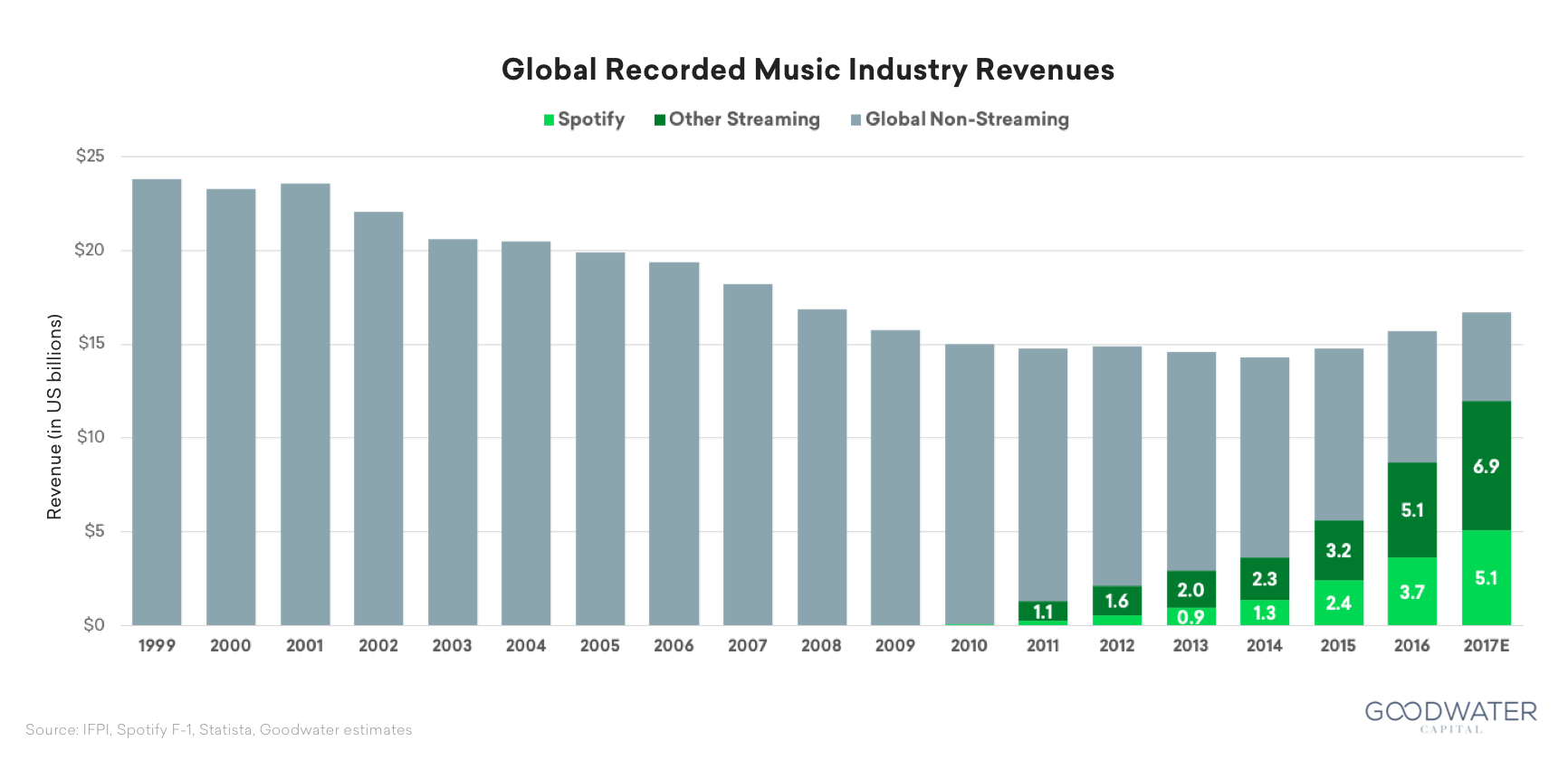

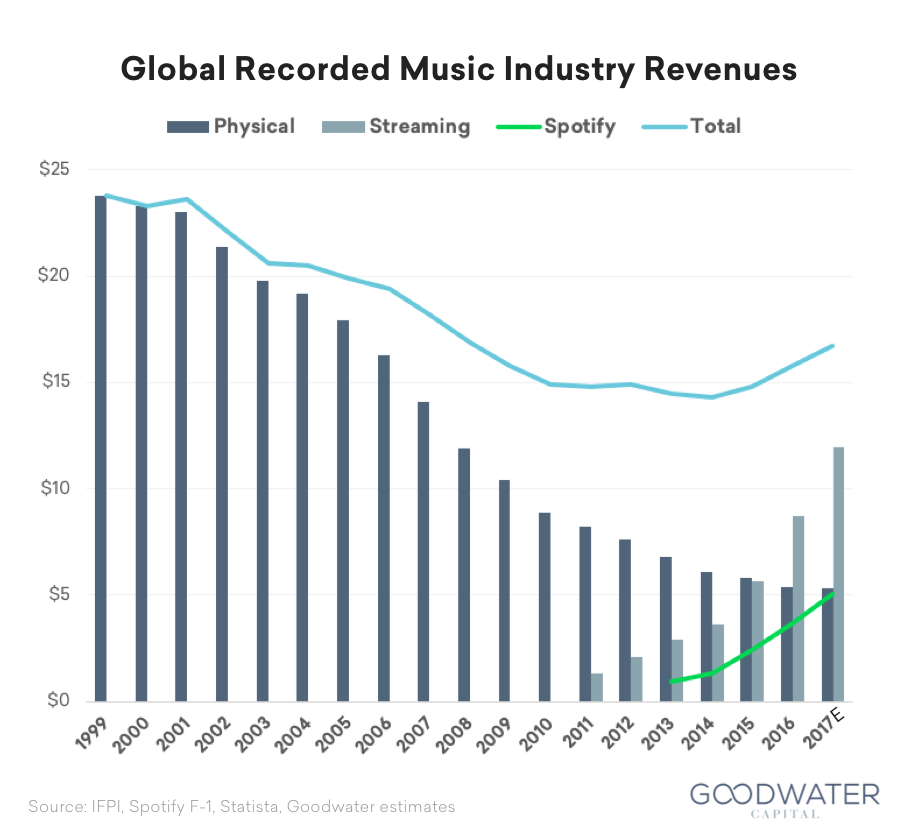

The first wave of internet-based music services (Napster et al.) facilitated piracy and illegal digital distribution, significantly reducing global music revenues, which declined by 40% from $23.8 billion in 1999 to $14.3 billion in 20143. Sixteen years of annual revenue declines coupled with poor and unreliable customer experiences in pirated music created a market where both publishers and consumers were receptive to a new solution. Spotify’s streaming model was a key driver of the music industry’s inflection point; from 2011 to 2017, the streaming category grew from 9% of revenues to 72%4. In 2016, global music revenues reached its highest annual growth rate in 20 years, increasing 6% to reach $15.7 billion. Spotify’s revenue represented 23% of the global music market in 2016 and 30% in 20175. More importantly, it now represents 42% of the streaming music market – the largest and fastest growing portion of the market6. The company is well-positioned to scale its user base and capture revenue opportunities in recorded music and more broadly in the music industry.

Winning Strategies

What can entrepreneurs and investors learn from Spotify’s path to IPO?

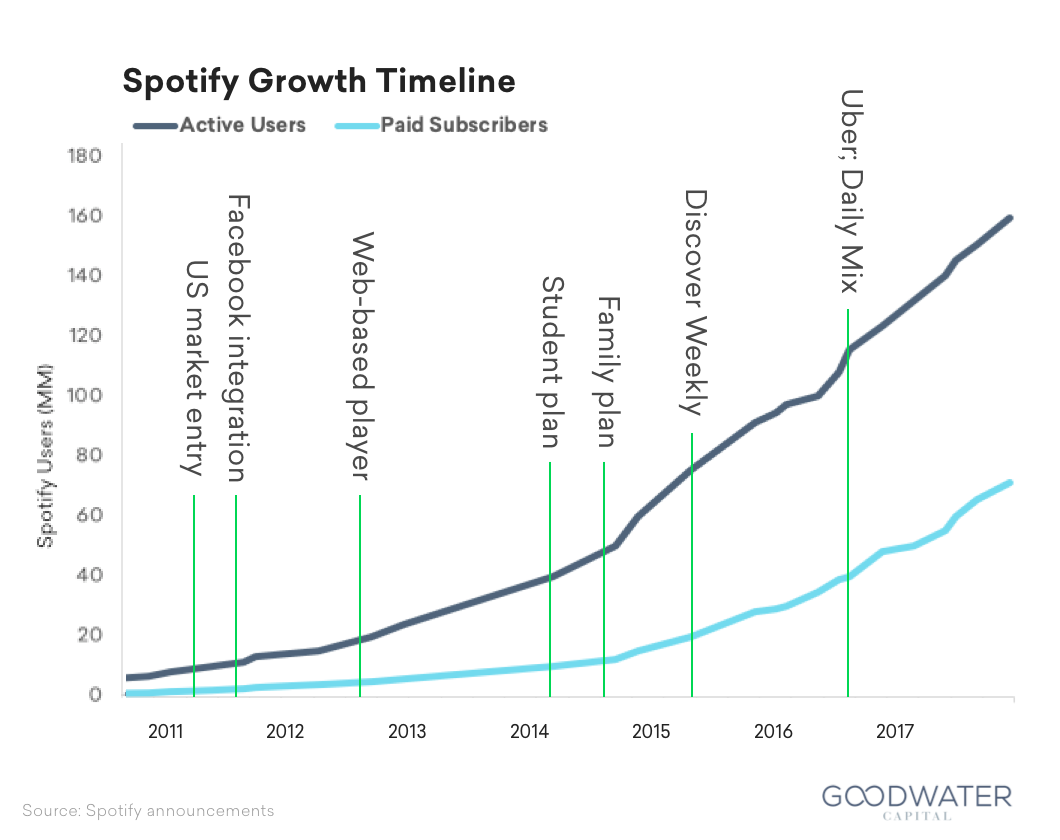

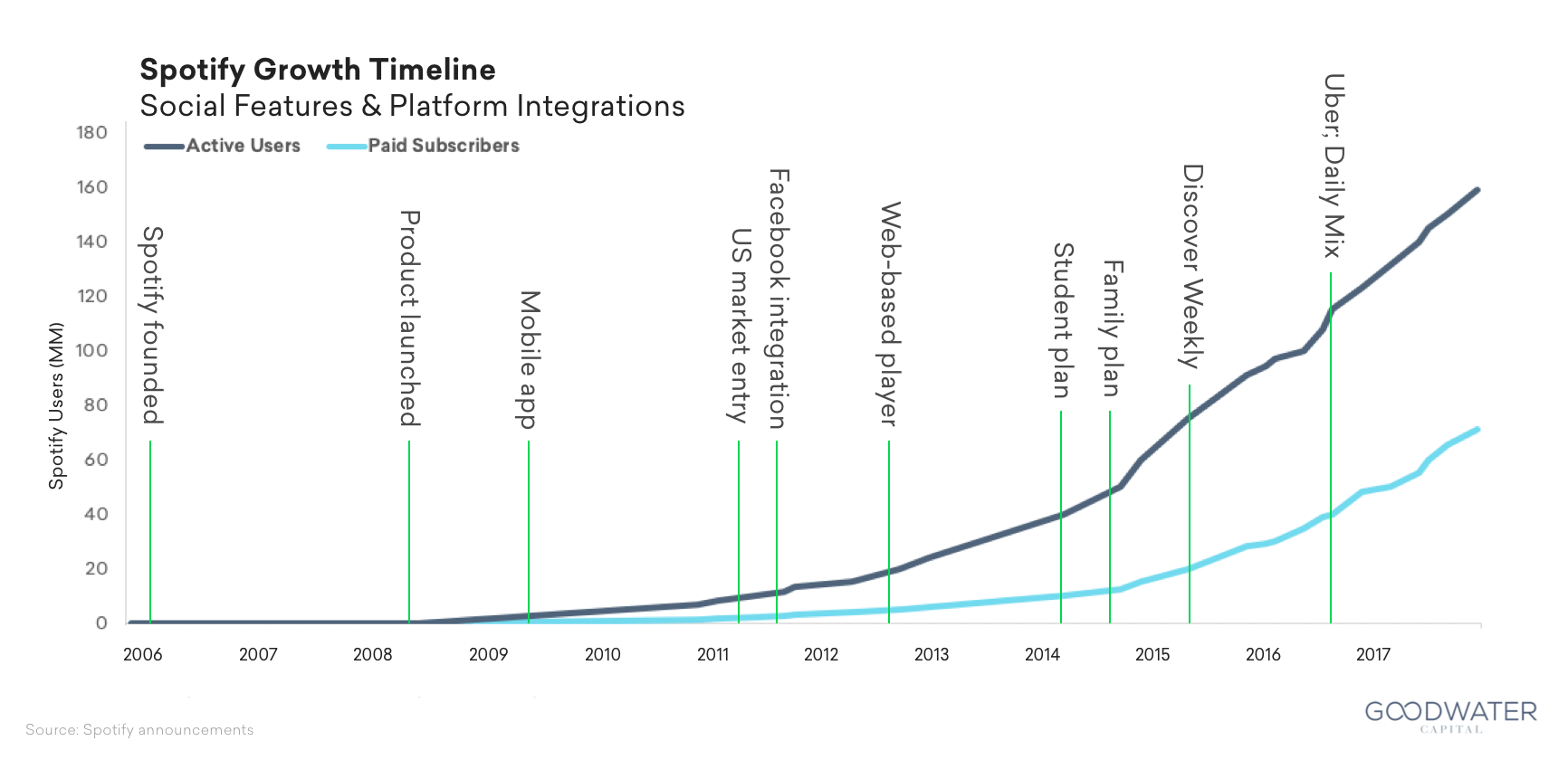

- Build scale through an organic & controlled go-to-market strategy. Spotify’s go-to-market strategy enabled it to organically build a large audience through controlled scaling by geographic region. By rolling out in Europe (2008) and the United States (2011) with an invite-only system, the company generated buzz and increased demand through perceived scarcity. This strategy also equipped Spotify with a lever to control growth given its variable cost structure, incurring royalty costs for each new user who listens to songs. Spotify also launched a freemium service, attracting a large initial audience and expanding the market by offering a solution that bridged customers from legacy music options like iTunes and piracy software into a streaming music experience.

