Pinterest helps users find inspiration through visual recommendations. Where conventional search engines aim to help a user locate specific information, Pinterest aids in the discovery of new ideas by leveraging visual-centric, data-driven suggestions. Founded in January 2010, the company has since surpassed 250 million monthly active users across 15 international markets. Pinterest’s combination of unique product innovation, strong fundamental metrics, and ideal market conditions make for an exciting upcoming IPO. Here are 5 key takeaways from its journey:

- Pinterest may be unprofitable now, but it has a clear path to healthy margins.

- It’s the best market for consumer tech IPOs in 15 years.

- A diversity-rich culture is critical to Pinterest’s success.

- Pinterest brought color to a text-heavy world, which appealed to an underserved demographic.

- Pinterest is expanding the advertising TAM, especially for the consumer packaged goods and retail industries.

1. Pinterest may be unprofitable now, but it has a clear path to healthy margins.

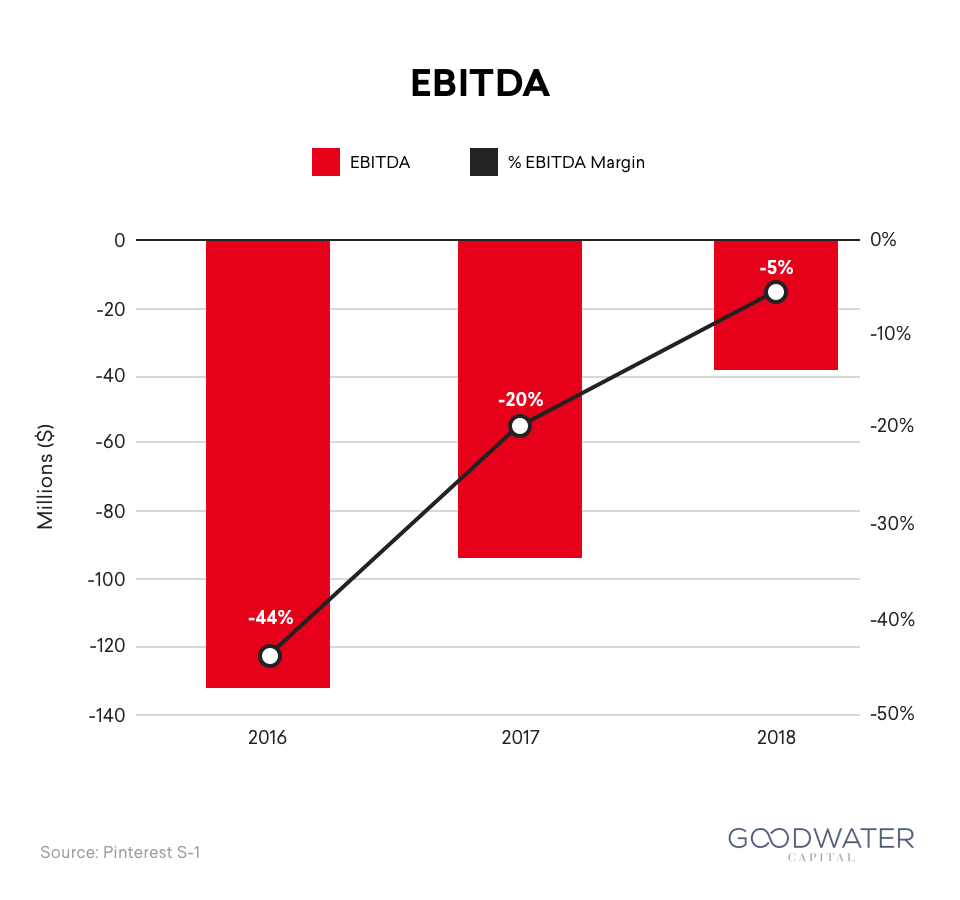

The second day of trading following Lyft’s recent IPO showed that anxiety about profitability still led investors’ fears.1 One might then conclude that Pinterest burning -$39 million in EBITDA over the course of 2018 could represent an obstacle. However, unlike Lyft, Pinterest is at least headed in a promising direction.

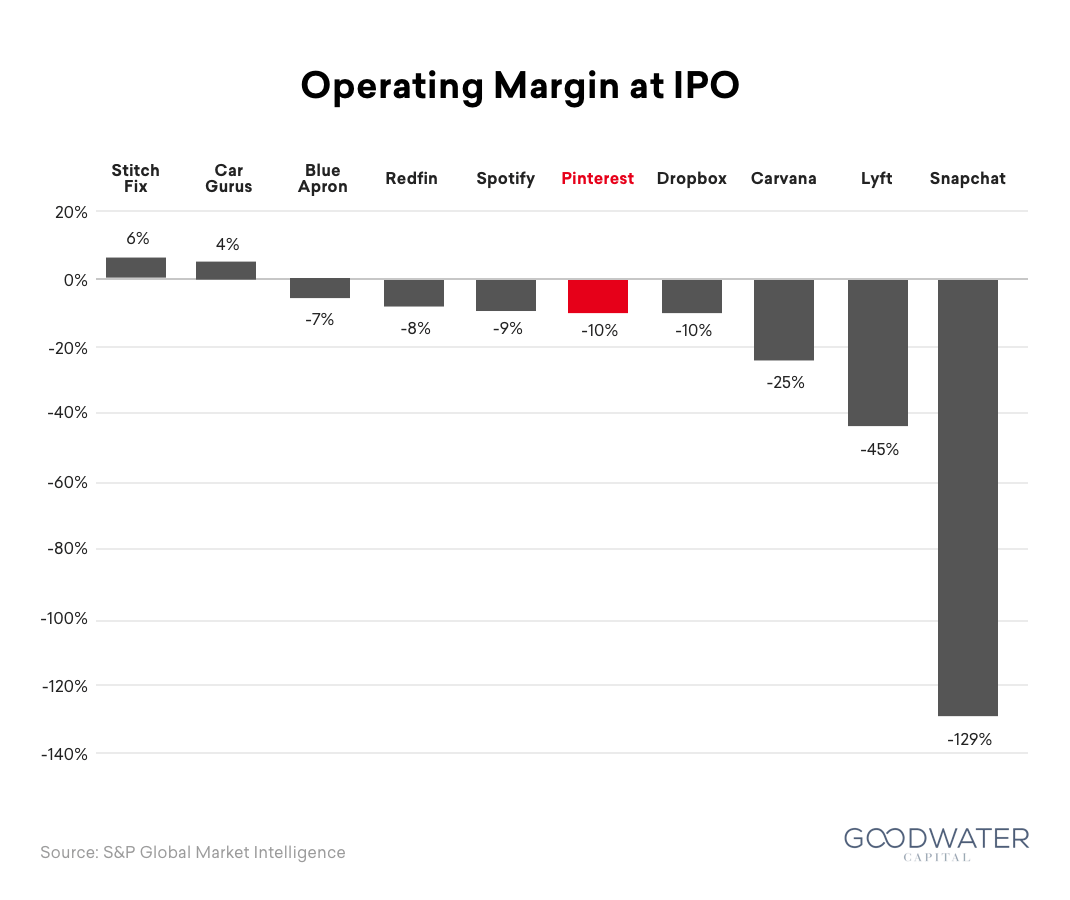

The company has decreased its burn significantly from -$132 million with a -44% EBITDA margin in 2016 to -$39 million with only a -5% EBITDA margin last year.2 Moreover, among recent internet IPOs, Pinterest’s operating margin at the time of IPO is right in the middle of the pack at -9.9%, with Spotify reporting -9.2% and Dropbox reporting -10.3%.

