Instacart is a surprisingly good business. Instacart’s S-1 and upcoming IPO prompted us to take another look at a business that we hadn’t looked at since pre-pandemic. COVID tailwinds have clearly reversed, but what remains is a surprisingly engaged customer base of the best grocery customers across the industry, and a differentiated position in the grocery ecosystem that leads to retaining those consumers. There remain challenges ahead, most importantly how to grow the core grocery delivery business from this point. In this Thesis report we dive into the customer dynamics currently powering the business and potential paths that Instacart might pursue to reignite growth.

What is Instacart?

Instacart is a US company that operates as an Internet-based grocery delivery and pick-up service in the U.S. and Canada. The company operates a third-party (3P) grocery delivery service: order on the app, Instacart relays that order to a ‘shopper’ who then picks and packs your groceries and deliveries to you.

Founded in 2012, the company has been able to expand rapidly:

Today, Instacart partners with more than 1,400 national, regional, and local retail banners across more than 80,000 stores that represent more than 85% of the U.S. grocery industry. Millions of households depend on us and our partners for their grocery needs. We power tens of billions of dollars in annual sales for retailers, which makes Instacart the leading grocery technology company in North America. Our GTV, representing the online sales we power for all of our retail partners, grew at a compound annual growth rate of 80% between 2018 and 2022, compared to 50% for the overall online grocery market and 1% for offline grocery. We have demonstrated our ability to help our retail partners drive strong growth and stay competitive in a complex and increasingly digital industry.

– Instacart S-1

Expect to Pay 40% More for the Service

No discussion about Instacart is complete without understanding its pricing.

Pricing is determined by three factors:

- Markups (on the prices of the items)

- Fees

- Tipping

Markups

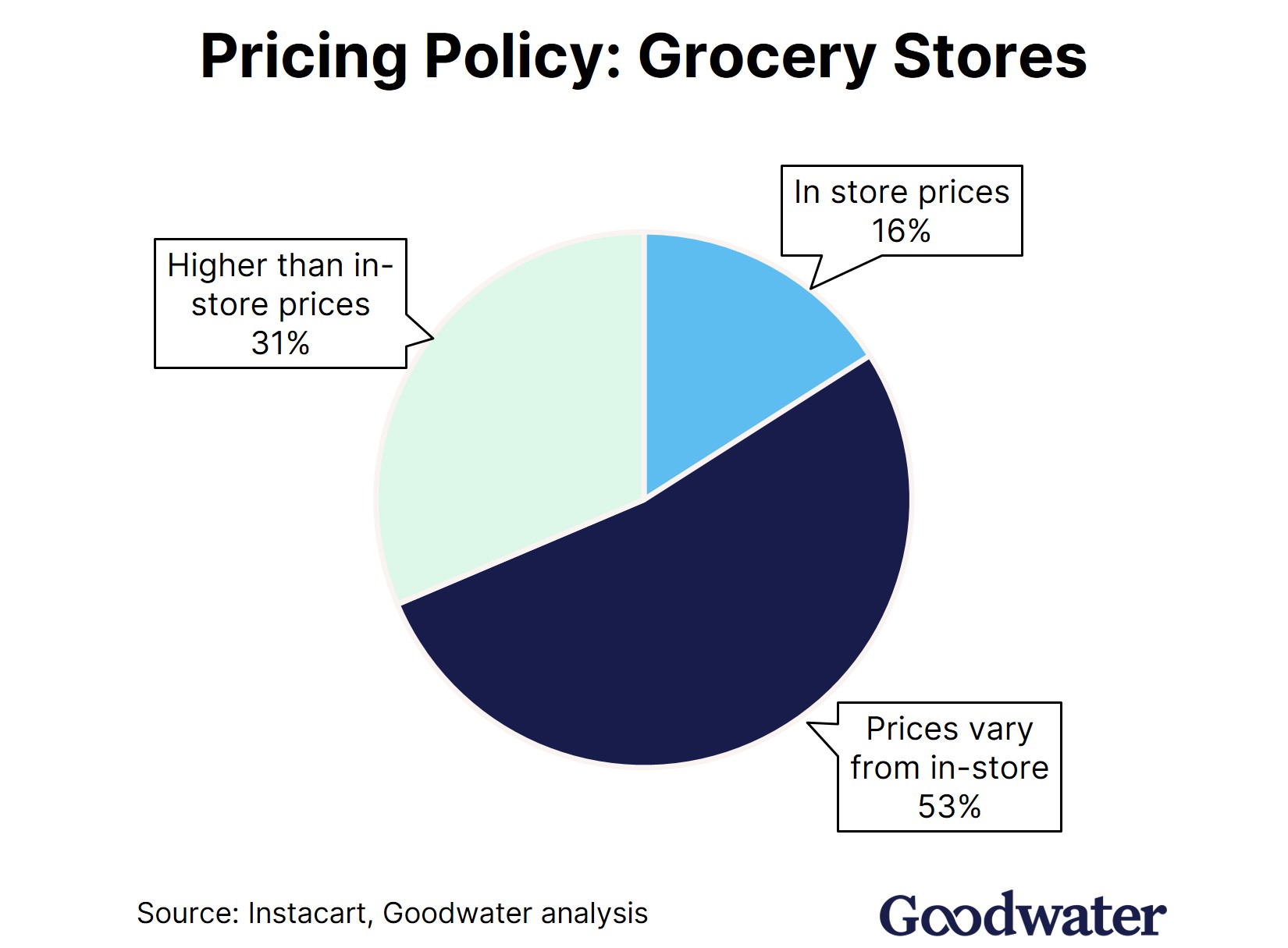

Instacart has 3 pricing levels:

- Everyday store prices – prices are the same as in-store

- Prices vary from in-store – prices could be the same or higher than in-store

- Higher than in-store prices – prices are higher than in-store

From our data scraping, we find that 84% of grocery store prices are different from in-store prices, and that they are almost always higher.