- Harness social platforms to increase distribution and drive network effects. Spotify leveraged music’s inherently social nature to drive sharing and discovery amongst users. Unlike earlier music piracy services that destroyed value for music industry revenues with each share, Spotify created a viral loop that increased the value of the market and network with each new user. Spotify’s growth-oriented social features such as shared links, shared playlists, and aggressive integrations with social networks like Facebook in 2011 catalyzed rapid audience growth. The company subsequently launched innovative integrations with platforms like PlayStation (2014) and Uber (2016).

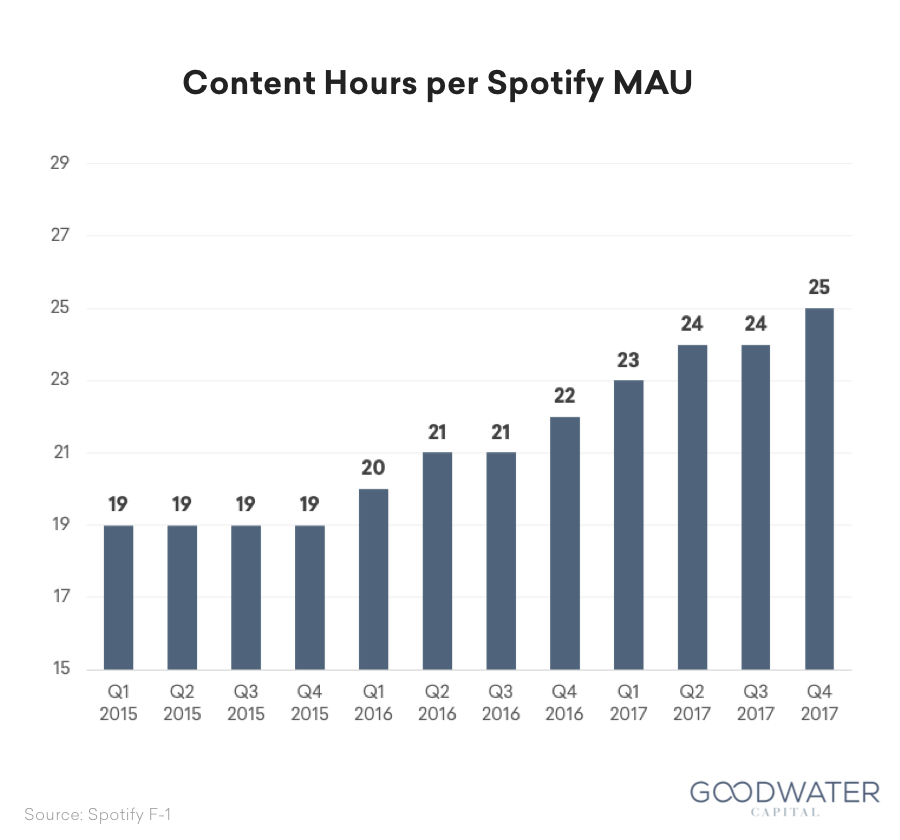

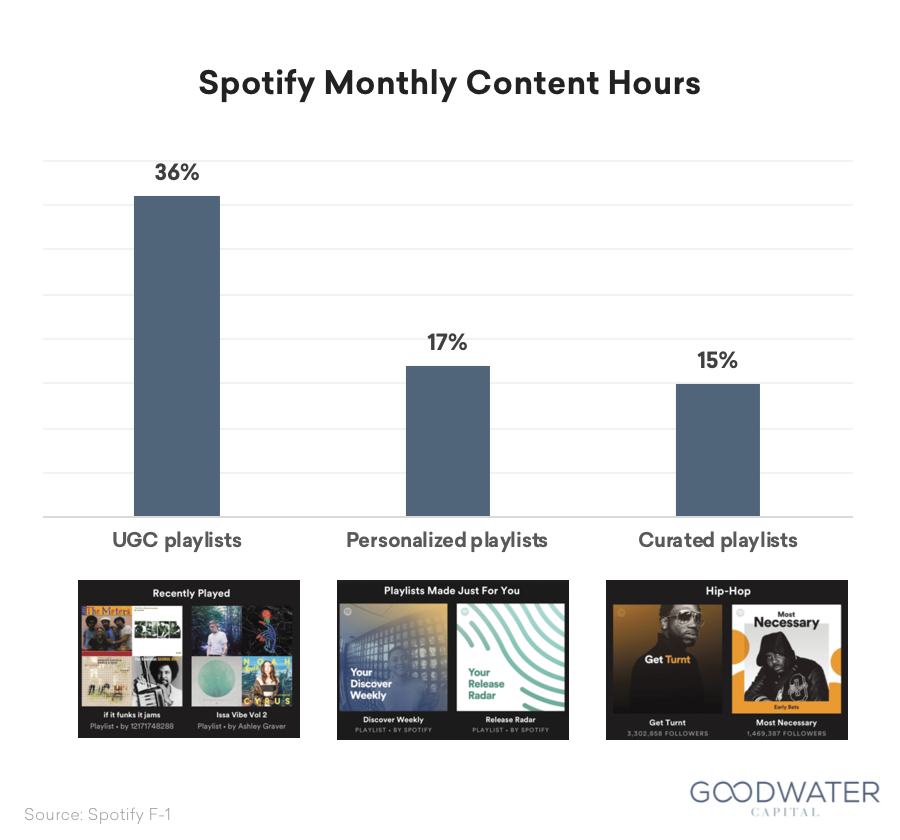

- Disrupt existing models with new ones better aligned with consumer needs. By introducing an all-you-can-eat utility service for a fixed monthly subscription, Spotify offered a clear consumer value proposition that unlocked an audience of customers willing to pay for music and increased revenue across the music ecosystem. As the company accumulated data from its growing user base on music tastes and preferences, Spotify expanded from utility to discovery, offering users data-driven personalization that drove both discovery and engagement. In Q4 2017, the average Spotify MAU consumed 25 hours of content per month, and 44% of MAUs accessed Spotify daily7. Spotify’s large captive audience further enabled its momentum in building out a two-sided marketplace, connecting and benefiting both creators and consumers. Spotify provides a platform for creators to monetize their work, connect with their fans, and access analytics to better understand and grow their business. Playlists are critical to the marketplace, enabling discovery for both consumers and artists: listening time for personalized and curated playlists increased from less than 20% two years ago to 31% in 20178.

- Introduce new paradigms in large markets facing systemic challenges or uncertainty. The first wave of internet-based music services facilitated piracy and illegal digital distribution, significantly impacting global music revenues which declined by 40% from $23.8 billion in 1999 to $14.3 billion in 2014. Piracy also delivered a poor customer experience as polluted BitTorrent networks left consumers unable to consistently access high quality music. With the industry’s declining performance, Spotify’s entry into the music market was timely – publishers and labels were receptive to trying new revenue models to revive growth, while consumers were ready to adopt a new paid option to access an unlimited jukebox. Furthermore, music labels have fixed production costs and little-to-no variable costs for incremental distribution, incentivizing them to forgo exclusive contracts and widely distribute their songs on every platform.

The Next Level

How does Spotify continue building a market-leading franchise in music and entertainment?

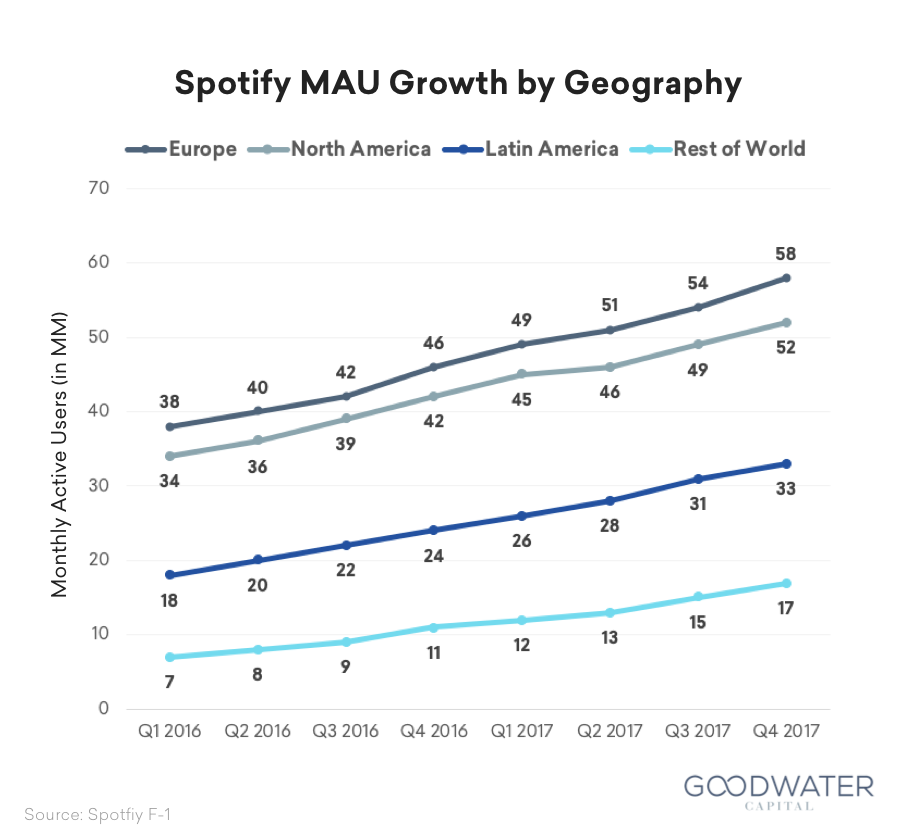

- Grow users in existing and new markets. Spotify is available in 61 countries and territories, but only 13% of payment-enabled smartphones in those markets have used the platform9. Europe is Spotify’s largest region, accounting for 37% of total users, followed by North America at 32%. The fastest growing regions are Latin America which grew 37% in 2017 to 21% of total Spotify users, and rest of world which increased 51% to 10% of MAUs10. To increase its penetration rate in existing markets, Spotify will continue enhancing the product’s freemium service, personalization, and content offerings. Spotify will also expand geographically into new markets, which requires optimizing for local music preferences and obtaining rights to local content and curators.

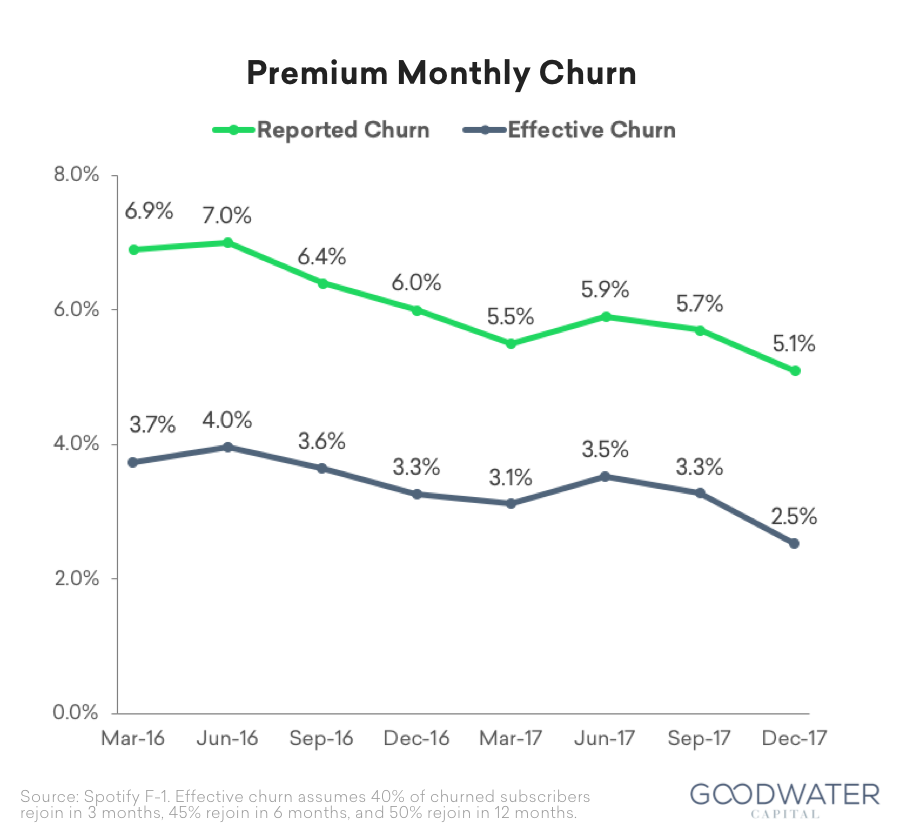

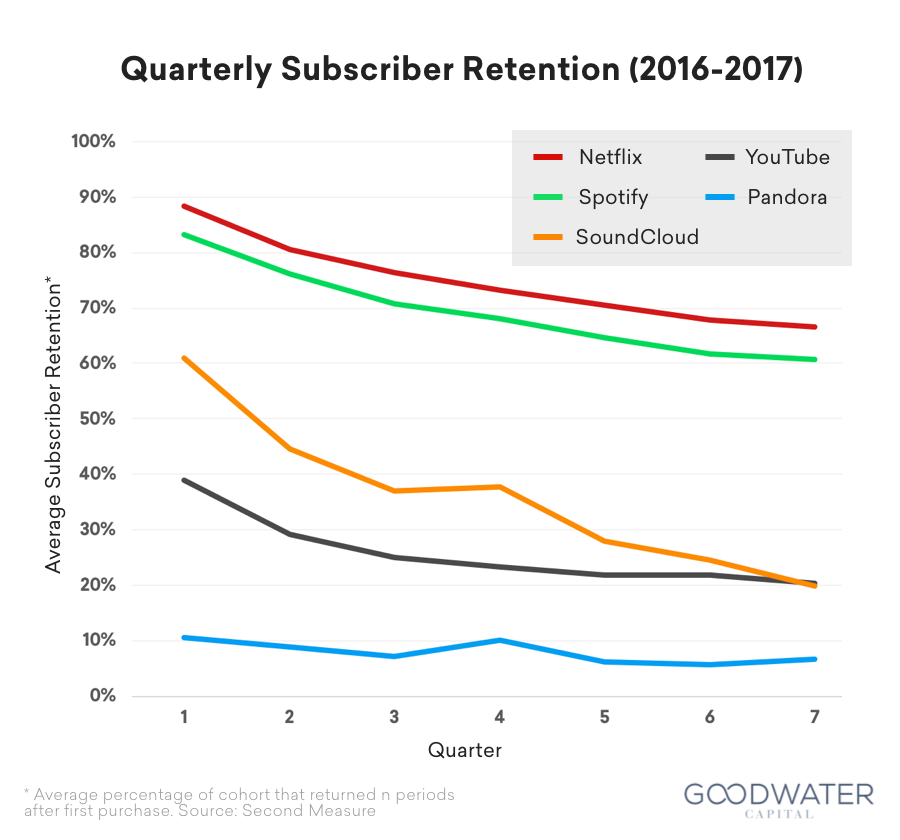

- Enhance the platform to retain and convert users. With increasing competition in the streaming music market, Spotify will enhance its product offering to not only drive continued engagement and conversion from existing users, but also to attract new users. The company reports a nominal monthly customer churn of 5%11, but 40% of its churned premium subscribers rejoin the platform within 3 months, yielding an effective monthly churn of 3% – 4%. Spotify will continue to make strategic acquisitions, invest in research and development that leverages data to deepen personalization, and expand on its platform-agnostic strategy to increase its presence and network effects among users. While individual songs are not exclusive and can be accessed from other music services, Spotify seeks to differentiate and keep users on its platform with its superior user experience, curated playlists, discovery mechanisms, and data-driven personalization.