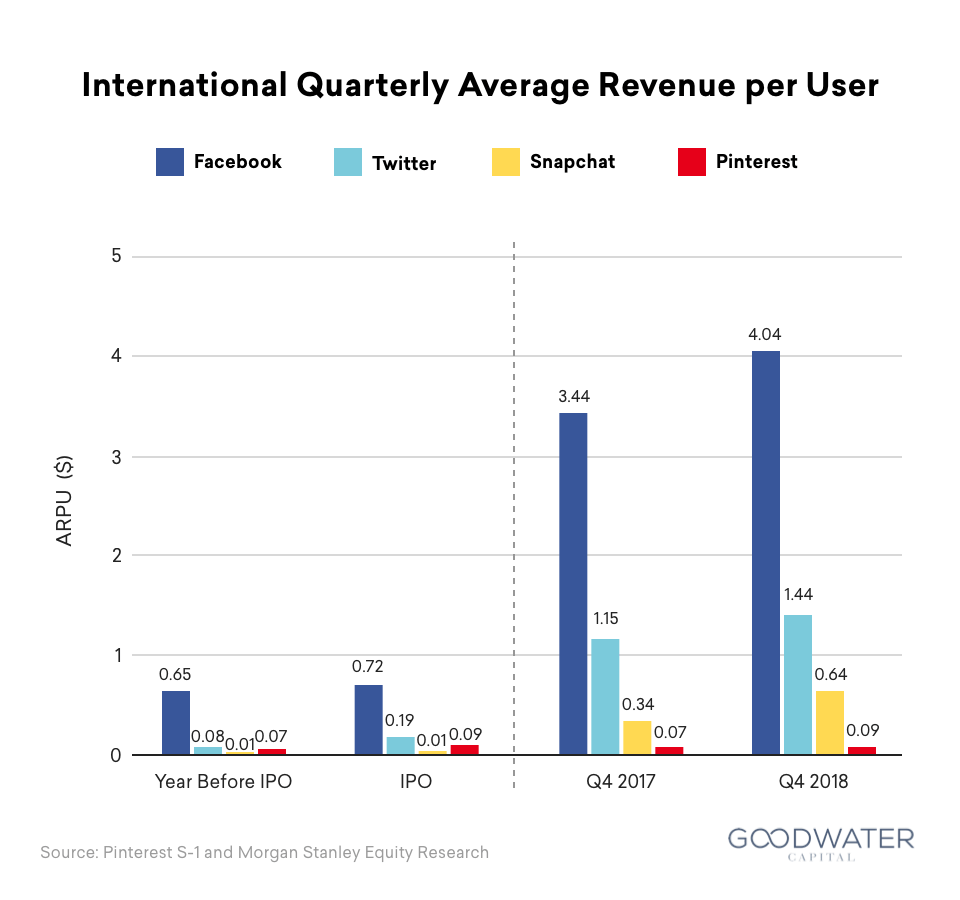

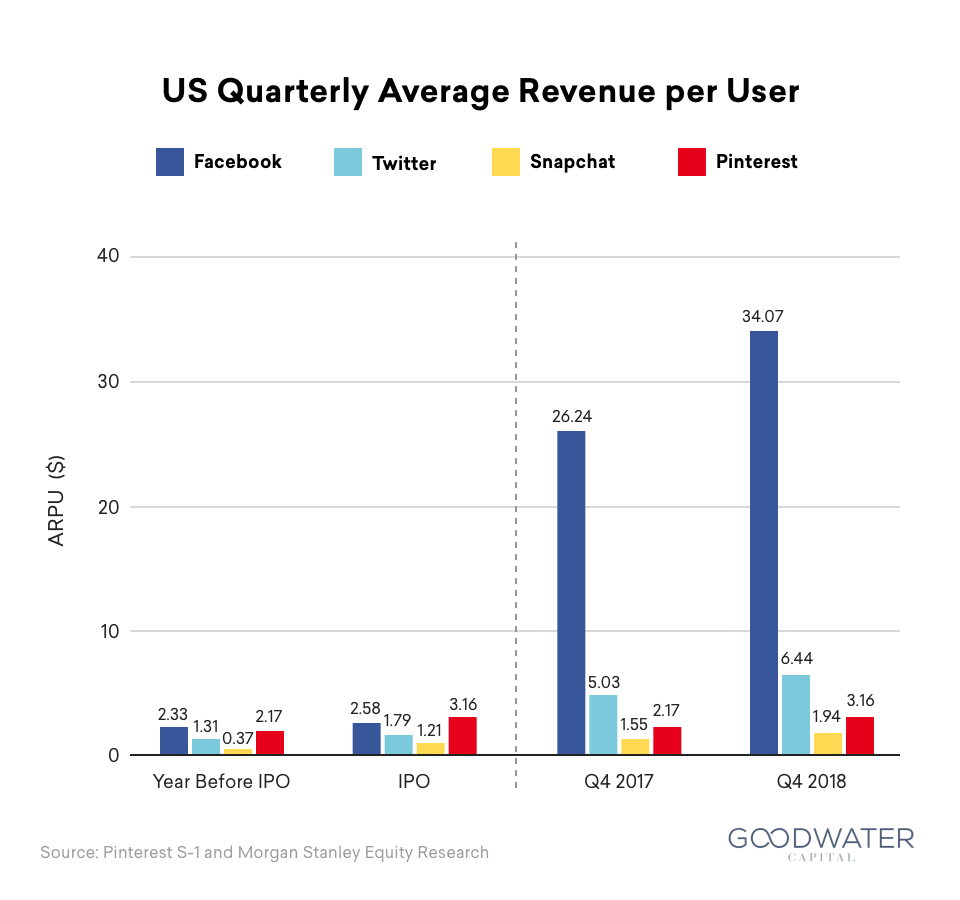

Luckily for Pinterest, its pathway to profitability is quite straightforward and relies on expanding the international monetization of its platform. In Q4 2018, Pinterest only generated $0.09 ad ARPU per international MAU.3 In comparison, the international ad ARPU was $0.64 for Snap (7x greater than that of Pinterest) and $1.44 for Twitter (16x greater than that of Pinterest).4 This means that by educating international companies further about Pinterest’s ad platform, the company has a feasible path to 10x+ their international ARPU by replicating similar monetization techniques that have already been successfully utilized by competitors.