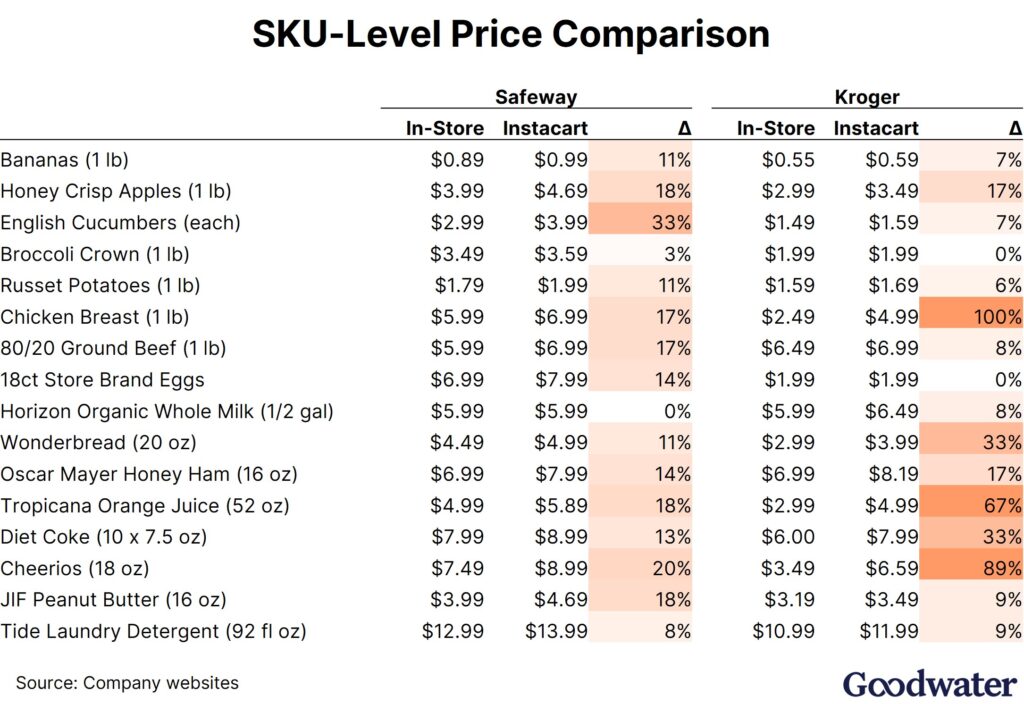

Below is an excerpt of a sampling of the most popular grocery SKUs in every American kitchen, sold by stores from the 2 largest publicly-traded grocery chains in America and how the prices of those items compare with Instacart:

Markups can range from none (milk and eggs) to 100%+ (chicken) with no clear trend from store to store. It can get even worse for shoppers who only purchase on-sale items, as those discounts are not always reflected on Instacart.

Overall, we estimate that on average, users are paying 15% more when there is a markup.

Fees

Beyond higher SKU pricing, Instacart also charges platform fees. According to Instacart’s website, there are 7 Instacart-specific fees that can be added to a user’s order.

- Delivery fee

- Heavy fee

- Service fee (with a special alcohol fee)

- Long-distance service fees

- Priority fees

- Pickup fees

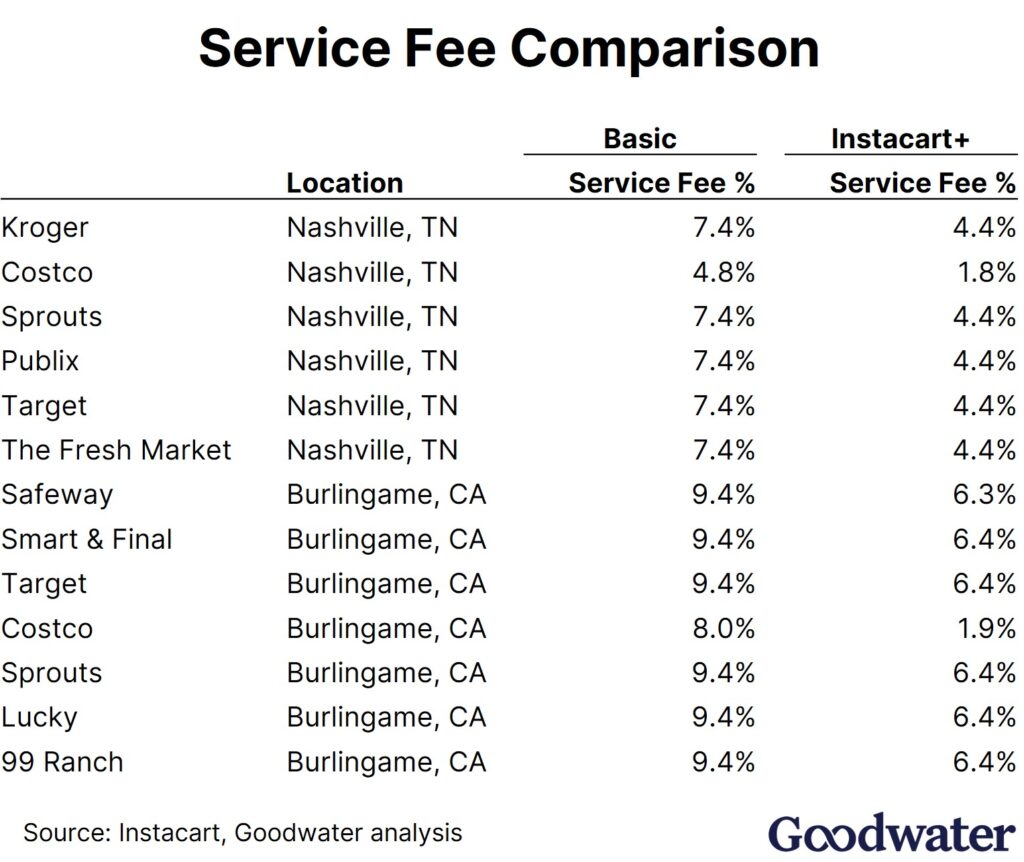

According to Instacart’s S-1, “in 2022, retailers and customers incurred an average of $16 in fees.” However, looking only at basic service fees, we see that they vary by retailer and by region:

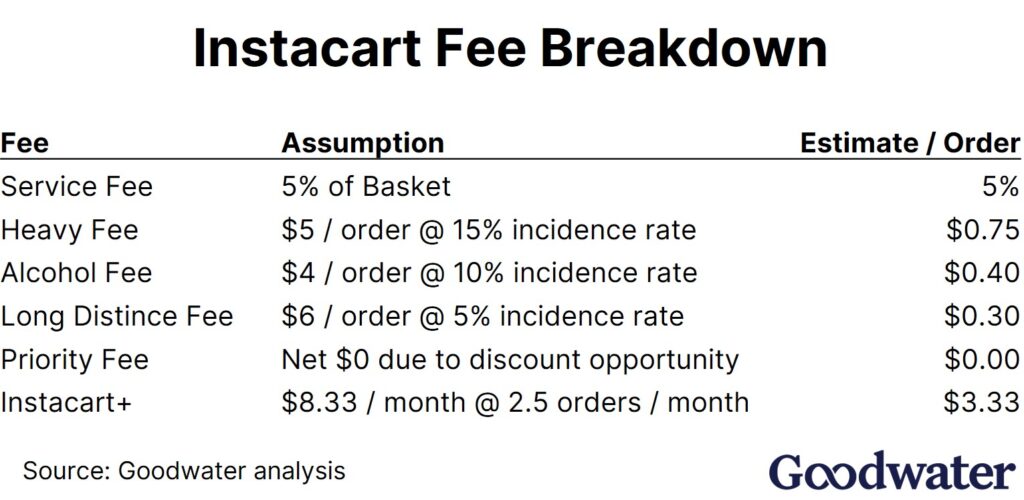

After compiling all the different fees, our best estimate of each fee is shown below. Fees will inevitably be variable, based on the retailer, shopping habits, and more.

Tipping

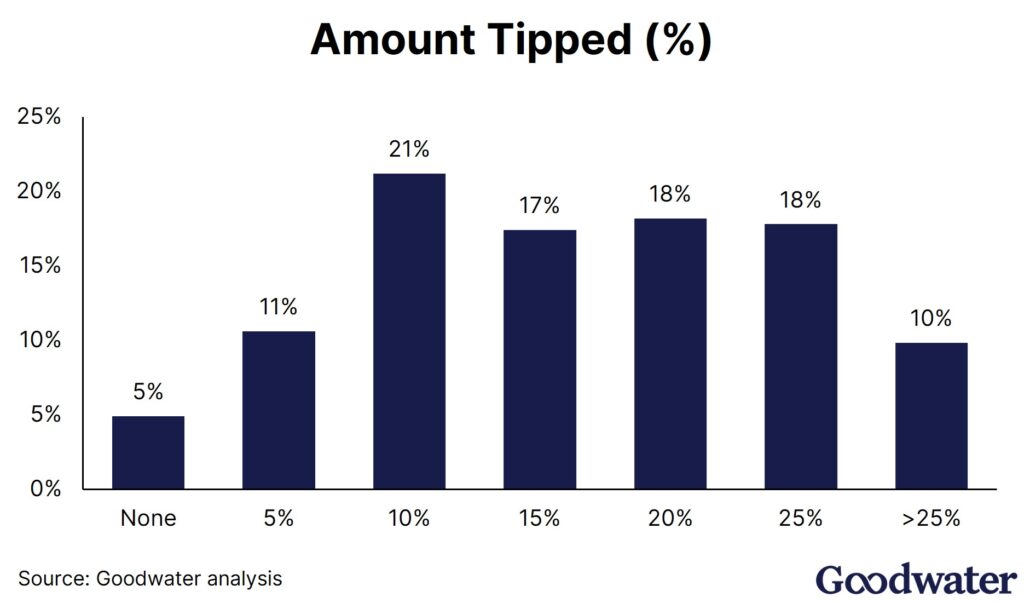

We conducted a survey of 264 Instacart users, which indicates that how much is tipped varies widely depending on the end user, but as a whole, users tip around 15% of their basket size.

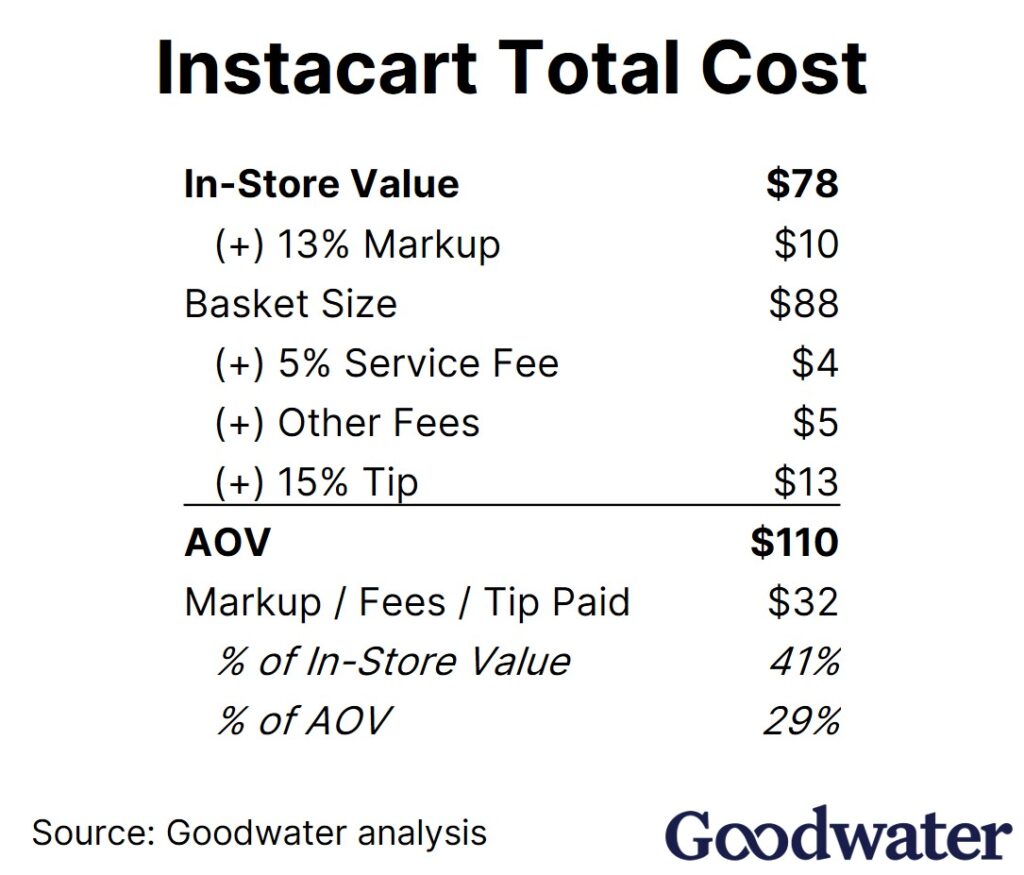

Total Cost of Instacart

Combining all three factors, the average Instacart user can expect to pay 40% more than if they just purchased the items in-store. In other words, for a $110 order on Instacart, a customer is getting only $78 in goods and paying $32 for the convenience of getting it delivered.