- Improve gross margins through audience scale. While Spotify successfully scaled an audience and built out an impressive library of content, the company is still unprofitable and faces notable challenges toward profitability. Spotify’s biggest hurdle to profitability is at the gross margin level where it pays out more than 70% of its revenue in royalties12. In parallel with investing in direct artist relationships, Spotify needs to leverage its sizeable and growing audience to negotiate increasingly favorable contracts with labels to improve gross margins.

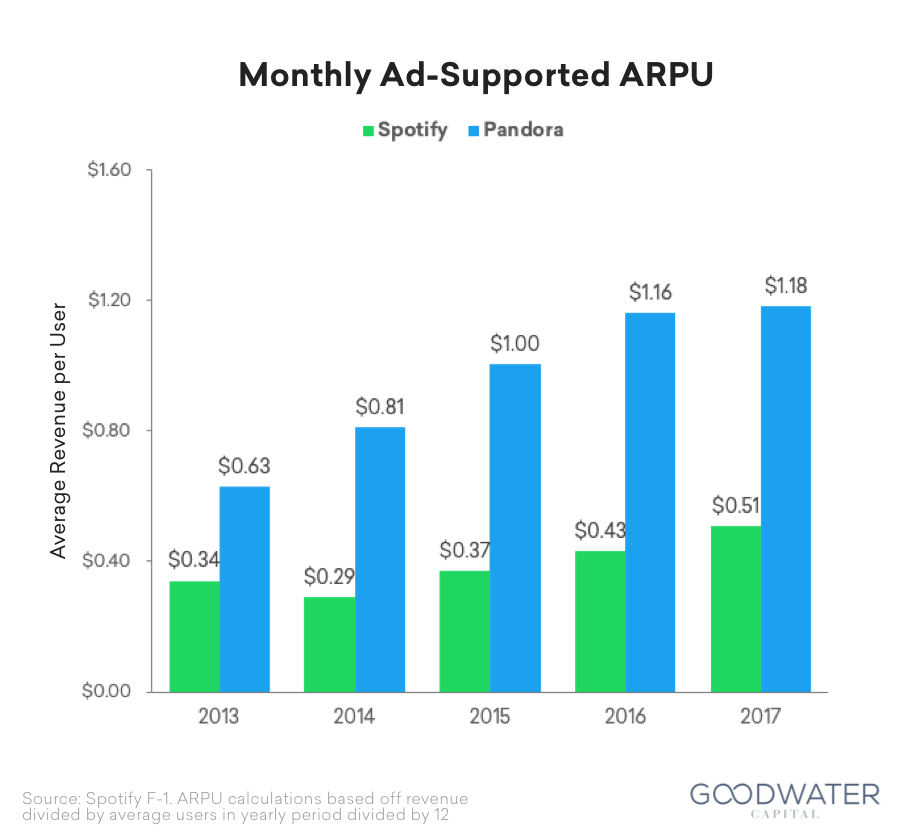

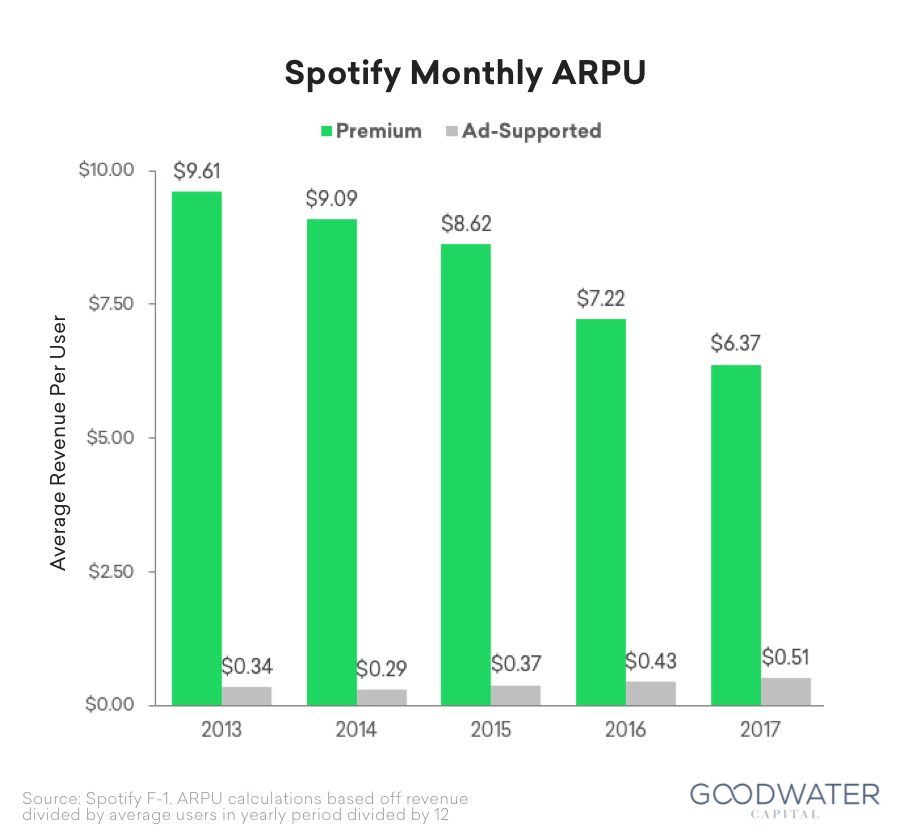

- Maintain or improve margins in the ad-supported business to unlock costless, rapid growth. Spotify materially improved the gross margins on its ad-supported users to 10% in 2017 from negative margins in previous years. Achieving positive gross margins on these free users is a key turning point for the business that transforms a marketing cost into a margin-producing revenue stream. Spotify can now accelerate growth cost-effectively by attracting free users into the ad-supported product while still generating positive margins on those users. The company increased the ad-supported segment’s gross margins by creating more value for advertisers and better monetizing ad-supported users. Spotify increased ad-supported revenue by 41% from 2016 to 2017, primarily driven by enhanced programmatic channels that increased ad impressions 31% and represented 18% of ad revenue13. In September 2017, Spotify launched its self-serve advertising platform – Spotify Ad Studio – to improve efficiency and scalability of its advertising platform. Today, 10% of Spotify’s revenue is generated by ad-supported users. Spotify’s ad-supported ARPU was $0.51 in 2017 compared to Pandora’s ad-supported ARPU of $1.1814, suggesting ample room for growth in ad-supported revenue. Spotify will continue to improve its ad targeting to deliver more relevant ad content, develop compelling audio, video, and display ad unit experiences (e.g. skippable audio ads, sponsored playlists), build relationships with brands to run high eCPM campaigns, and improve advertiser analytics to improve campaign performance.

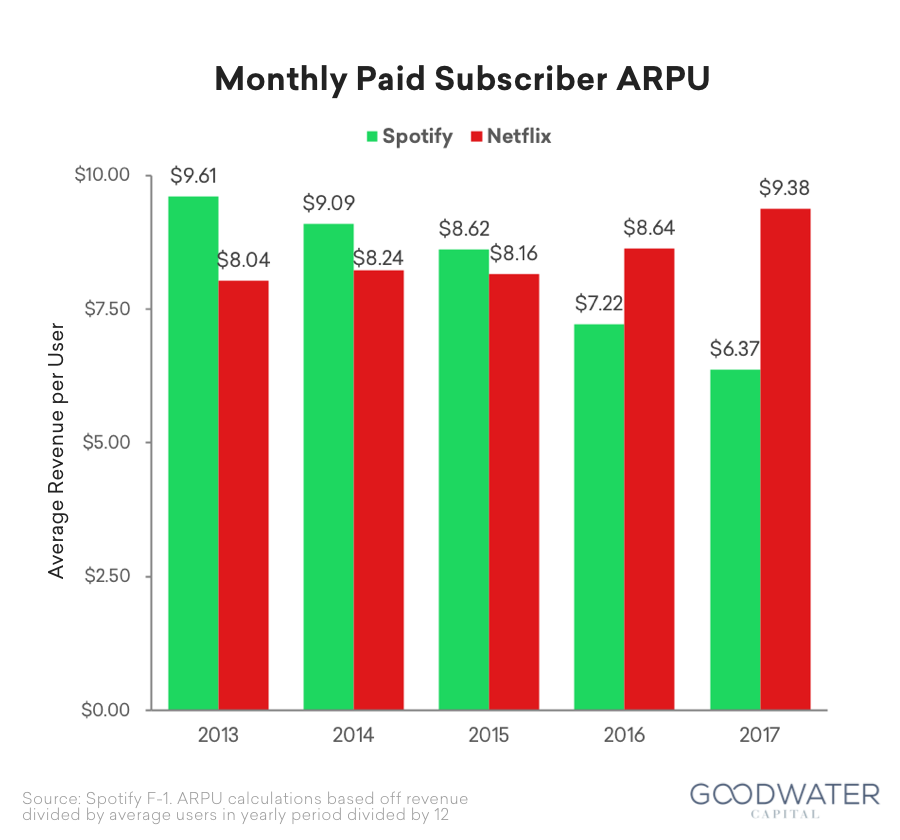

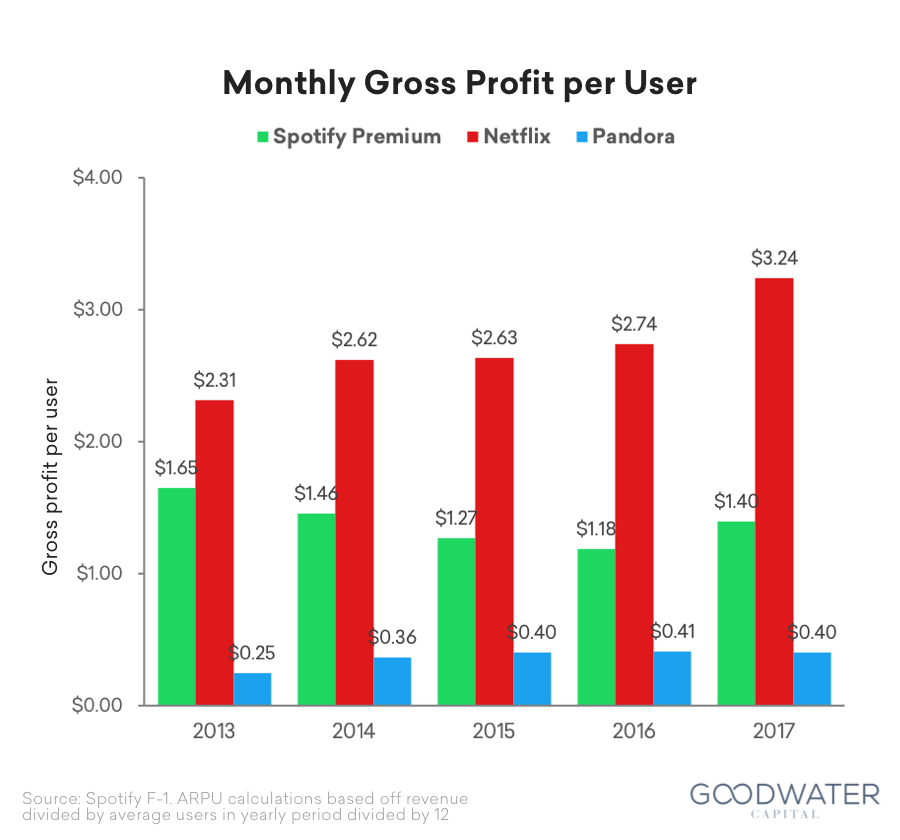

- Develop a stronger moat through proprietary and diversified content. Today, 87% of Spotify’s streams are licensed from Universal Music Group (UMG), Sony Music Entertainment (SME), Warner Music Group (WMG), and Merlin15. To continue growing its business and expanding margins, Spotify will need to diversify away from licensed catalogs towards other content sources which are either proprietary to Spotify or net new in the market. Echoing the Netflix model of developing exclusive and proprietary content, initiatives like Spotify Studios enable Spotify to directly develop artist relationships and content, which could yield significantly better monetization and margins as demonstrated by the difference between Netflix’s $3.24 gross profit per subscriber16, and Spotify’s $1.40 gross profit per subscriber. Spotify is also expanding beyond music content by offering podcasts, artist merchandise, concert tickets, and short form videos that feature substantially higher margins or do not require fees. Diversified and exclusive content increases Spotify’s ability to raise premium subscription pricing in the future.

- Continue to win over the modern family. Changing demographics and consumer behaviors have redefined the term “family” from its original connotation of the “nuclear family”. Technology and media companies must increasingly service the needs of this modern family of roommates, friends, family and peers who may not be in the same physical location. While video streaming services have experienced unauthorized sharing (30% of Americans use someone’s shared password17, Spotify addresses this need with its family plan, providing access for up to 6 accounts for $14.99 per month. Spotify makes adding friends and family to this plan seamless, only requiring users to register their account with the same home address. By comparison, Apple Music’s Family Sharing plan is limited to iOS users and has a much higher hurdle to adoption, requiring users to be part of an additional Family Sharing account. Spotify’s family plan improves retention by adding economic and social friction to switching platforms.