2. It’s the best market for consumer tech IPOs in 15 years.

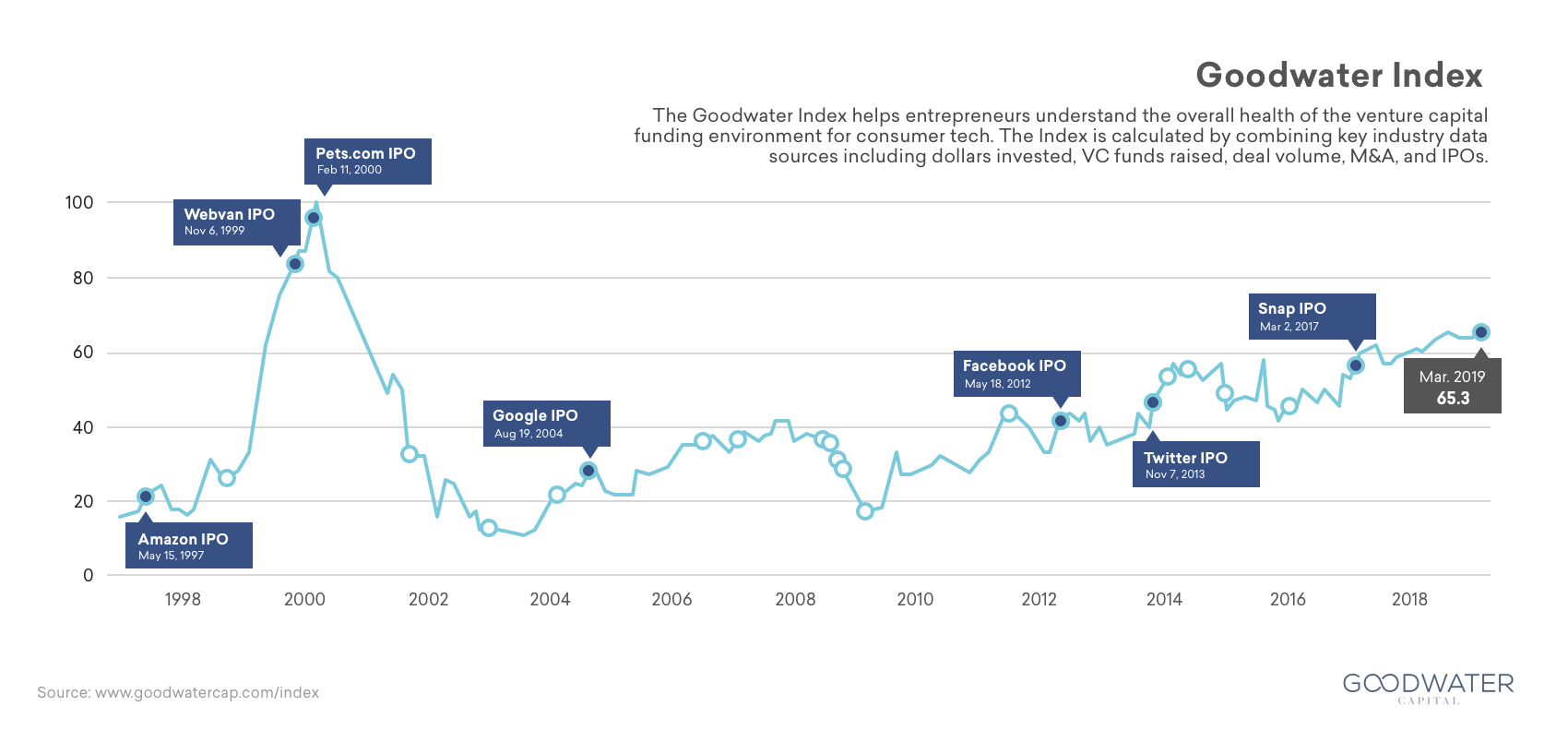

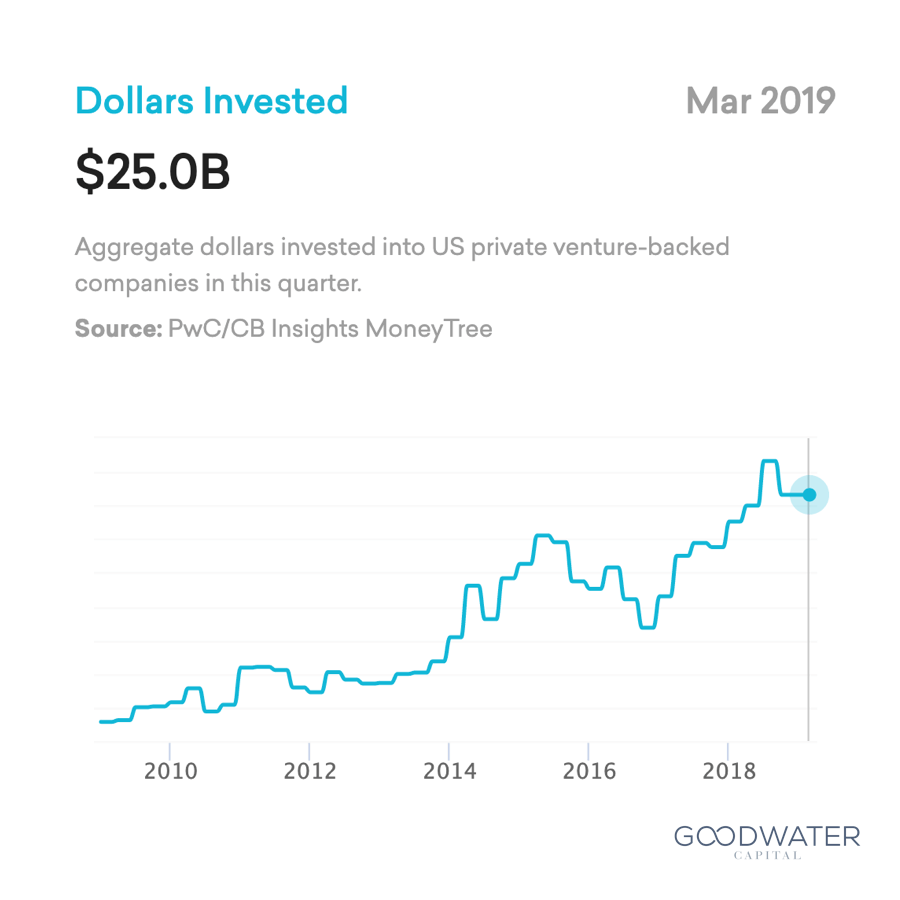

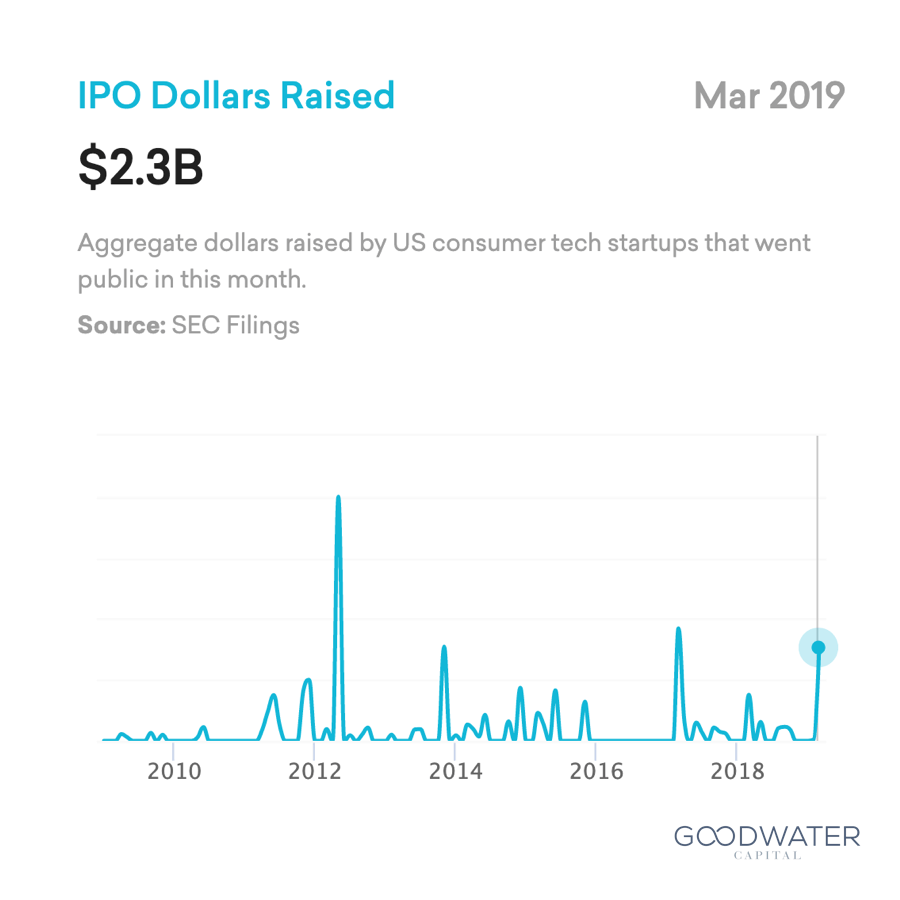

In choosing to go public now, Pinterest is capitalizing on a hot market for IPOs. The Goodwater Index, which helps entrepreneurs understand the overall health of the venture capital funding environment for consumer tech, is currently at a very strong 65.3, up 8% from a year ago. These positive numbers, which are among the highest in the last 15 years, are driven primarily by an impressive amount of private capital not seen since the dot-com bubble. The vast resources available makes it not only a great time to fundraise as an entrepreneur, but also to transition to public markets.

The current collection of big-ticket IPOs may be just the beginning of a multi-year boom. Initial public offerings tend to run in cycles, where several years of low IPO volume are followed by very high volume years. According to Pitchbook, the number of VC-backed IPOs in the United States declined from 2014 to 2017, before rising drastically in 2018.5 Thus, 2019 and 2020 are expected to be high volume, with probable entrants including Lyft (already IPO’d), Uber, Palantir, Airbnb, Slack, Casper, Postmates, and Doordash. Lyft, Uber, Palantir and Airbnb alone raised a total of $26 billion in venture capital, and sport a collective private valuation of $158 billion.6