Note that this does not include taxes, which will increase based on the more expensive basket, but are highly variable based on local law. This also assumes users are subscribed to Instacart+, which is the logical thing to do if you use Instacart even as little as once per month.

TAM Saturation is A Real Possibility But Customers are Among the Best Grocery Customers in the Industry

Instacart is an expensive product. It effectively charges a 40% premium over a regular grocery store, and because of that price difference, it is unlikely to appeal to the entire US market, especially in today’s macroeconomic environment. However, that is the point of the service — Instacart’s customers aren’t the budget consumer, but instead, Instacart’s customers are actually among the most valuable grocery customers in the industry, and the platform provides a sticky value proposition for those customers.

We can dig into some of the external data and survey results that show this customer dynamic.

Instacart’s User Growth Has Flattened as Pandemic Tailwinds have Reversed

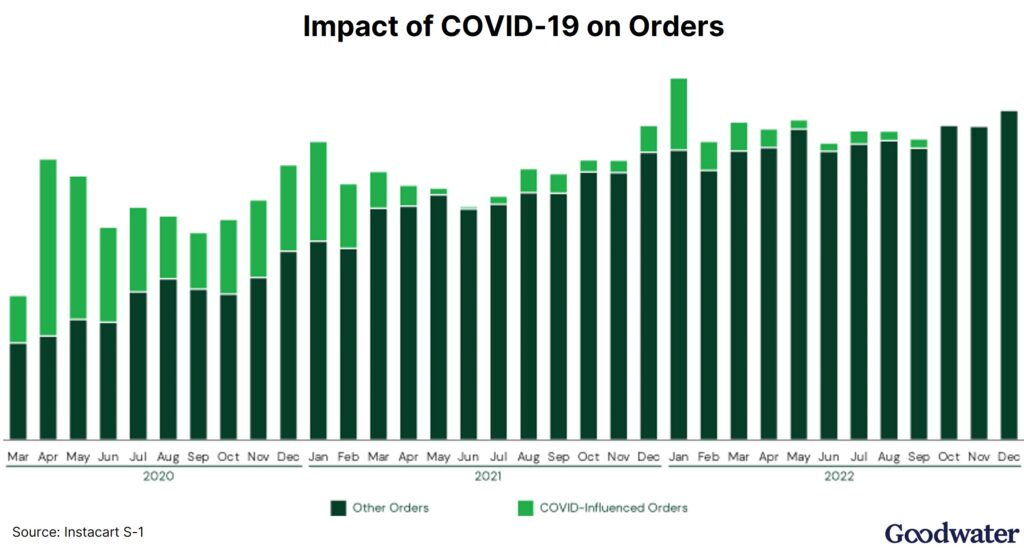

Instacart is well aware of the potential challenges in user growth where it’s S-1 shows monthly order numbers flattening as pandemic tailwinds have reversed:

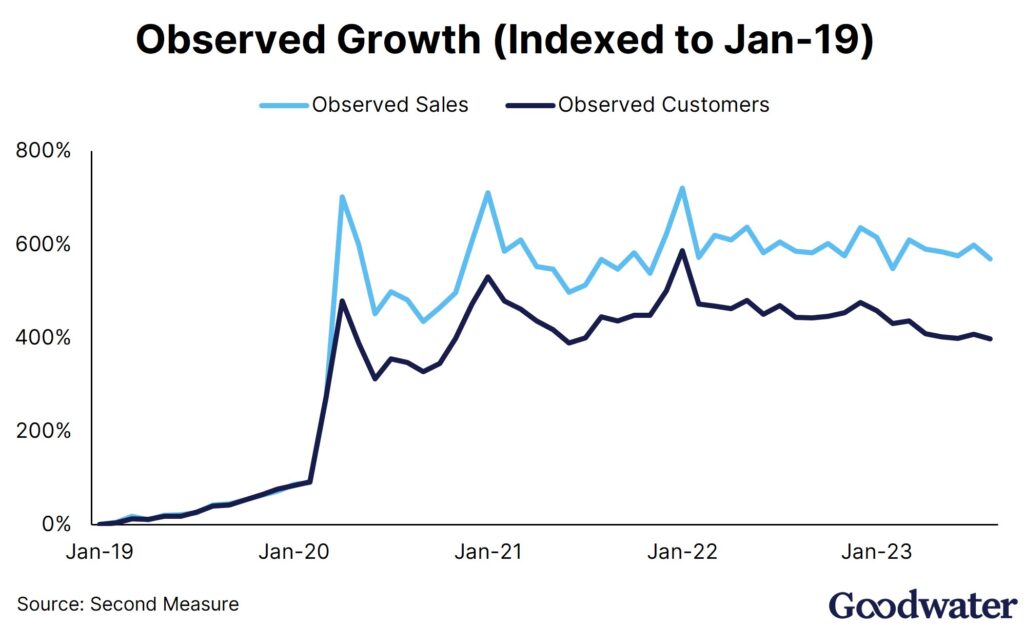

External data sources corroborate this trend and show that the slowdown has been due to the number of customers having peaked:

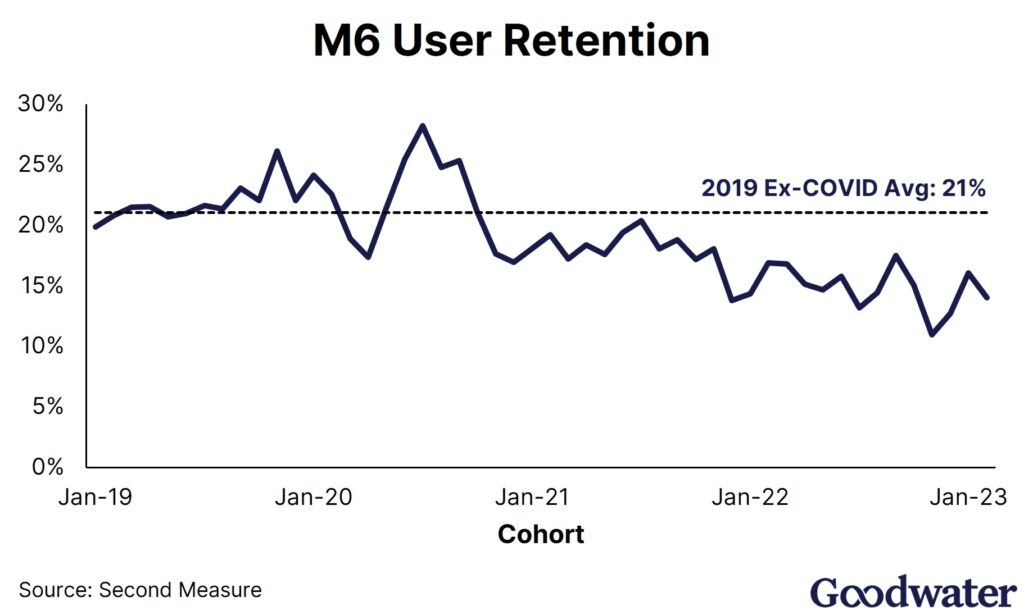

New users acquired today are also less retentive than users previously acquire with M6 retention having decreased from ~21% to 15%:

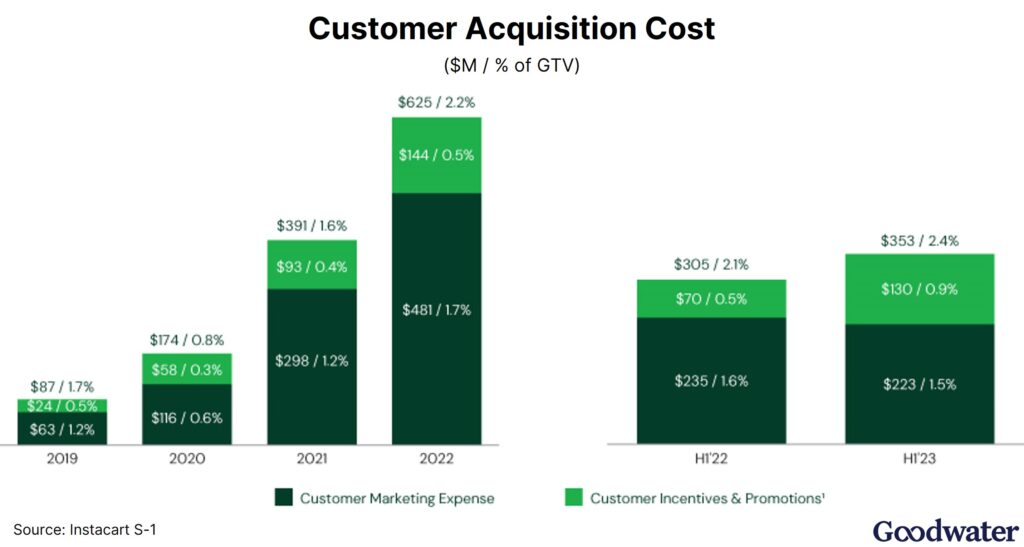

This also ties with the sharply increasing customer acquisition spend in recent years, which is generally an indicator that it is getting more difficult to find quality customers.

Paired with the commentary from management in the S-1, it is clear that figuring out how to grow the business is going to be one of the key questions going forward.

But Instacart’s Remaining Customers Are Strong Grocery Consumers

However, what the topline numbers fail to show is the quality of the user base.

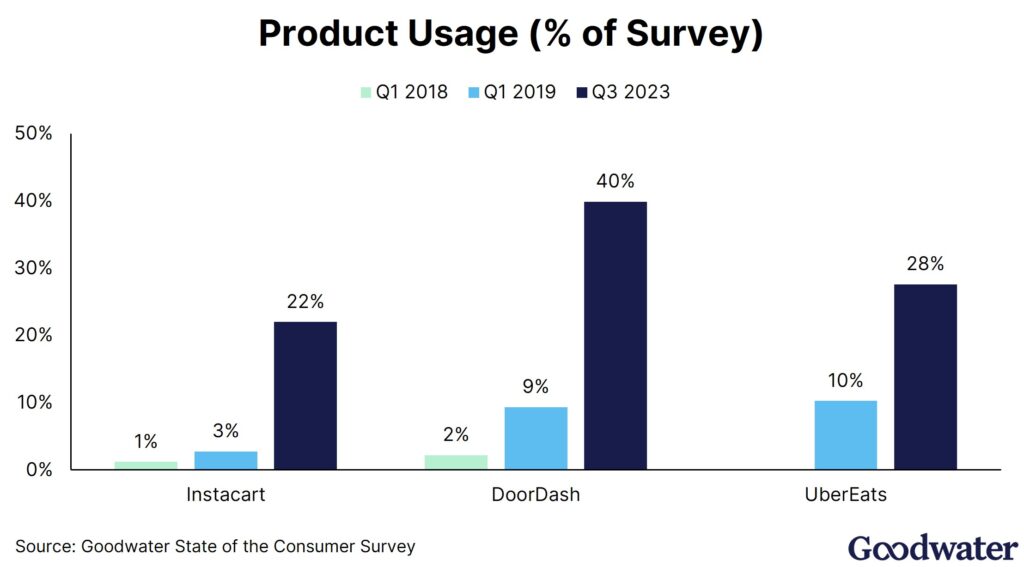

Goodwater has run a cross-sectional survey over the past 5 years that surveys consumer attitudes toward a wide panel of consumer tech services. Survey results indicate that before the pandemic, Instacart had the lowest penetration of any delivery service at 3% (vs DoorDash and UberEats at 9-10%) in Q1 2019. However, usage surged due to the pandemic, where usage ballooned to 22% of survey respondents:

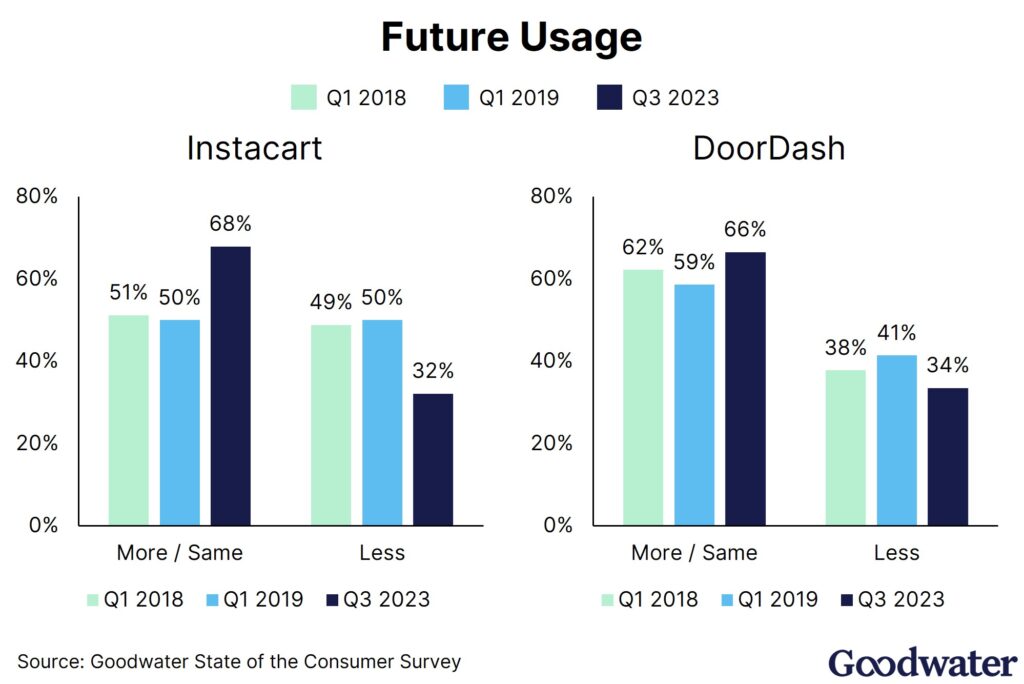

Attitude toward the service has also increased — 68% of Instacart users report increasing usage versus 50% pre-pandemic. This is a larger shift than DoorDash over the same period:

So while the wider perception of Instacart is that its value proposition is weaker post-pandemic, Instacart users actually see a stronger value proposition as the platform has scaled.

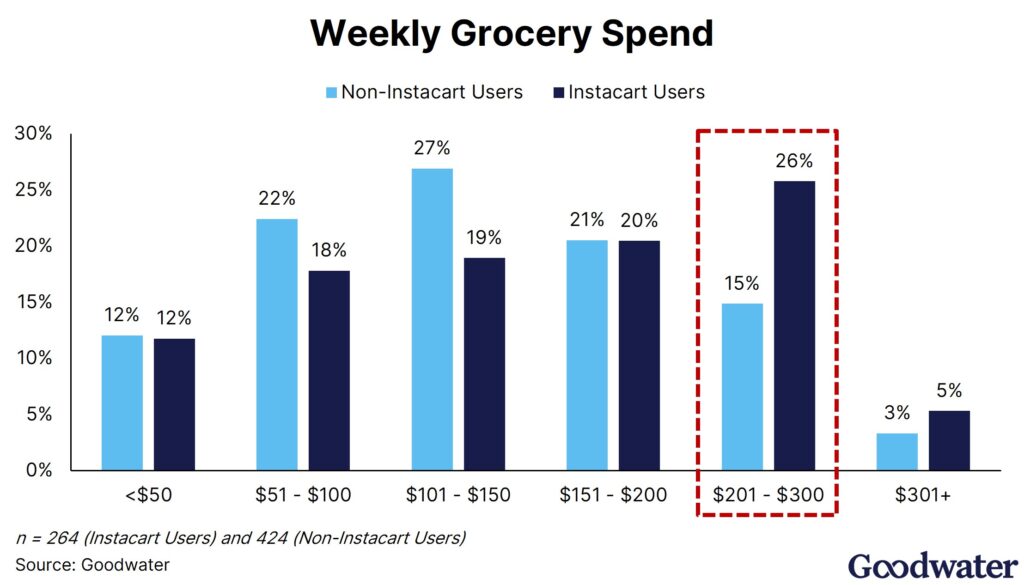

And Instacart users are incredible grocery customers. While only 39% of non-Instacart users spend >$150 on groceries each week, that jumps to 52% for Instacart customers where the biggest group of customers spend $201-300 per week:

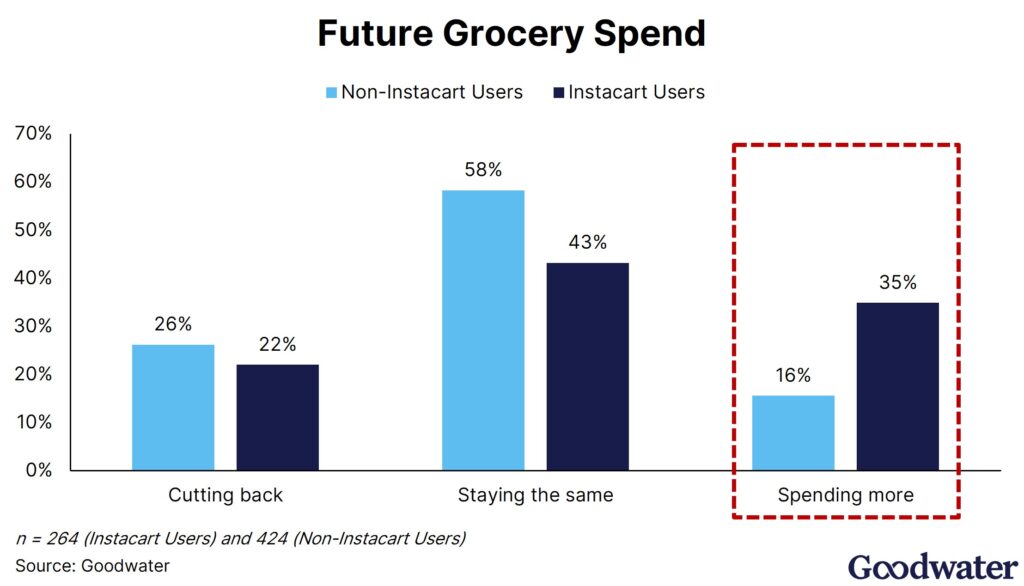

That gap is expected to widen: 84% of non-Instacart consumers are expecting to cut or hold grocery spend flat over the next 3 to 6 months, but over one-third of Instacart users want to increase grocery spend:

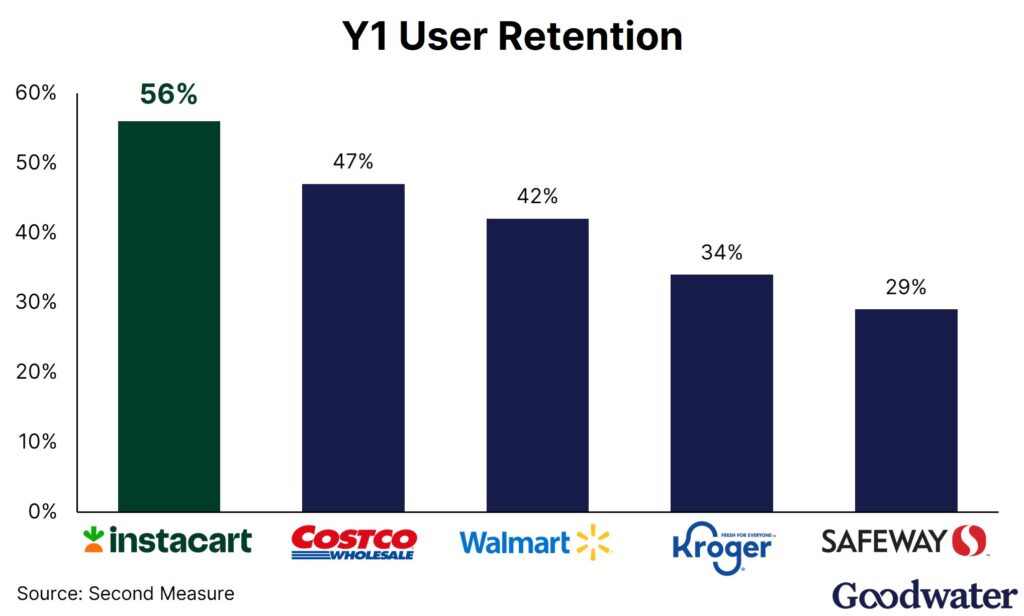

Instacart’s customers are also much stickier than the rest of the grocery ecosystem. 56% of Instacart customers come back in the year after first purchase, exceeding that of Costco, Walmart, and regular grocery stores.

The stickiness of that user base is actually an indication of its relative customer appeal despite the high fees, and actually speaks to its unique position in the market as being one of the few providers of grocery delivery in the market today.

With its fee markups, Instacart isn’t likely to appeal to everyone. But Instacart is incredibly appealing to its core user base who are among the highest spending and highest engaged grocery shoppers in the industry. And this points us to how Instacart can continue growing: instead of raw user growth, it can lean into serving these highly engaged customers with better service offerings.

Possible Ideas from the Early Stage Venture Ecosystem

A number of ideas around the delivery space have emerged in the early-stage venture ecosystem around the world. While there have been countless variations, here were three areas that have emerged in the earlier stages that we’ve seen that that could be interesting opportunities for Instacart:

1. In-house to Create a First-Party (1P) Delivery Tier

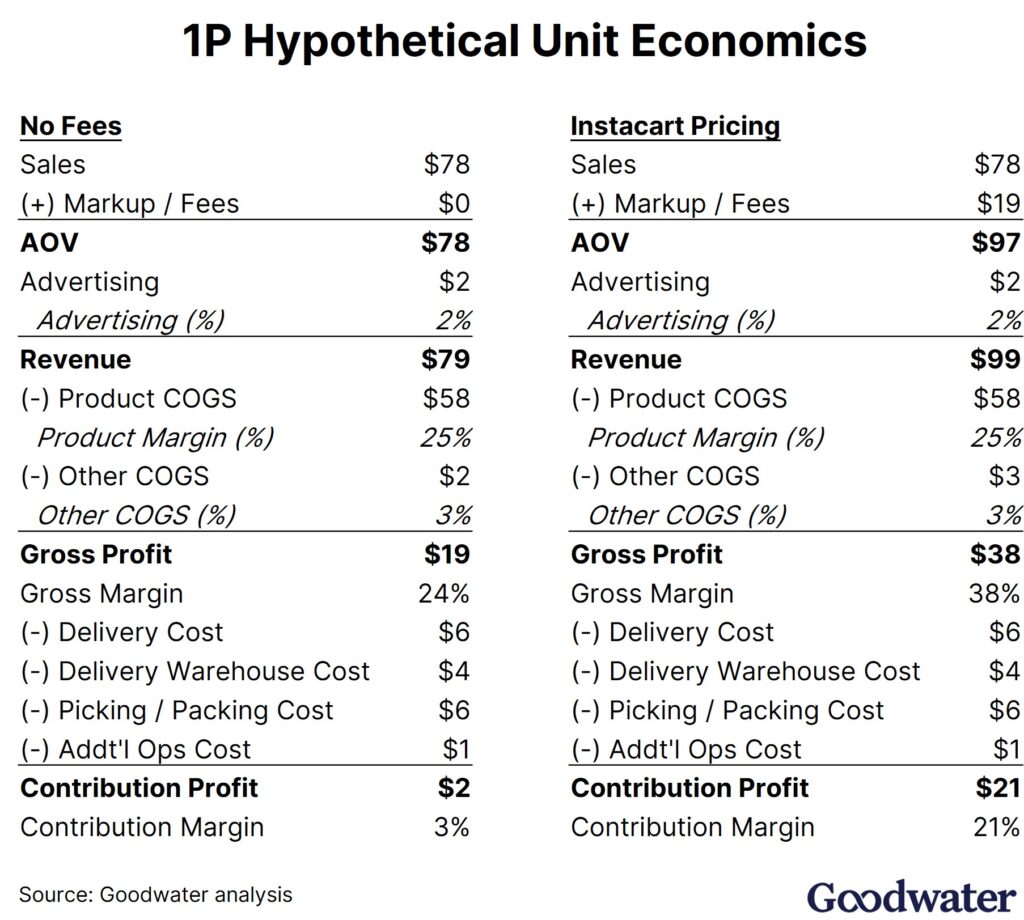

A 1P model can be capex heavy, and cash flows are hard to manage, and where operational efficiency is a recurring challenge. However, with the right technology and model what we’ve seen is the possibility for a 1P model to succeed, and where it could look something like the following:

A 1P model is a long-term investment that requires both capital and a new muscle to be built within the business, but if done right, can open up a lower effective price to consumers, and in Instacart’s case, expand the TAM to a larger set of more price conscious consumers.

However, it is important to note that while it can be a potential expansion opportunity for Instacart, a 1P model brings them in direct competition with their current retail partners and in direct contradiction with its stated goal of “bring[ing] the grocery industry online and help[ing] make grocery shopping effortless.”

2. Order Hyper-Batching

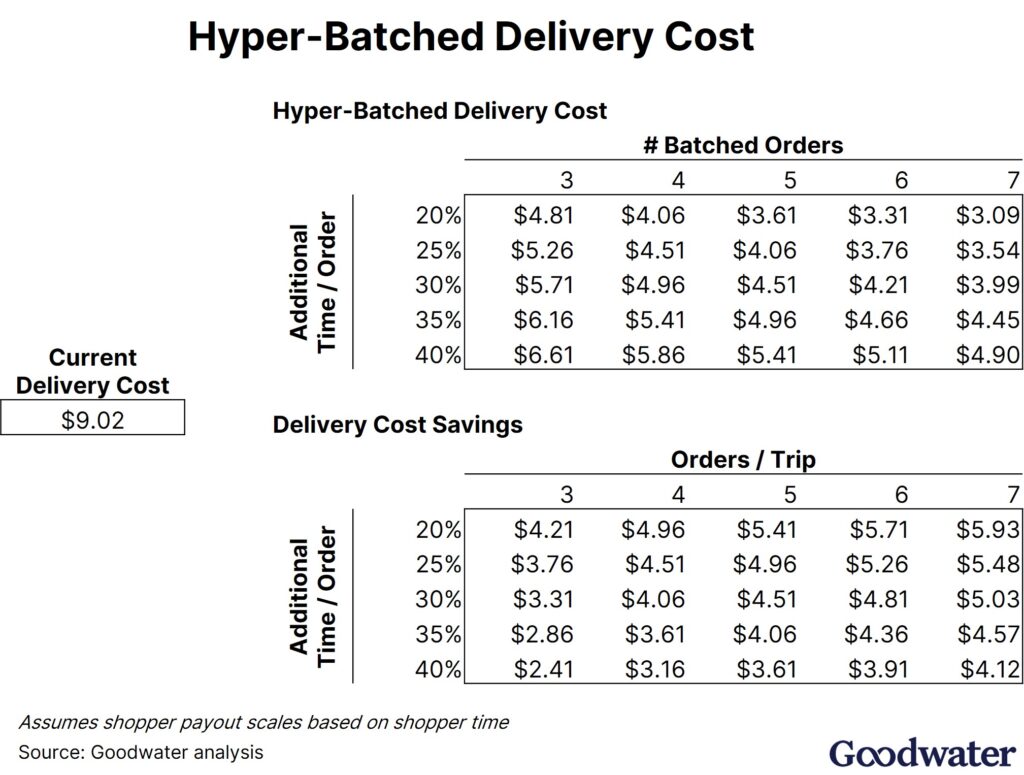

Instacart has a limited form of order batching — if you are willing to wait a few hours, Instacart can provide a couple of dollars off of your order. But based on the pricing we’ve determined, a couple of dollars is likely not going to be enough to convert someone to using Instacart.

An idea explored in the early-stage venture ecosystem is whether something more restrictive (e.g. scheduling days in advance with restricted time windows) could increase batching by a substantial amount and drive enough savings that can be passed on to the user. It has long been a dream of DoorDash and UberEats to pick up 10+ orders from a single restaurant and deliver it all to customers in a very tight radius. The model would look something like this:

With just a few orders batched, Instacart could lower the direct fee charged by $3-5 / order (from ~$9). While total fees would remain relatively high at ~$28, and would be unlikely to spur a massive TAM expansion, the effect of introducing a product offering here would be as a potential retention mechanism for customers interested in trading money for time.

Despite these challenges, there are a few examples of this worldwide, where entrepreneurs and their teams have gotten around this by working with a limited number of partners to help aggregate demand and by requiring scheduling well in advance. We’ve seen this combined most often with the 1P model in order to help with picking and packing efficiency and ensuring enough demand density to make it cost effective.

3. AI Shopping Engagement

An emerging area across consumer tech has been to use AI as an engagement mechanism in the shopping experience. Ideas are still relatively nascent, but there have already been a number of ideas centered around using AI to help parse recipes and aggregate the ingredients into a basket of items to automatically purchase. Brain Technologies has an existing flow that glimpses what a possible user experience would look like:

Because of Instacart’s position between the grocery retailer and the customer, it would be easy to imagine an experience where items are selected automatically based on existing user preferences and with tailoring of the recipes.

Instacart May Not Be For Everyone, But It Certainly Has a Lot of Opportunities to Grow

All of the available data on Instacart supports the picture that user growth is slowing as pandemic tailwinds have lifted. That is not necessarily surprising — a ~40% premium to a core grocery experience is likely to price a portion of the market out of the core Instacart service.

However, the data also suggests that the customers that remain on the Instacart platform are among the most engaged grocery shoppers spending well above the industry average, and who retain at a higher rate than regular grocery stores because they find strong value in Instacart’s service.

It’s because of this strong core of customers that Instacart occupies a differentiated position in the grocery ecosystem, and where its position actually gives the company a great opportunity for future growth by leaning in and serving those customers (and others) with an even wider variety of services for years to come.