Business Overview

Spotify is a mobile-first, online music streaming platform with paid subscribers and ad-supported users. Paid subscribers can play and download songs on demand from their phone, desktop or other devices while free users can play songs on-demand only on their desktop and can listen to radio-like playlists on their phones with intermittent ads.

History. Today, Spotify is one of the largest drivers of global music revenue, with 159M MAUs generating $5.1 billion in revenue in 2017. The journey began 12 years ago when Daniel Ek and Marten Lorentzen founded Spotify in Stockholm, Sweden. Key milestones include:

- 2007. Launched first public beta in Spring. Viral growth followed in Winter with the introduction of shared playlists.

- 2008. Launched in Europe in October. As it grew in distribution, Spotify decided to monetize its free users through ads; they controlled free user growth through an invite-only mechanism. Raised a $22 million Series A round.

- 2009. Raised a $50 million Series B in Summer 2009 to license the labels’ music by prepaying, which helped to secure deals with labels that were not initially familiar with the new music streaming business model. Launched mobile platform in Fall 2009, taking advantage of the rising tide of iOS and Android devices.

- 2011. Announced 1 million paid subscribers in Spring. Expanded internationally into US. Raised a $100 million Series D.

- 2012 and beyond. Went on to raise $2 billion in total equity financing while making Spotify more accessible to users through partnerships with Facebook, Uber, and PlayStation, and introducing pricing options such as student and family plans.

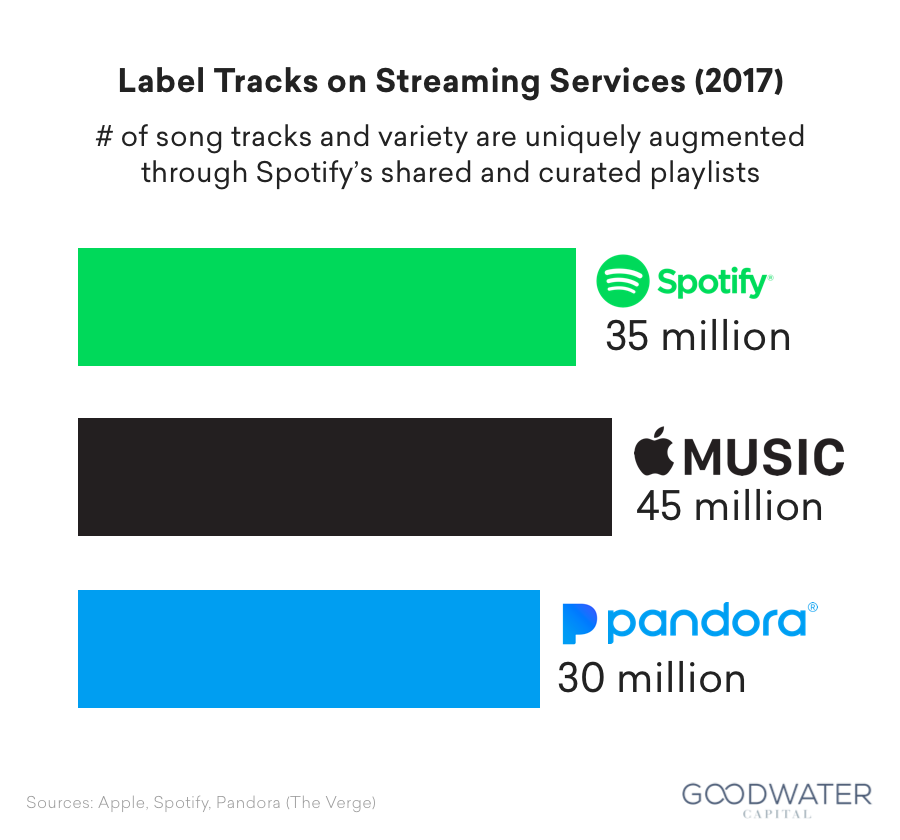

Clear value proposition for consumers. By offering unlimited music streaming, Spotify shifted consumer behavior from a transaction-based model to an access-based model. The company offers listeners unlimited access to a catalog of over 35 million songs. Spotify organized these millions of tracks in a systematic manner, allowing listeners to easily search or filter for songs by genre, album, and artist on demand. Unlimited access aligns well with listeners’ desired usage; the average MAU consumes 25 hours of content per month and 44% of those MAUs access Spotify daily.

Consumer-centric focus leads to robust user growth. Strong execution on its product strategy ultimately helped the Company reach 159 million MAUs (32% 2-year CAGR). Spotify has two types of MAUs: paid premium subscribers and free ad-supported users. The 71 million premium subscribers, representing 45% of all Spotify MAUs, are largely sourced through the freemium go-to-market strategy with 60% of total premium subscriber gross adds coming from free ad-supported users. The Company also reduced its high nominal monthly customer churn from 7% to 5% over the past 2 years. In addition, 40% of its churned premium subscribers rejoin the platform within 3 months, yielding an effective monthly churn rate of 3% – 4%.

Personalized content drives higher retention. Spotify markets itself as a “discovery” platform helping consumers uncover and experience new artists, genres, and playlists. The company has been able to deliver on this promise of discovery by leveraging an immense data set of more than 200 petabytes to personalize and curate content across more than 40 different parameters per user. This data set is even larger than that of Netflix, which depends on a 60 petabyte data set to drive its personalization engine18. Spotify tracks more than 150 billion daily user actions, which enabled the platform to grow from less than 20% listening time in personalized and curated playlists to 31% in two years19. Spotify’s personalized, access-based model drives significantly higher retention rates compared to other music streaming services after four quarters.

User Generated Content (UGC) increases switching cost. One of Spotify’s first initiatives was to allow users to easily share playlists with friends. Spotify now houses over 3 billion UGC playlists on its network, creating additional friction for users to switch music streaming platforms. The UGC content simultaneously allows users to creatively express themselves, building a stronger community on Spotify, and now represents 36% of all Spotify listening time20.

Providing value to both sides of the marketplace. While providing a best-in-class experience for music listeners, Spotify also empowered its suppliers by helping artists and labels better monetize, distribute, and analyze their songs. In a challenged industry, Spotify helped drive growth by making artists’ songs easily discoverable by its millions of users across 61 countries, and provided artists with $8B+ in royalties. Spotify’s robust data is also additive to artists, enabling them to be more easily discovered by future fans through its personalized and curated playlists, as well as to engage their audience more meaningfully through data analytics tools.

Market Landscape

Rise of digital streaming. From 1999 to 2014, the music industry lost nearly 40% of its revenue. Spotify’s launch in 2008 introduced streaming, which catalyzed a second wave of music services that restored growth to the global music industry. Global music revenues in 2016 reached its highest annual growth rate in 20 years, increasing 6% from 2015 to reach $15.7 billion. Spotify’s revenue accounted for 30% of the global music market in 2017, representing 42% of the streaming music market. Paid streaming subscriptions continue on an upward trajectory across the music industry; streaming revenues grew from 9% of global music revenue in 2011 to 72% in 201721.

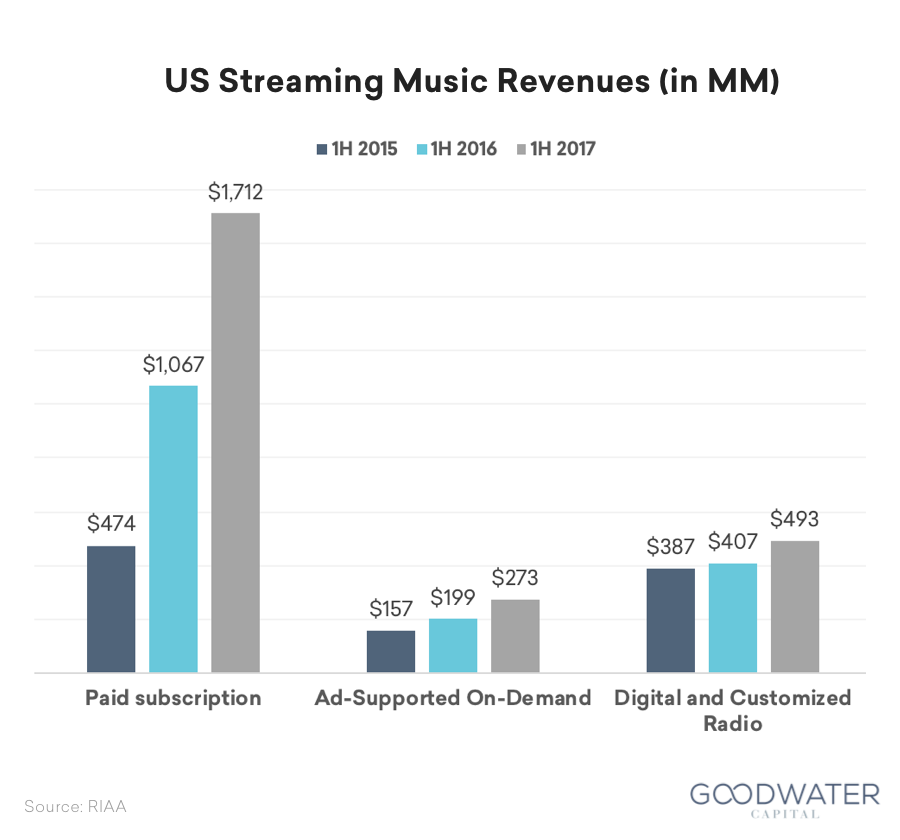

Streaming music services account for 62% of the US music business. In the first half of 2017, revenue for streaming services, including subscription services, digital and customized radio, and ad-supported on-demand streaming, grew 48% to $2.5 billion22. Revenue growth from paid subscriptions services like Spotify has far outpaced that of radio services like Pandora and ad-supported music services like YouTube.

Music ecosystem dynamics. By offering consumers a legal and convenient solution to access music, Spotify’s product unlocked an audience willing to pay for music, which subsequently increased monetization across all players in the music ecosystem. As the enablers of the ecosystem, subscription streaming services like Spotify take about a 30% cut23 and are well-positioned to capture user data to further drive revenue opportunities. For example, Spotify can leverage its data on music tastes and geography to drive ticket sales for live music events, where 40% of live ticketing event seats are unfilled24. Labels and publishers like Sony, UMG, and WMG will continue to experience revenue increases as streaming services drive distribution and engagement with their content, while ad-funded streaming services will negatively impact radio revenue.

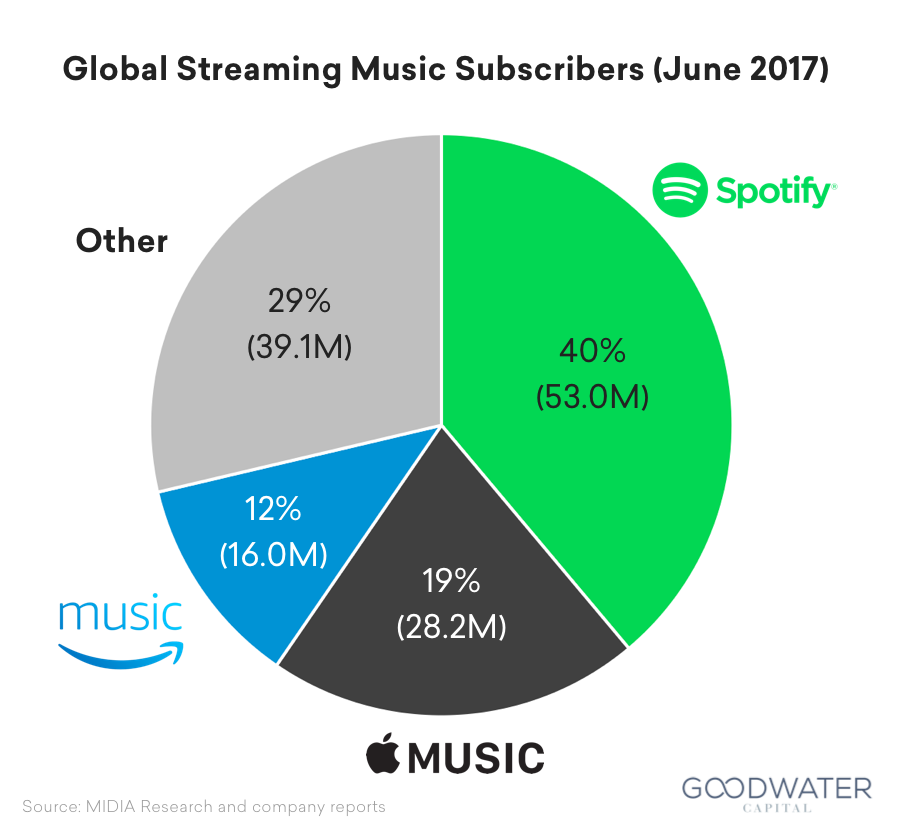

Streaming competitor landscape. Spotify competes for consumer time and attention across different forms of media and content, such as radio, video, social media, and other on-demand music streaming services. Of 136.3 million music streaming subscribers globally, Spotify accounted for 40% of subscribers25. On-demand streaming competitors are dominated by large technology companies like Apple (19%), Amazon (12%), and Google, as well as well-capitalized music-focused companies like Pandora, Tidal, and SoundCloud.