3. A diversity-rich culture is critical to Pinterest’s success.

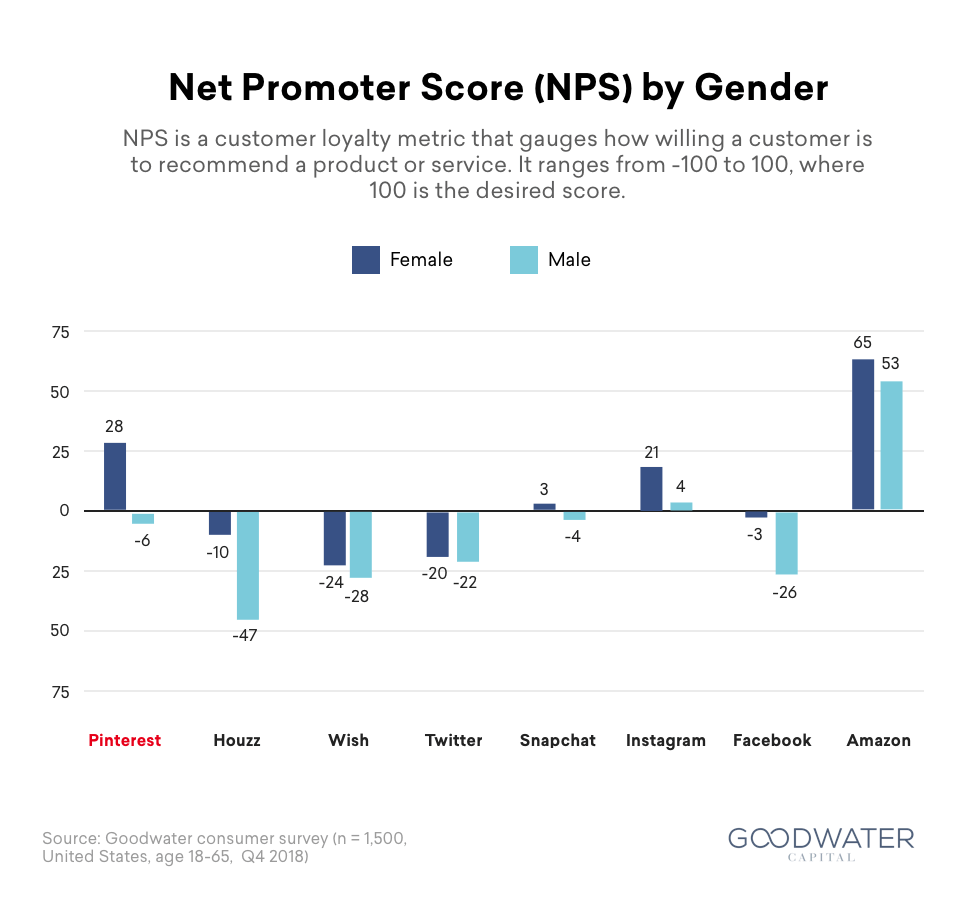

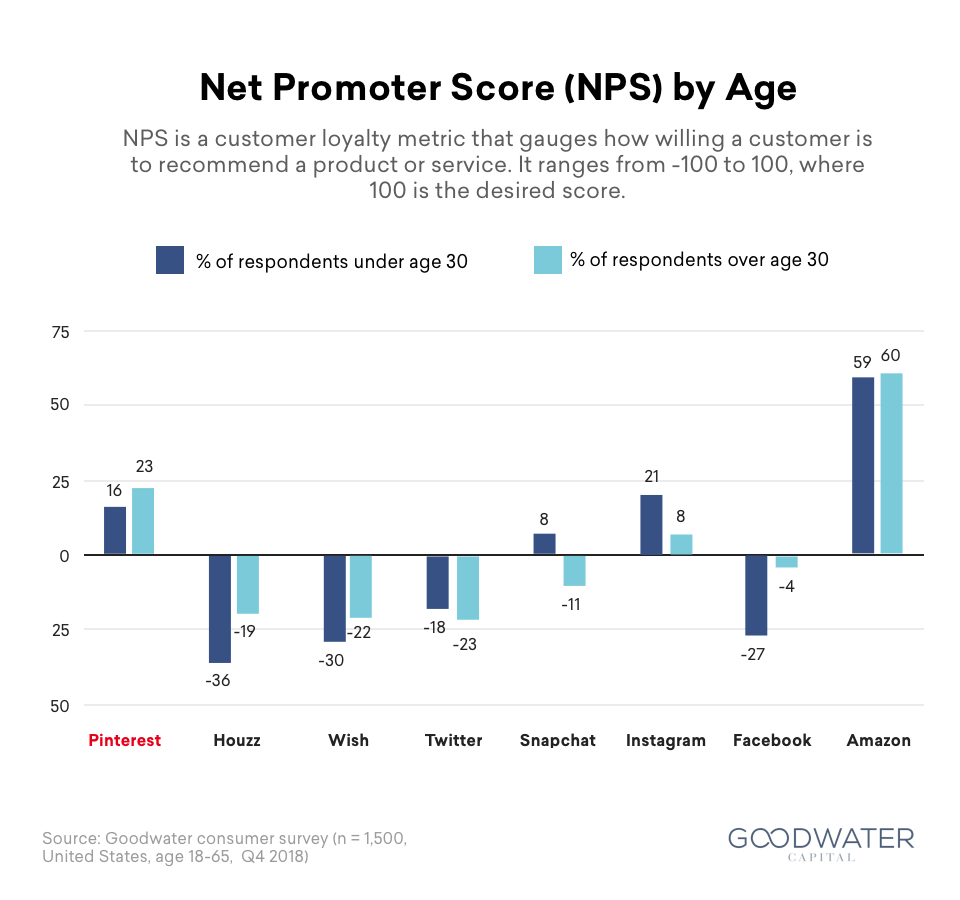

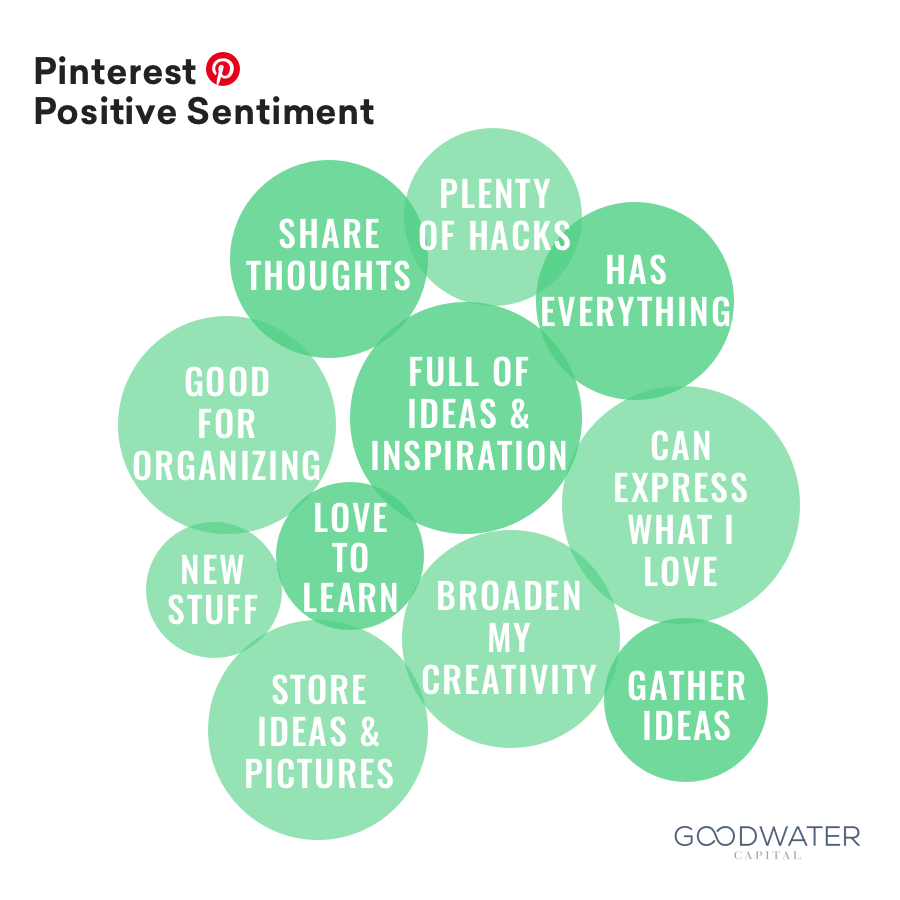

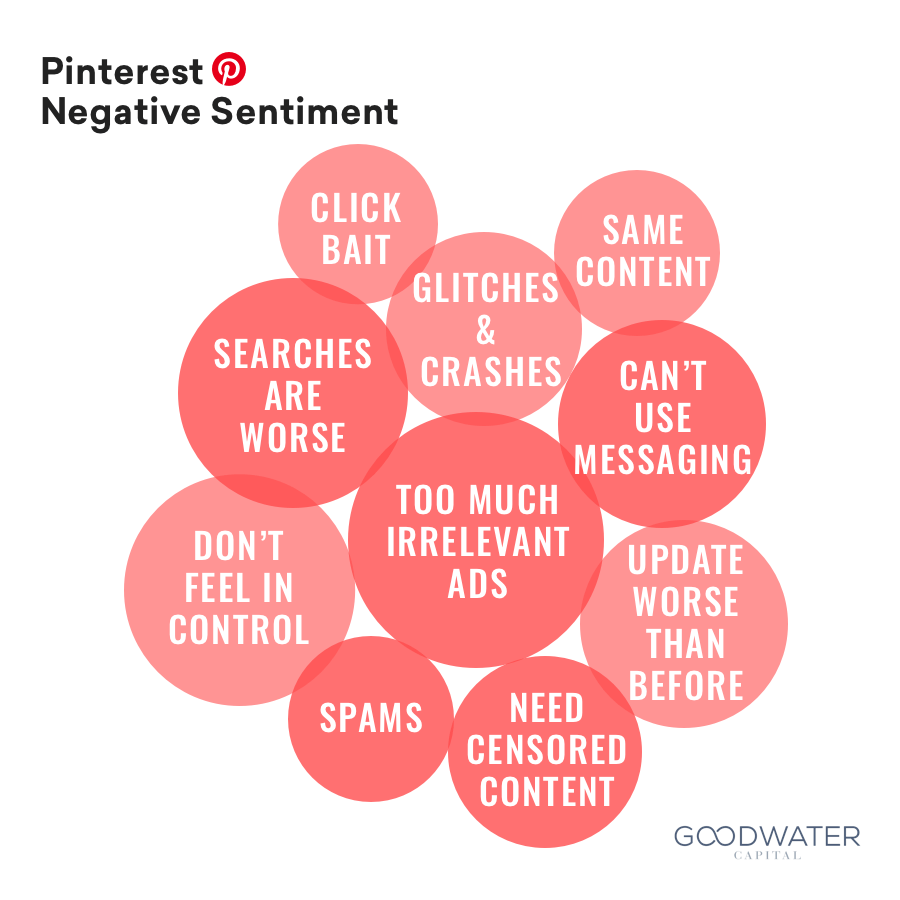

Pinterest’s diverse corporate culture significantly influenced how the company caters to the needs of its user base. For example, Pinterest recently released a new feature aimed at solving a pain point for users of color. The feature, which enables Pinners to sort beauty search results by skin tone, was the direct result of diverse, cross functional team members coming together to improve the product experience.7 Such inclusive feature design helped drive Pinterest’s NPS score higher than that of any other social network among women and across all ages.

Combining diverse talents and perspectives is critical for the creation of innovative products. Studies indicate that companies which prioritize a high level of diverse perspectives have the capacity to produce 19% more revenue than their more homogeneous competitors.8 Pinterest leaned into this trend, and is now a leader in championing diversity and inclusion. For example, as of January 2019, women make up more than 47% of the company.9 In contrast, Twitter is at 37%, Facebook is at 35%, and Google is at 31%.10

Not only does Pinterest’s diverse team enable it to pioneer new product features, but it also aided the company in growing its business around the world; as of Q4 2018, 69% of its monthly active users are from international regions, up from 57% in Q4 2017. Pinterest has expanded to over 15 international markets while successfully localizing their product. By tuning algorithms for local languages and visual content, the company strives to provide users across the world with the same positive experiences of inspiration, ideation, organization, and personal expression which made Pinterest popular in the US.

4. Pinterest brought color to a text-heavy world, which appealed to an underserved demographic.

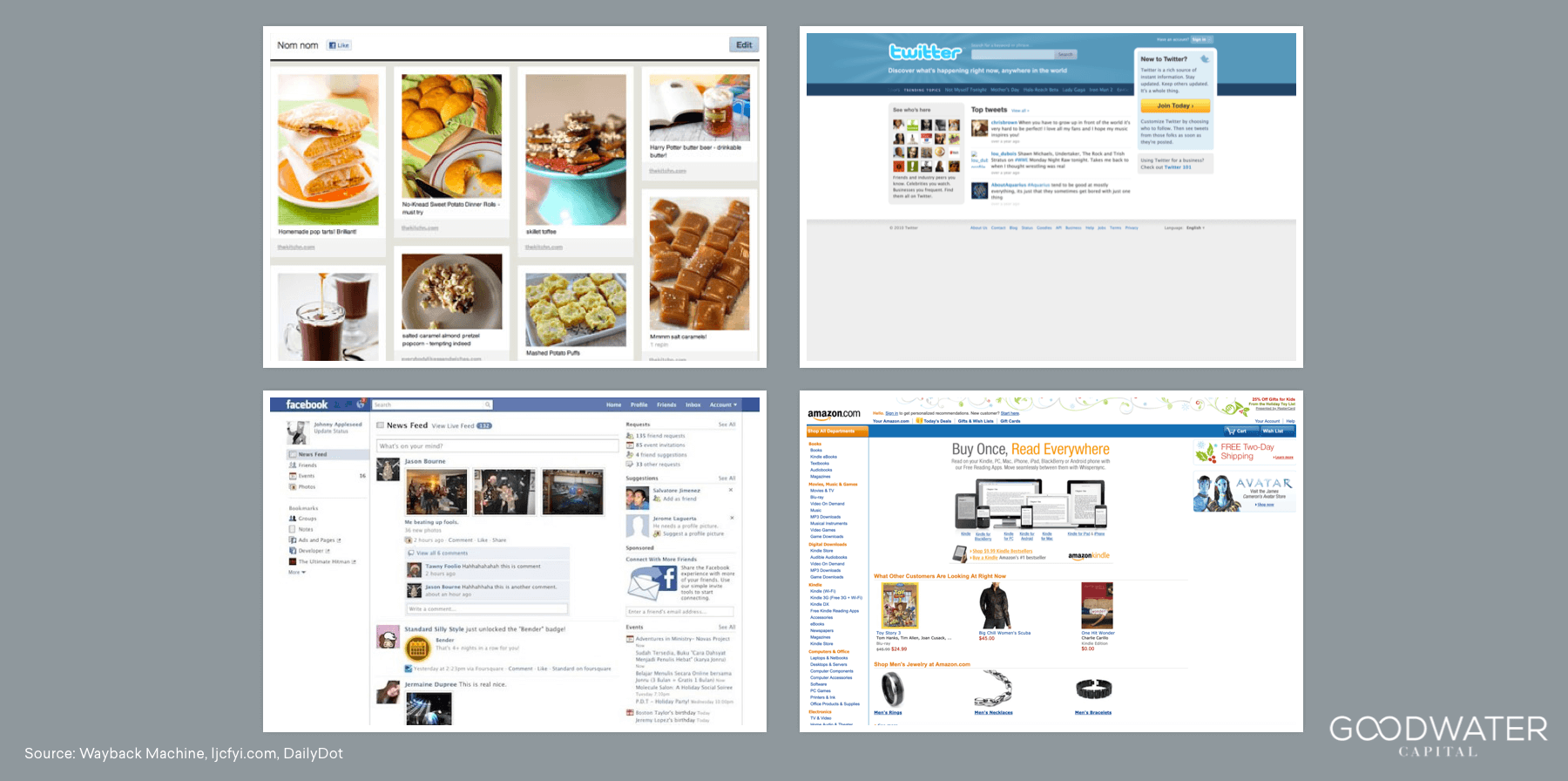

Many tech products get their start by appealing to a young, oftentimes male demographic on the coasts, but Pinterest bucked this trend. Instead, the company’s first audience was composed of 18-35 year old females located in the Midwest and Southern United States. This underserved group was very interested in home design, arts and crafts, style, fashion, and cooking.11 Pinterest’s visually distinct graphical format, which contrasted heavily with the text-centric experiences of other websites at the time (e.g. Amazon and Facebook), was perfect for exploring this particular set of interests.