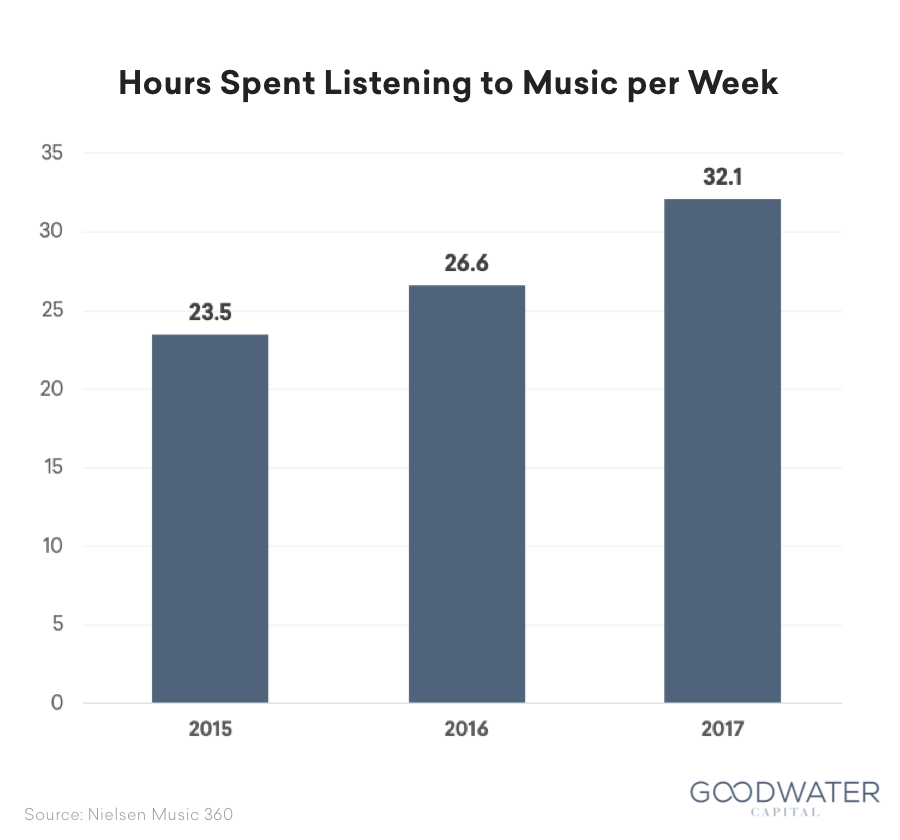

Technology has driven increased music consumption for consumers. The average number of hours spent listening to music per week in the US increased from 23.5 hours in 2015 to 32.1 hours in 2017 business insider. Streaming subscribers listen to more hours per week than average music listeners (39.1 hours vs 35.7 hours), and use more devices to listen to music (4.8 devices vs 3.4 devices) business insider26.

Music streaming competitors offer differentiated value propositions and audience segments, but share characteristics of several consumer technology trends.

- Access over ownership. Most music streaming services offer on-demand access to media where users can stream a song without having to download it. The trend of favoring access over ownership extends to both digital (Netflix and video) and physical (Uber and cars) behaviors.

- Data-driven personalization. Music services facilitate discovery in a giant sea of content. Companies are collecting and leveraging data to better understand users and recommend personalized content to deliver a better experience and increased engagement. Stitch Fix, for example, leverages data combined with human judgment to provide personalized retail at scale.

- Content unbundling. In the past, music was “bundled” and sold in albums. Music services today unbundle albums into individual songs that can be repackaged and personalized. Cable television similarly experienced disruption when consumer technology services offered unbundled content.

Large Tech Incumbents. Large technology incumbents seek to supplement their product suite by offering music services. Apple, Google, and Amazon have a significant advantage in owning platforms with large distribution, and benefit from existing scale, brand recognition, and budget as leverage to negotiate licenses and build out their music libraries.

- Apple Music is Spotify’s closest direct competitor with 38 million paying subscribers compared to Spotify’s 71 million27. Apple has previously experimented with exclusives and differentiation based on human touch, like its Beats 1 radio and playlists which are curated by tastemakers28.

- YouTube & Google Play Music. Alphabet’s biggest differentiator is its YouTube catalogue with an unparalleled collection of music videos, original content, remixes, and covers that be accessed on-demand, as well as offline via YouTube Red. Music is one of the most popular genres of video on YouTube with more than 1 billion users per month29.

- Amazon Music offers a limited catalogue of ad-free, on-demand music as part of Amazon Prime, and can be upgraded for a fee to Amazon Music Unlimited which includes an expanded library and offline listening. Amazon Prime music is usage is most concentrated in US, Japan, Germany and UK, where 35% of Prime subscribers are Prime Music users30.

Pure Streaming Players. These well-capitalized companies focus on music as a core part of their business, each with a different consumer value proposition.

- Pandora is a personalized radio service with hundreds of curated stations by genre. To compete with the rising popularity of on-demand streaming, Pandora offers ad-free premium services that offer offline play, higher quality, and on-demand options.

- Tidal was founded in 2014 by Jay-Z and is widely known for its audio quality and artist-friendly business model.

- SoundCloud is known for its user-generated content, which is augmented by its creator-friendly tools for uploading and sharing files. It is popular among niche audiences for content like indie music, electronic dance music, podcasts, etc.

Consumer Trends & Research

Goodwater conducts proprietary consumer research via survey panels and sentiment word clouds to identify consumer insights and trends.

Survey Panel. Every quarter, Goodwater runs a 3,000-person consumer survey across a panel of consumers representing all ages, demographics and geographies of the US. We systematically track the usage of hundreds of products, market share changes between competing products, and expected increased or decreased usage. The insights below are based on the following music streaming services: Spotify, Pandora, Apple Music, Google Play Music, Amazon Music, and SoundCloud.

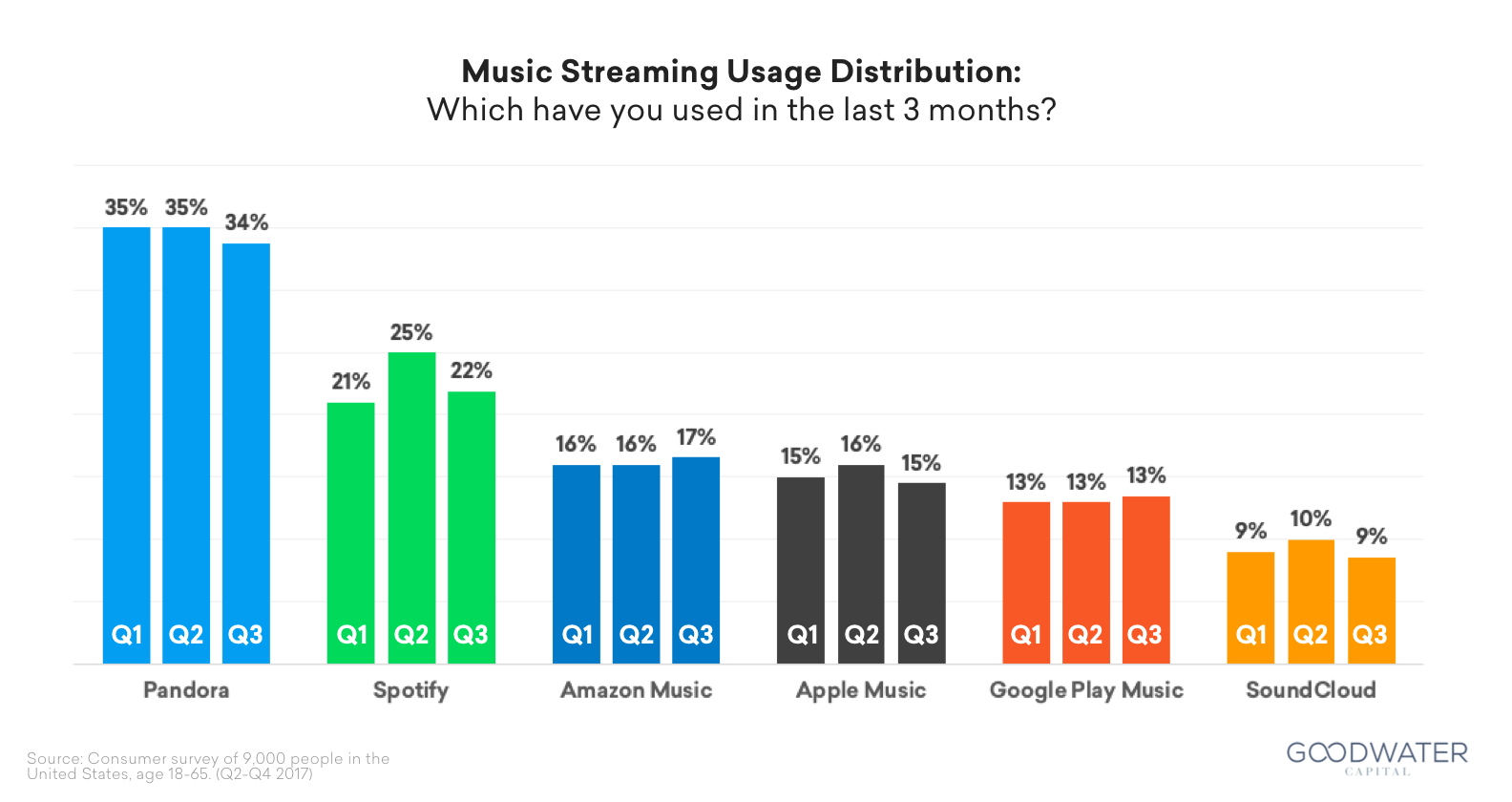

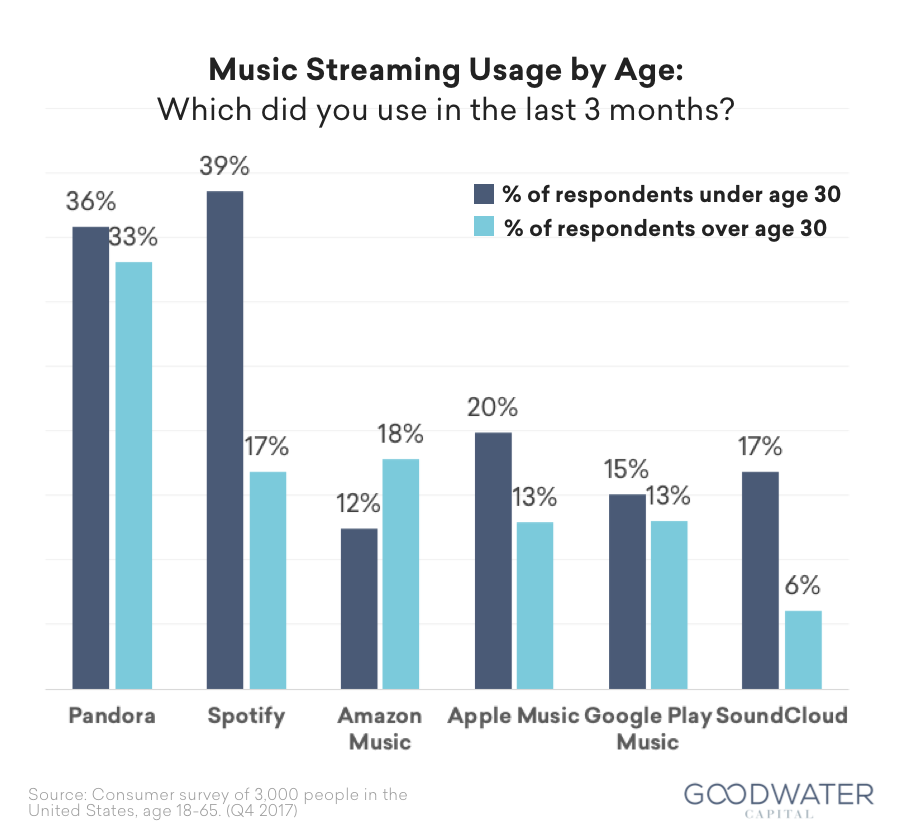

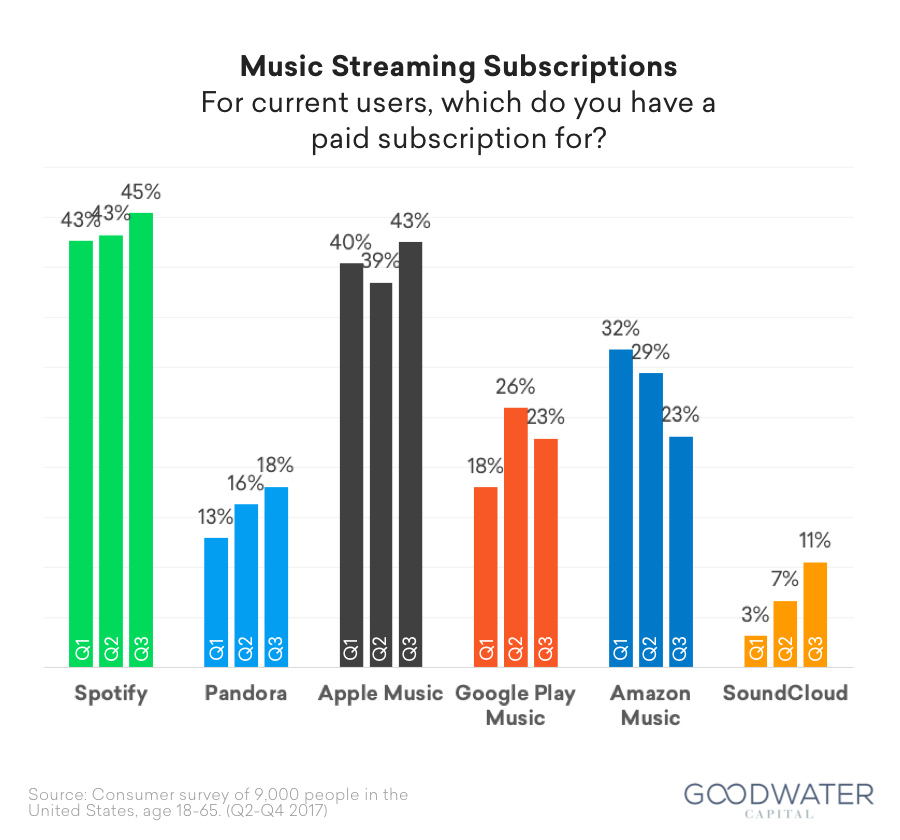

Music service usage distribution. In Q4 2017, 65% of respondents used at least one music streaming service. Over the last year, Pandora consistently had the highest usage rate at 34-35%, followed by Spotify at 21-25%. Music services by large technology incumbents Amazon, Apple, and Google Play had less usage across respondents, ranging from 13 to 17%.

Streaming with multiple services. 46% of respondents who used a music streaming service reported using more than one, indicating that while services offer content that’s highly substitutable, music platform usage can be complementary and fulfill different needs.