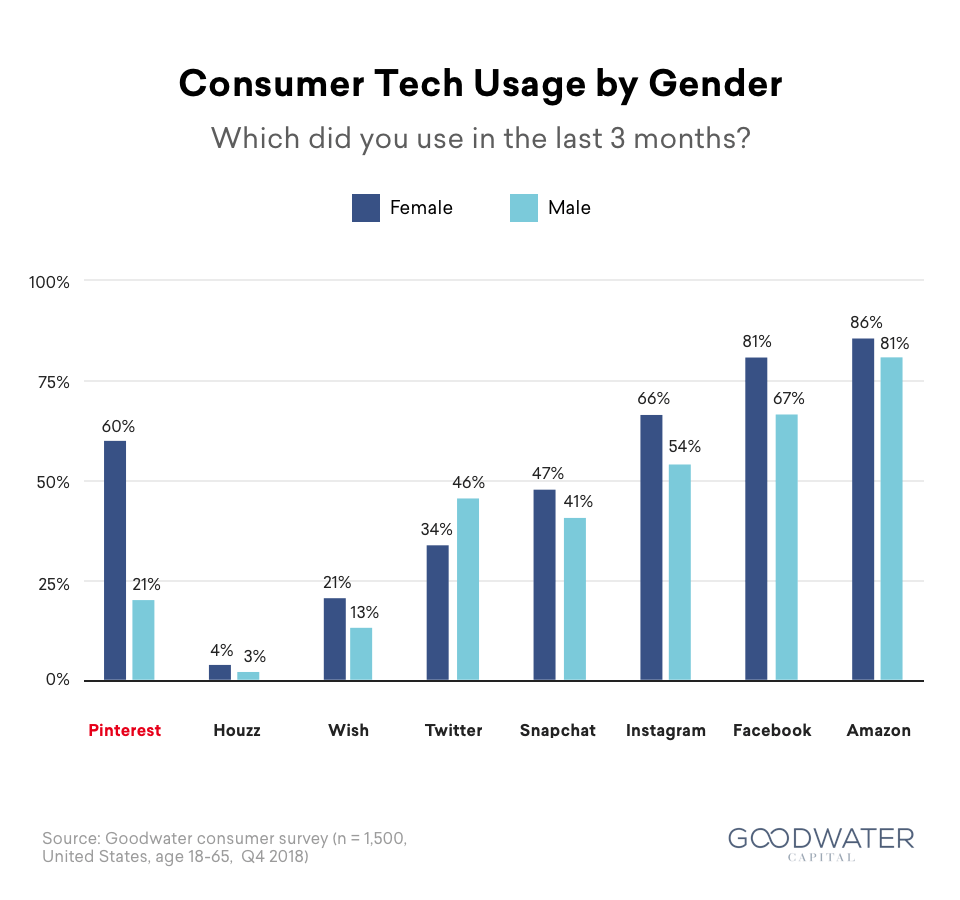

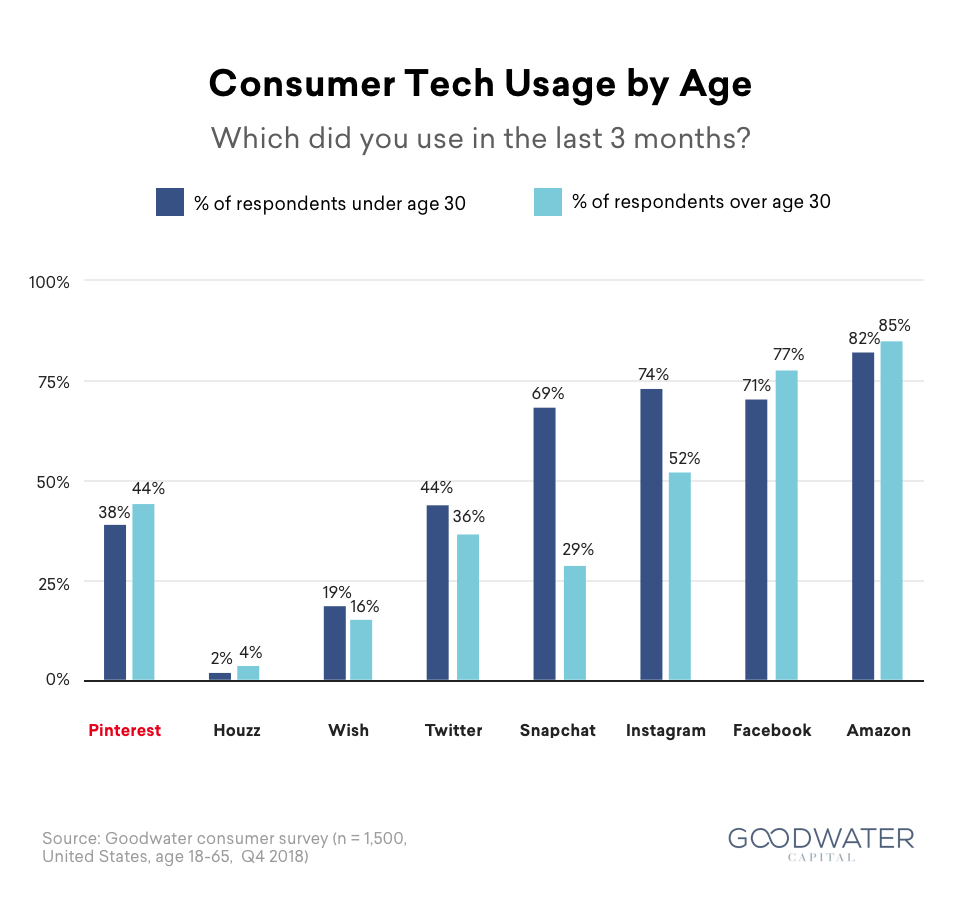

This graphical form of discovery is built on millions of curated pins, a data trove which Pinterest calls the Taste Graph. Not unlike Facebook’s Social Graph or Amazon’s Shopping Graph, the data collected by Pinterest can be used to predict extremely relevant content which can drive personalization – an impressive 82% of Pinners say Pinterest feels personalized for them.12 In addition to this proprietary data, the fact that Pinterest is neither solely a search tool (like Google) nor social media outlet (such as Facebook) means a completely different group of users can be tapped. With its highly relevant personalization and distinctive user experience, Pinterest won over a diverse and loyal user base. Goodwater’s consumer survey found that 60% of female respondents and 21% of male respondents used Pinterest in Q4 2018. These numbers skew far more female than for any other widely used social media product. Additionally, both respondents under 30 and over 30 years old equally used Pinterest compared to Instagram and Snapchat, which skew younger.

5. Pinterest is expanding the advertising TAM, especially for the consumer packaged goods and retail industries.

The global advertising market is set to grow from $693 billion in 2018, to $826 billion in 2022, which is a 5% CAGR. The digital ad market alone is projected to swell from $272 billion in 2018 to $423 billion in 2022.13 Pinterest is uniquely positioned to expand advertising’s total addressable market (TAM).

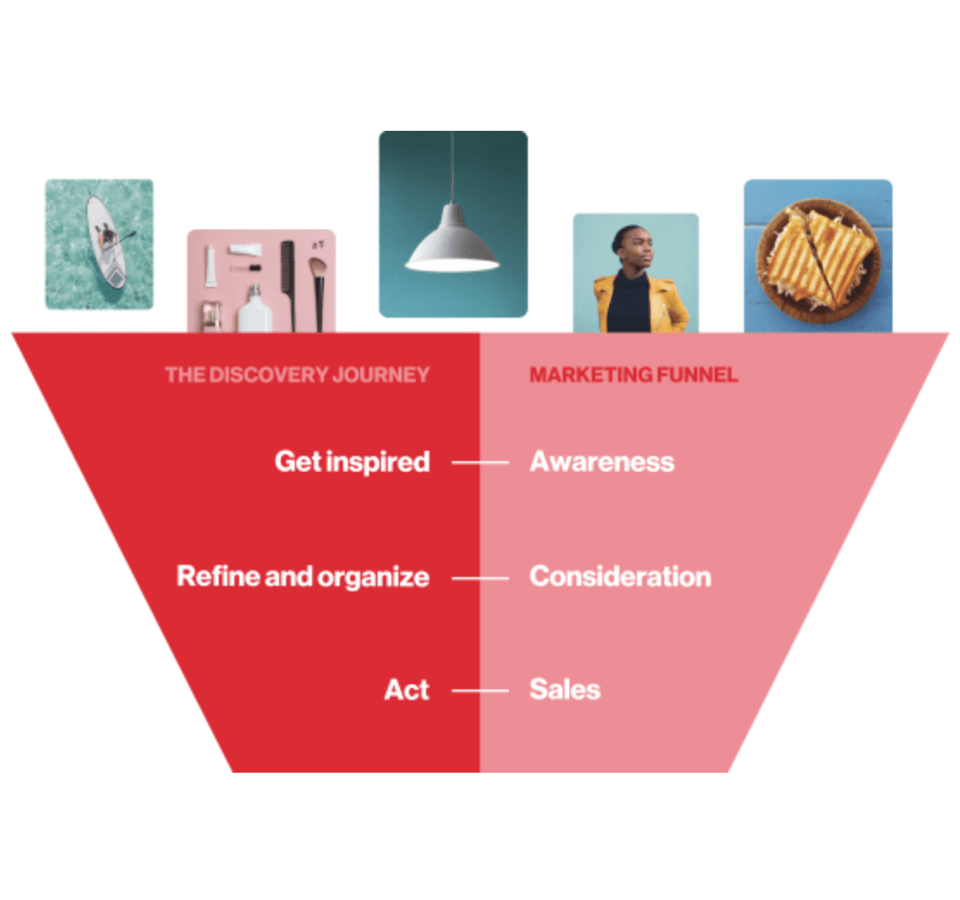

By creating novel ad units that sit throughout the product discovery process, the company is perfectly oriented to reach potential customers long before a search engine query is even considered. As they continue to build out products around what they call the “Discovery Journey,” there are new and natural touchpoints for brands to reach the consumer, such as so-called promoted pins, visual search and search-inspired planning. The success of Pinterest’s new ad units is already becoming apparent, with some of the latest campaigns showing a 3.8x return over a regular digital media campaign, all while delivering $2 in profit for every $1 spent by advertisers in the CPG and retail spaces.14 ROI is also enhanced by Pinterest’s Taste Graph, which links adjacent interests together to create extremely relevant content for the user.

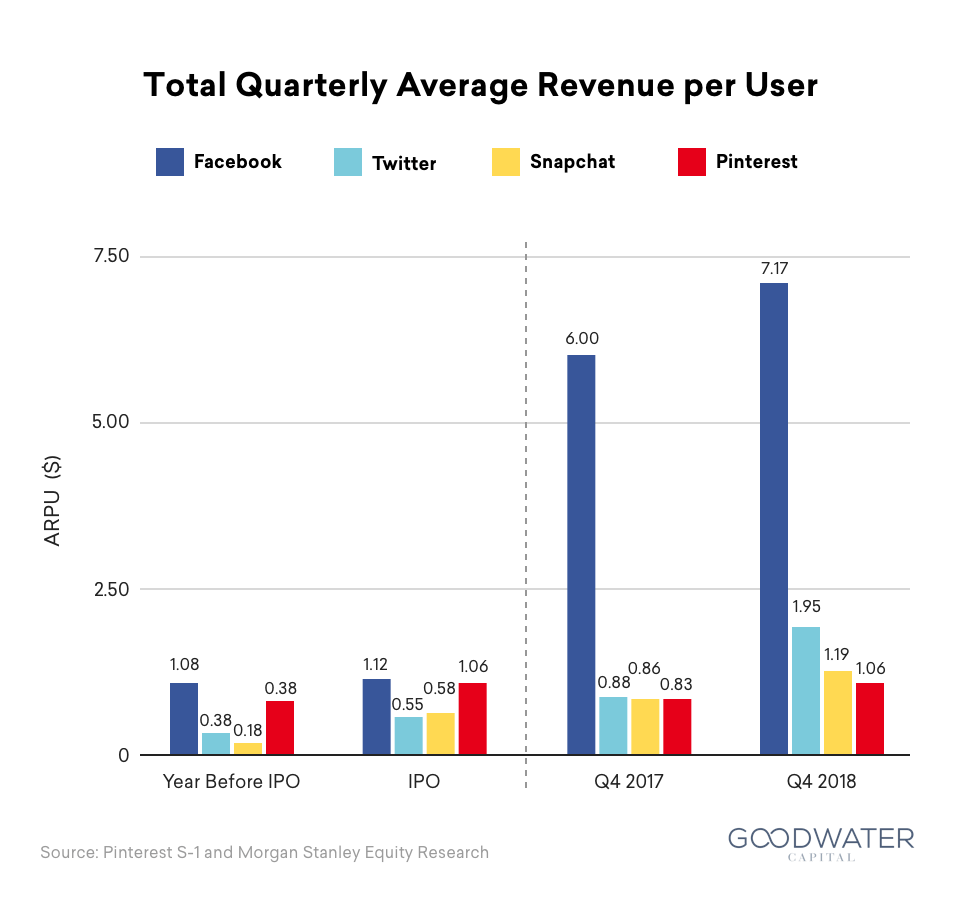

While all social media companies are growing US ARPU as the overall digital ad market expands, Pinterest managed to grow theirs the fastest at 45% YOY.15 This laudable performance means the company is positioned to take market share by appealing to large CPG brands and retailers who have been under pressure as of late. With once-iconic retail stores like Toys R Us, Sears, and Gymboree filing for bankruptcy this past year, the pressure to adapt and find effective marketing channels to reach a new generation of consumers makes Pinterest especially critical for this class of companies.

- Titan, https://www.titanvest.com/research/2019/03/29/lyfts-ipo-buyer-beware-LYFT

- PINS S-1, at page 13.

- PINS S-1, at page 70.

- PINS S-1, Morgan Stanley Equity Research.

- PitchBook, https://pitchbook.com/news/articles/all-the-companies-making-2018-a-historic-year-for-ipos

- CNBC, https://www.cnbc.com/2019/04/01/april-could-see-ipos-from-uber-and-pinterest-heres-what-to-expect.html

- Pinterest Newsroom, https://newsroom.pinterest.com/en/post/building-a-more-diverse-pinterest

- Forbes, https://www.forbes.com/sites/annapowers/2018/06/27/a-study-finds-that-diverse-companies-produce-19-more-revenue/#50e81716506f

- Pinterest Newsroom, https://newsroom.pinterest.com/en/post/building-a-more-diverse-pinterest

- Recode, https://www.recode.net/2017/12/19/16795074/pinterest-employee-diversity-report-women-tech-silicon-valley

- RJMetrics, https://blog.rjmetrics.com/2012/03/12/new-pinterest-data-whats-everyone-pinning-about/#.UoUmDpRgZYg

- PINS S-1, at page 2.

- PINS S-1, at page 4.

- PINS S-1, at page 121; Pinterest Business, https://business.pinterest.com/en/blog/pinterest-drives-38x-greater-sales-than-the-average-digital-campaign

- PINS S-1, Morgan Stanley Equity Research.