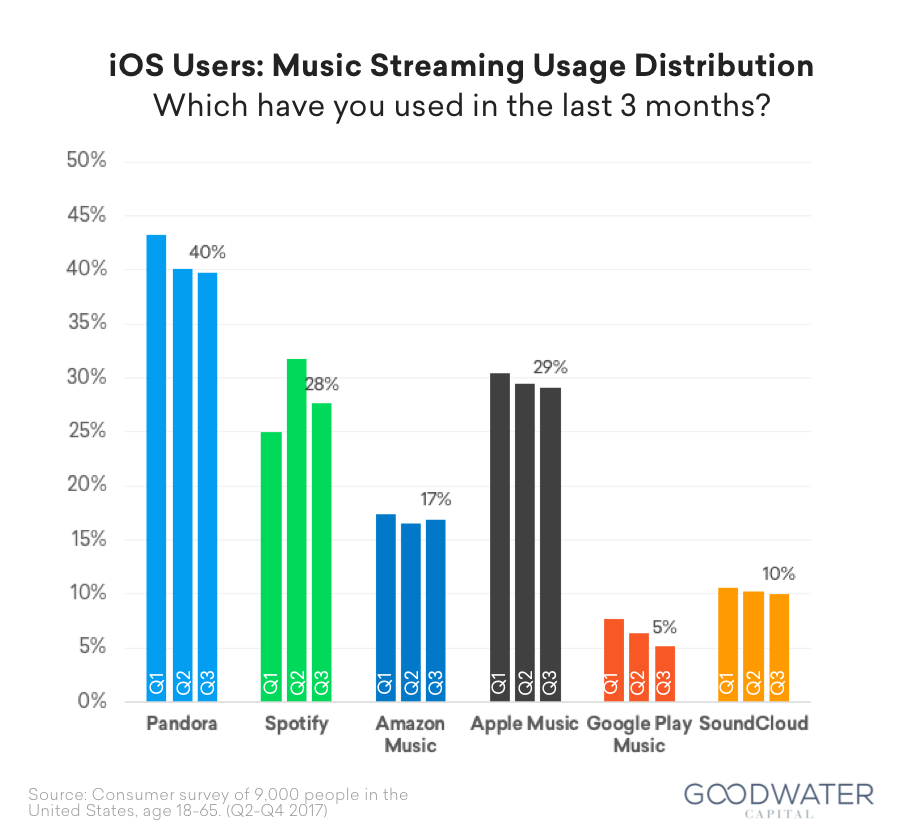

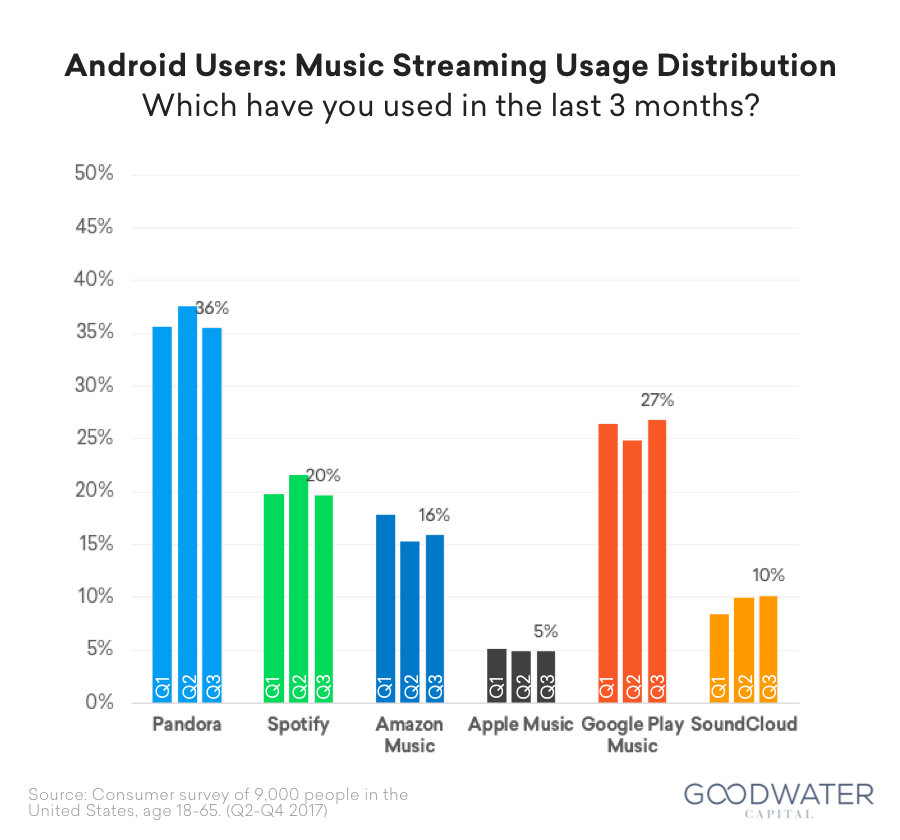

The platform advantage. Consumers who use iOS are 6x more likely to use Apple Music than Google Play Music; conversely, consumers who use Android are 5x more likely to use Google Play Music than Apple Music. Despite clear platform distribution advantages, Spotify’s platform-agnostic strategy has achieved similar usage penetrations of 28% and 20% on iOS and Android, respectively, in Q4 2017. There is no clear indication that Apple Music usage is growing more rapidly than Spotify usage, even on iOS.

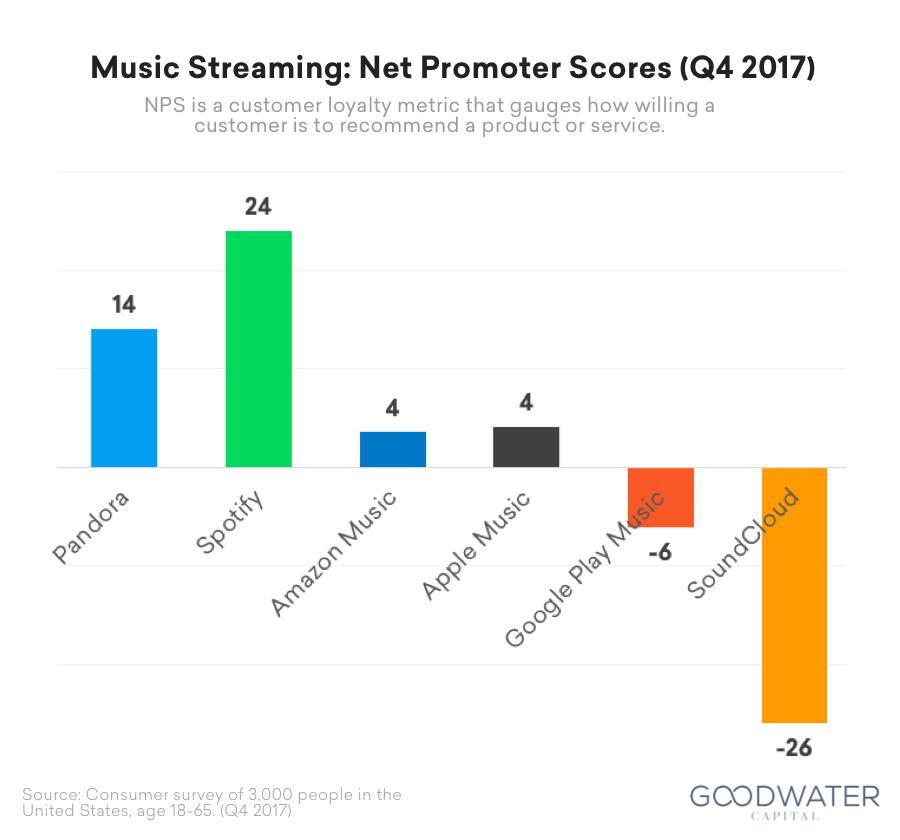

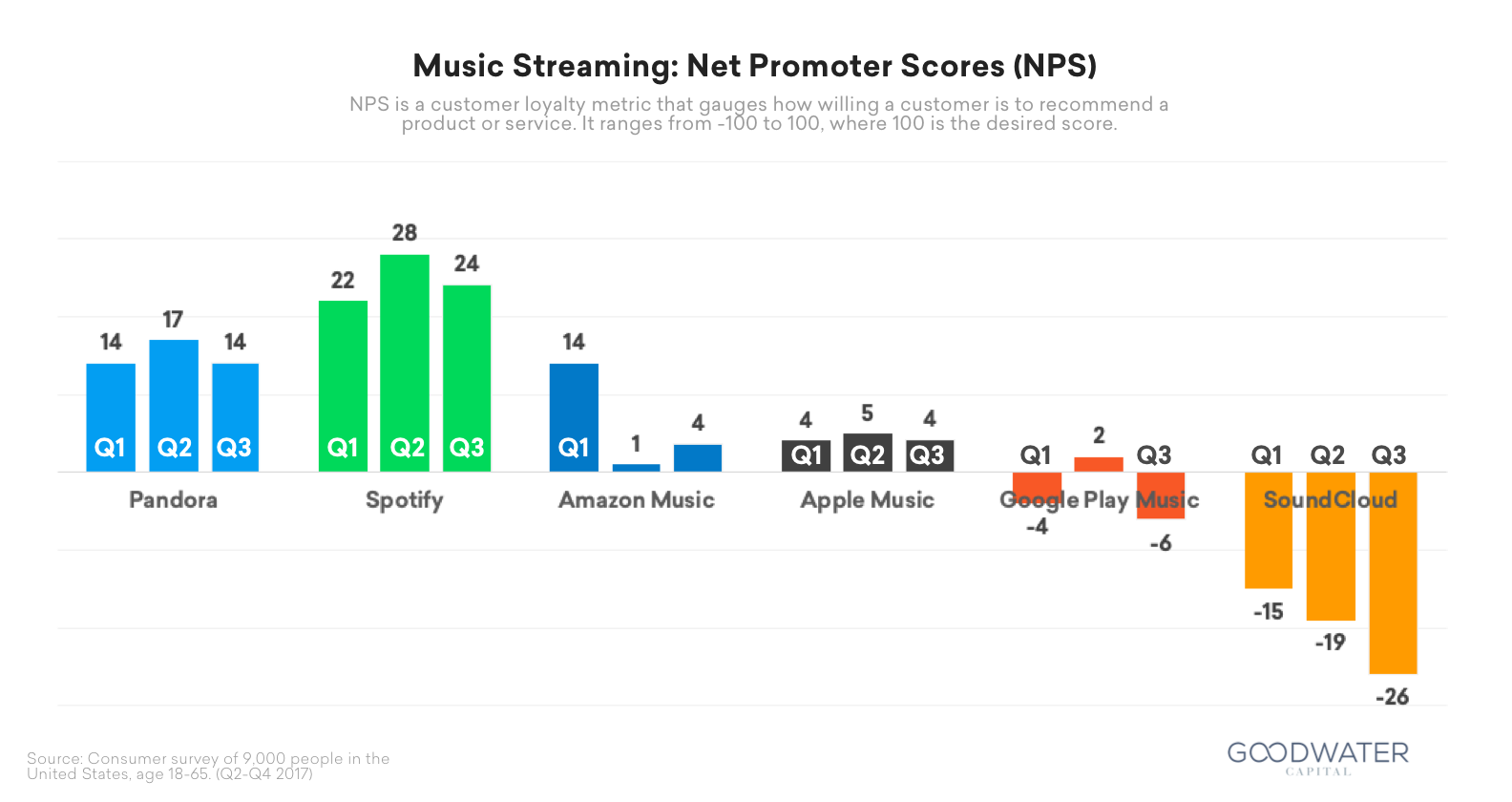

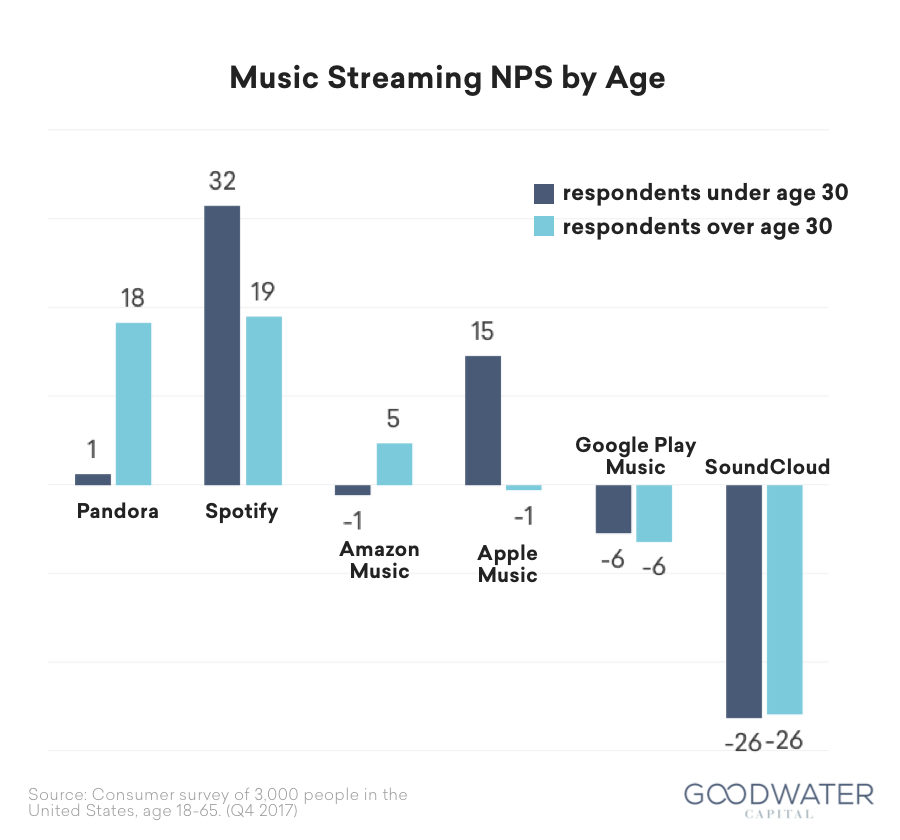

Undisputed customer love. Spotify has the highest user satisfaction across multiple measures. Among its users, 92% expect to maintain or increase their usage of Spotify. Pandora follows with 86% expected continued usage and Amazon with 80%. Spotify users also consistently reported the highest NPS (24 in Q4) among music streaming services. Pandora follows Spotify in customer satisfaction, but is largely driven by its more mature audience.

Millennials & Music. Adoption of new consumer technology products is strongly influenced by the usage and preferences of younger generations. Spotify, Apple Music, and SoundCloud strongly skew toward consumers under 30 years old. 39% of consumers under 30 used Spotify last quarter, compared to 17% of consumers over 30 years. While Spotify, Apple Music, and SoundCloud all skew towards consumers under 30, NPS scores for Spotify (32) and Apple Music (15) indicate that these two services are most loved by the younger generation.

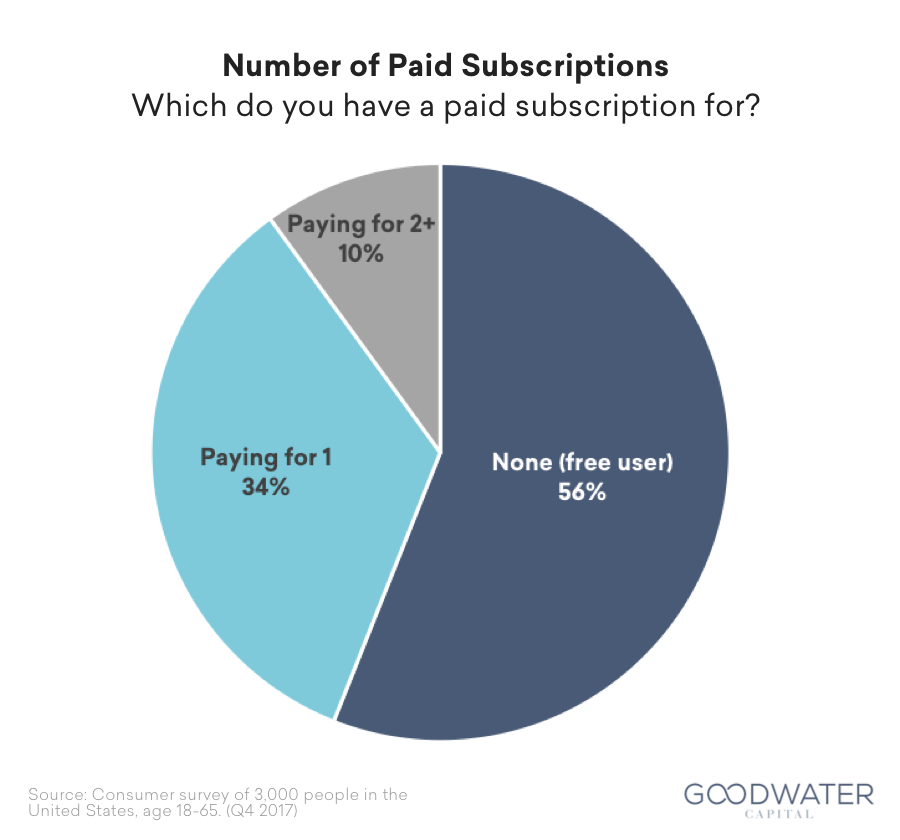

Paid subscriptions trends. Of consumers who used a music streaming service last quarter, 56% streamed for free, 34% paid for one service, and 10% paid for multiple services. Spotify and Apple Music have the highest penetration of paid subscribers, with 45% of Spotify users paying for the service and 43% of Apple Music users. Pandora and SoundCloud have a significantly lower, but rapidly growing, percentage of paid subscribers.

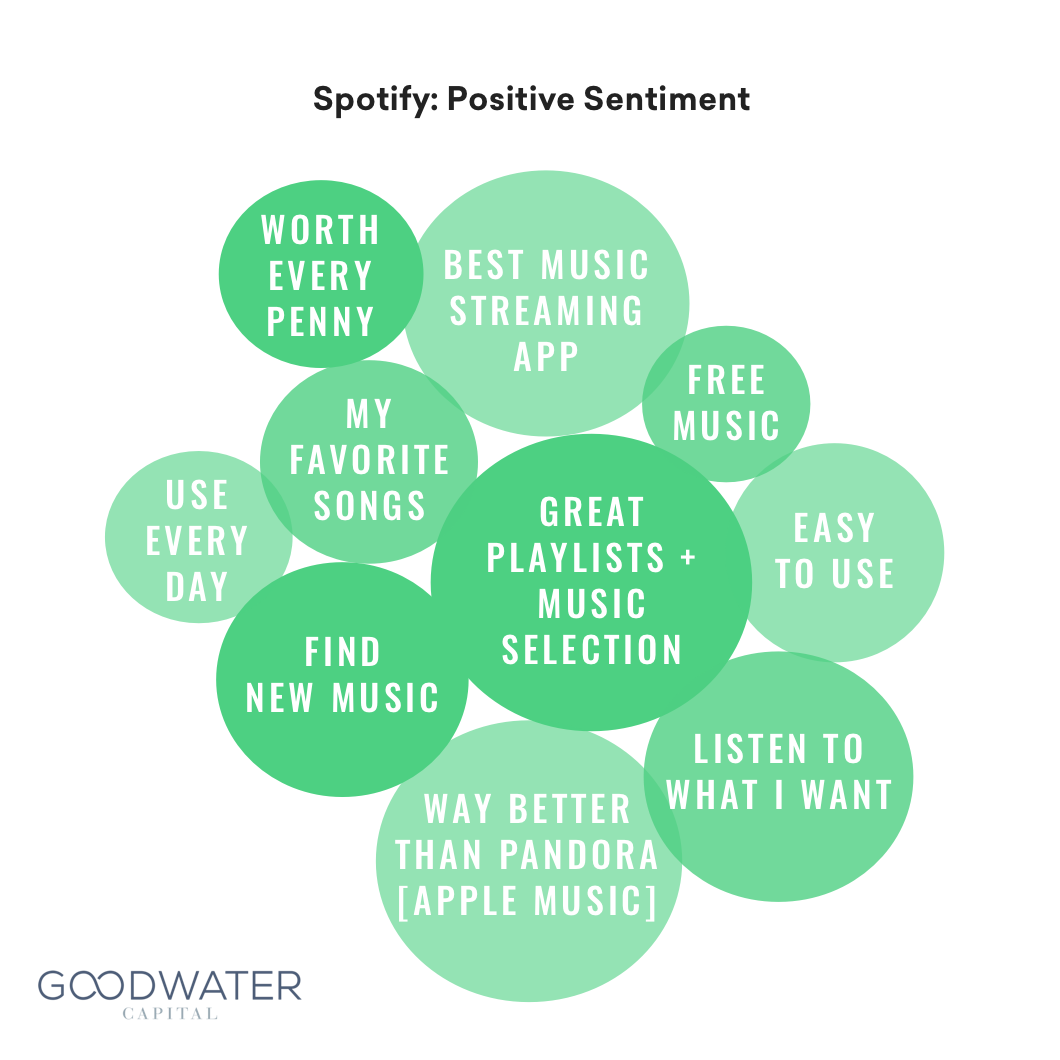

Sentiment Word Clouds. Our word clouds lay out how consumers most frequently describe a particular product with respect to positive and negative associations. We analyze customer reviews and conduct interviews and surveys to generate these word clouds. Positive sentiment phrases provide insight into how the product is used and which aspects users love, while negative sentiments surface common annoyances, feature requests, and responses to product changes.

Spotify’s word clouds highlight the core experience of streaming music, where positive and negative sentiment strongly correlate with the experience of accessing music content. Positive sentiment phrases illustrate an appreciation for the vast music selection and playlists, on-demand access to music, and discovery; users who have positive experiences use it daily and find it easy to use. Negative sentiment for Spotify is largely driven by users frustrated by limitations of the free tier. These users are annoyed by not being able to access specific desired songs, seeing too many suggested songs, and missing features such as touch preview, lack of an Apple Watch app, and inability to rearrange playlists.

Financial Overview

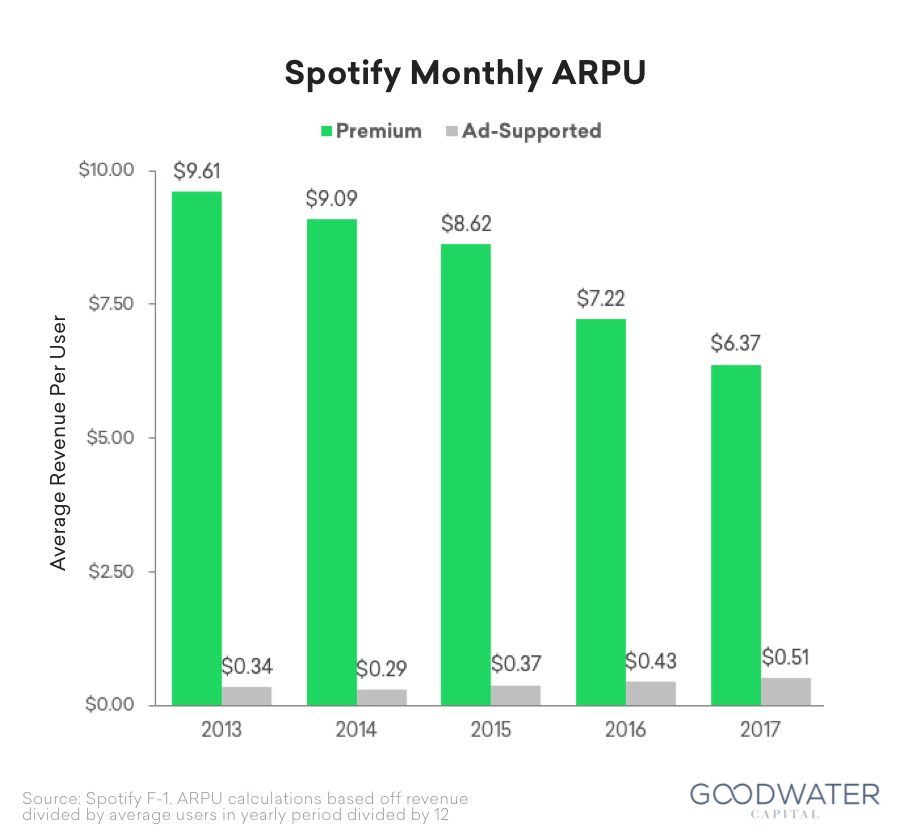

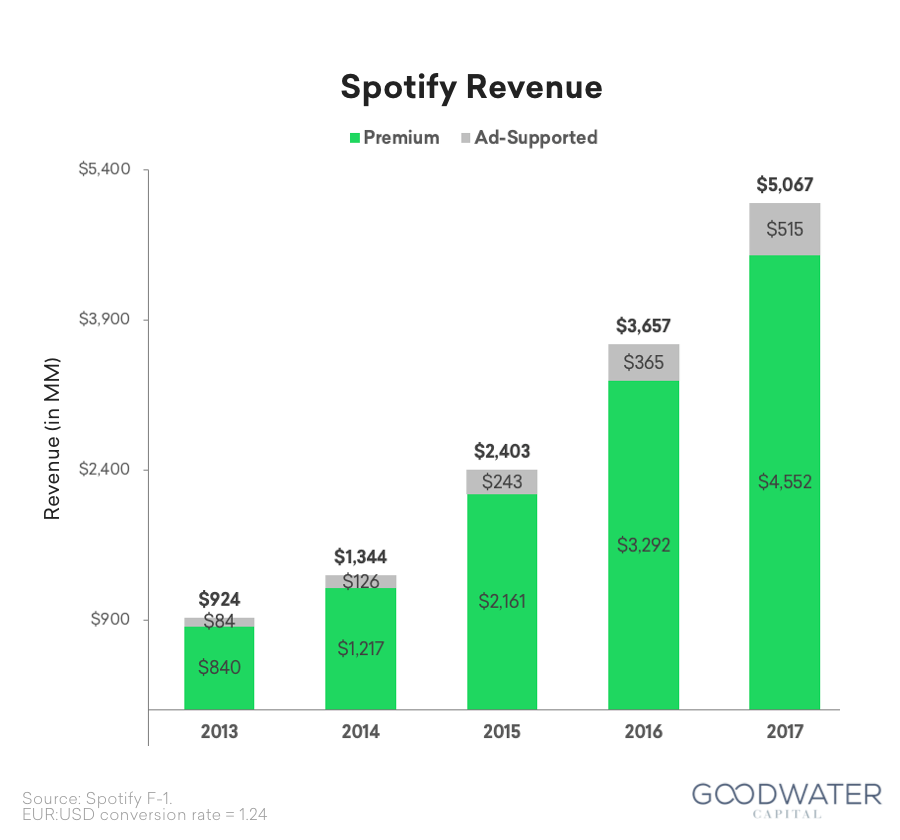

Rapid revenue growth. Spotify primarily monetizes users through its premium subscribers, who account for 90% of revenue. The remaining 10% is generated from its ad-supported, free users. Monthly ARPU per premium subscriber was $6.37 in 201731. Spotify initially launched its free service which served as a cost center for acquiring premium subscribers. As Spotify has amassed a much larger audience, the company was able to generate advertising revenue from its free user base. In 2017, Spotify turned this gross-margin negative revenue stream into a 10% gross margin business, thereby dramatically improving its acquisition costs given that 60% of gross premium subscribers convert from the free service. The success in both user types allowed Spotify to grow its total revenue 39% and premium subscriber revenue 38% in 2017, resulting in a 45% 2-year CAGR for total revenue growth.

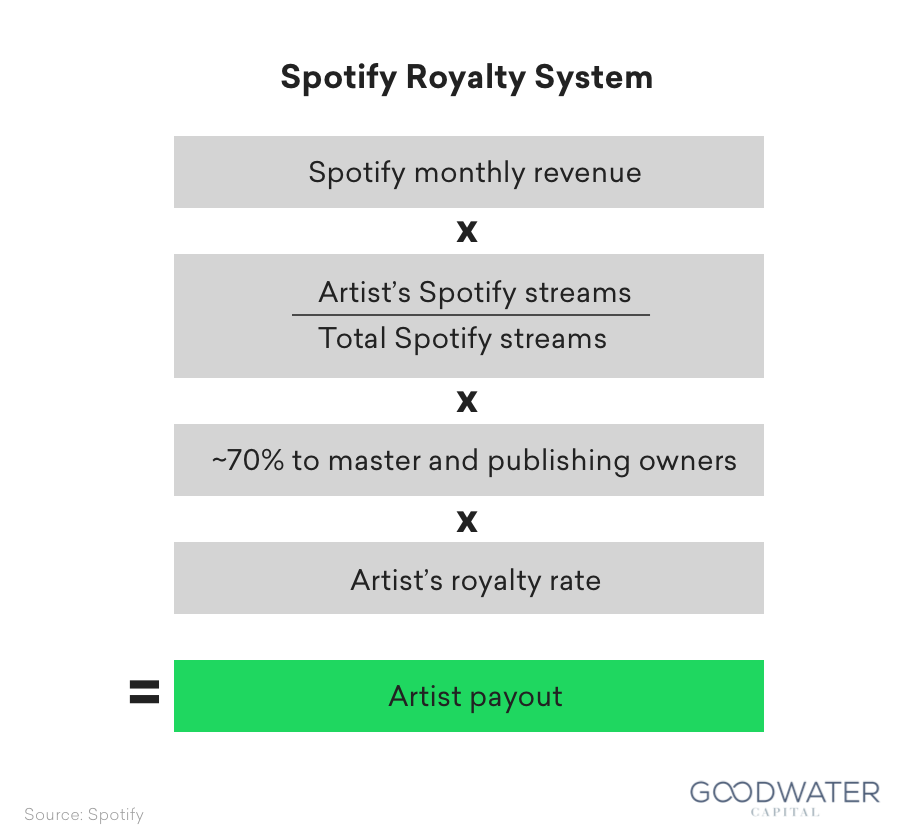

Path to scaling with healthier gross margins. Spotify’s cost structure is primarily driven by royalties paid to the music labels. The royalties are determined by i) the greater of a percentage of revenue or a per user amount for premium subscribers and ii) the greater of a percentage of revenue or amount per time listened for ad-supported users. Spotify improved its gross margins over the last two years by 9 percentage points to 21% in 2017. Importantly, the ad-supported business is no longer gross margin negative, through re-negotiating its contracts with major music labels. While the Company was shy of their internal goals of reaching 25% gross margins32, Spotify has been able to markedly improve their margins through continuing to provide value to their suppliers and leveraging their increasing scale.

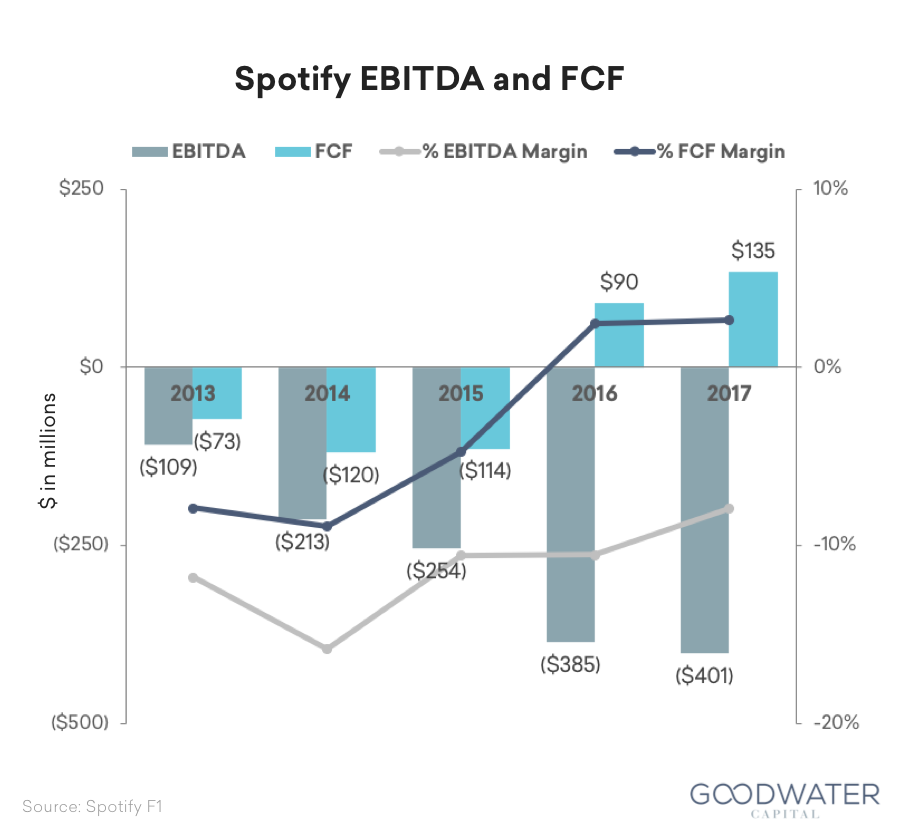

Marching towards profitability. Overall as the Company has continued to scale, its EBITDA margin has steadily improved to -8% in 2017 from -12% in 2013. These improvements primarily flow through from the gross margin level. Spotify has successfully maintained its marketing cost as a percentage of revenue around its current level in 2017 of 14% even as the Company has accelerated user growth and gained significant scale. Spotify’s marketing efficiency is largely attributed to continued word-of-mouth growth lowering Spotify’s dependence on paid marketing as well as funneling marketing costs through their freemium go-to-market strategy. As a result, Spotify achieved positive contribution margins after marketing costs beginning in 2013.

The Company’s R&D expense as a percentage of revenue has also stayed consistent at 10% in 2017. To reinforce the importance of tech enablement in the business, Spotify’s management believes the R&D expense percentage will rise in the future as the Company continues to innovate on the customer experience.

Spotify achieved free cash flow (FCF) profitability in 2016 and generated $135 million of positive cash flow in 2017. The difference between EBITDA and FCF is mainly due to Spotify’s positive net working capital dynamics. In particular, Spotify benefits from its scale, allowing them to pay labels in arrears (as opposed to its position in 2009 when Spotify had to pay labels upfront), as well as from increases in deferred revenue similar to other growing software-as-a-service (SaaS) businesses.

Comparables Analysis

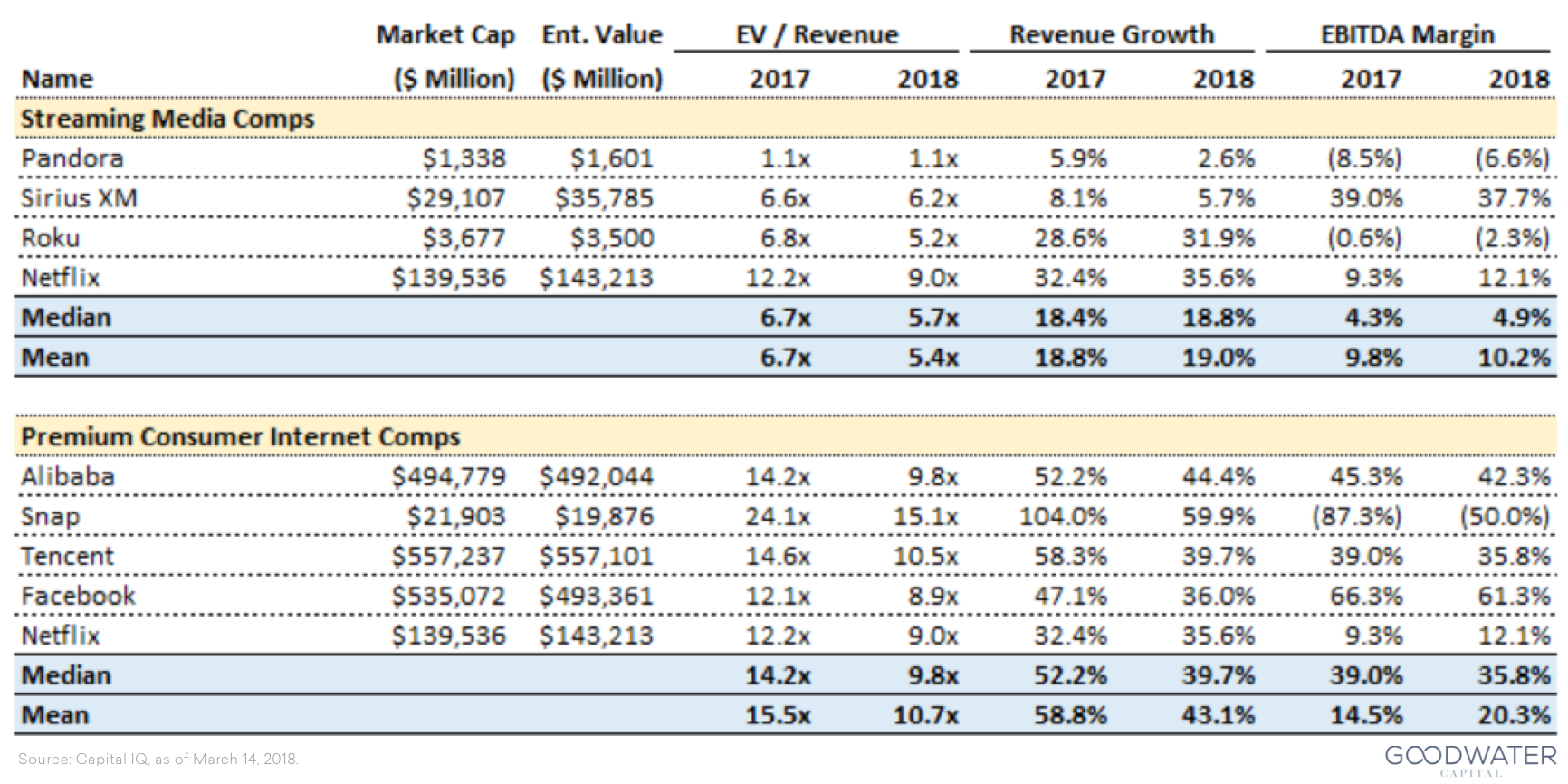

Below are two sets of comparable company analyses, including streaming media businesses and premium consumer content platforms. Spotify has improved monetization significantly, yielding a 45% revenue CAGR over the last two years, and most recently grew revenue by 39% in 2017, putting it at the high end of streaming media comparables and in the range of the premium consumer internet comparables. Spotify also grew premium subscribers by 46% in 2017. However, its negative EBITDA margin of 8% puts it at the low end among the same comps.

Key Risks

There are a number of risk factors to Spotify’s long-term prospects, including:

- Spotify is dependent on third-party licenses for music streaming content. Failing to negotiate favorable terms or obtain these licenses will materially impact the business and customer experience.

- Recent changes to copyright laws will increase the streaming royalty rates due to songwriters and music publishers, and could negatively impact gross margins.

- Spotify relies on successful partnerships with third-party platforms, operating systems, and hardware to reach customers.

- Spotify has incurred significant operating losses and may not be able to generate sufficient revenue to be profitable.

- The Company has also identified historical weaknesses in internal control over financial reporting, which could adversely affect the accuracy and punctuality of financial results.

- Assertions by third parties of intellectual property infringements or violations by Spotify can harm its business. Since July 2017, six lawsuits alleging unlawful reproduction and distribution haves been filed against Spotify.

- Continued competition from larger platforms (Apple with iPhone, Google with Android, Amazon with Alexa) that can easily integrate and bundle music services could slow adoption.

- The emergence of new interfaces (e.g., car, voice) where consumers will want to access music may provide entry points for new competitors.

Executive Team

- Daniel Ek (CEO & Co-founder). Prior to founding Spotify in 2006, Daniel founded Advertigo, an online advertising company that was acquired by TradeDoubler. He previously held senior roles at Nordic auction company Tradera (acquired by eBay) and was CTO at Stardoll, a fashion and entertainment community for pre-teens. He studied engineering at Royal Institute of Technology before dropping out to focus on his IT career.

- Martin Lorentzon (Co-founder) has been a member of Spotify’s board of directors since July 2008. Mr. Lorentzon has served as a member of the board of directors of Telia Company AB, Sweden’s main telecom operator since 2013. In 1999, he founded TradeDoubler, an internet marketing company based in Stockholm, Sweden. He holds a MS in Civil Engineering from the Chalmers University of Technology.

- Barry McCarthy (CFO) has served as CFO of Spotify since June 2015 and is also an executive advisor at Technology Crossover Ventures. He served as CFO and Principal Accounting Officer at Netflix from 1999 to 2010, and prior to that served in various management positions in management consulting, investment banking, and media and entertainment. He holds an MBA from the Wharton School of Business at the University of Pennsylvania and a BA in History from Williams College.

- Seth Farbman (CMO) has served as Spotify’s Chief Marketing Officer since April 2015. Prior to that, he was Global Chief Marketing Officer at Gap, Inc., Senior Partner at Ogilvy & Mather, Senior Vice President at CRT/tanaka, Director of Marketing at PrimeCo Personal Communications (Verizon Wireless), and a producer and photographer at NBC News. Mr. Farbman holds a BA in Journalism from Ithaca College and an MS in Communications and Journalism from Syracuse University.

- Katarina Berg (Chief Human Resources Officer) has been at Spotify since November 2013. Prior to that, she was Head of HR & Communications at Rusta and Vice President at Swedbank. Ms. Berg holds an MA in Human Resources Management and Development in Behavioral Science from Lund University.

- SPOT F-1, at page 1.

- SPOT F-1, at page 72.

- SPOT F-1, at page 94.

- Goodwater Estimate.

- Goodwater Estimate.

- SPOT F-1, at page 95.

- SPOT F-1, at page 3.

- SPOT F-1, at page 4.

- SPOT F-1, at page 6.

- SPOT F-1, at page 6.

- SPOT F-1, at page 11.

- Bloomberg, https://www.bloomberg.com/news/articles/2018-03-12/spotify-is-said-to-plan-new-york-listing-during-week-of-april-2.

- SPOT F-1, at page 70.

- Pandora Company Filings; Morgan Stanley Equity Research.

- SPOT F-1, at page 17.

- Netflix Company Filings; Morgan Stanley Equity Research.

- Video Advertising Bureau Requiem For A Stream: Part II – Video Streaming Behaviors (2016 Report).

- SPOT F-1, at page 115.

- SPOT F-1, at page 4.

- SPOT F-1, at page 108.

- Goodwater Estimate.

- RIAA, http://www.riaa.com/wp-content/uploads/2017/09/RIAA-Mid-Year-2017-News-and-Notes2.pdf.

- Goldman Sachs Equity Research: Music In The Air (October 4, 2016).

- Goldman Sachs Equity Research: Music In The Air (October 4, 2016).

- MIDIA, https://musicindustryblog.wordpress.com/2017/01/06/music-subscriptions-passed-100-million-in-december-has-the-world- changed/.

- Business Insider, http://www.businessinsider.com/technology-is-changing-the-way-americans-listen-to-music-2017-11.

- CNET, https://www.cnet.com/news/apple-music-hits-38-million-subscribers/.

- Macworld, https://www.macworld.com/article/2934744/software-music/apple-music-faq-the-ins-and-outs-of-apples-new-streaming-music- service.html.

- Goldman Sachs Equity Research: Music In The Air (October 4, 2016).

- MIDIA, https://musicindustryblog.wordpress.com/2017/07/14/amazon-is-now-the-3rd-biggest-music-subscription-service/.

- Goodwater Estimate.

- SPOT F-1, at page 72.