It’s amazing to think about the year Airbnb has had in 2020: at the start of the year, the company made headlines for a dramatic drop in bookings that forced it to cut 25% of its workforce and take out a $1B term loan for survival. But a mere 8 months later, the company managed to navigate the pandemic, benefit from a rebound in domestic travel, and make its way to an IPO.

While a lot of media focus has been spent on the impact of COVID-19, it’s important to note a few things from Airbnb’s IPO that are underappreciated, and that the long-term value creation of the platform is still an amazing sight to see, even after a decade.

The Power of a Platform In a World of Physical Assets

The sheer breadth of Airbnb’s available properties is remarkable. Marriott, the largest chain in the world (especially after its merger with Starwood), has 7,300 properties, and 1.38M rooms in 134 countries. Compared with 100,000 cities for Airbnb and 5.6M active listings across 220 countries:

“In 2007, we began with a single listing on Rausch Street in San Francisco’s SOMA district. Today, Airbnb operates in approximately 100,000 cities, ranging from large cities to small towns and rural communities, in more than 220 countries and regions around the world. Our business is intertwined with these communities, and we are focused on seeing them thrive.”

Airbnb’s coverage of even the largest cities still rivals Marriott, with 1,000 cities with over 1,000 listings:

“Airbnb has a presence in nearly every corner of the world, and many of the approximately 100,000 cities where our hosts have listings do not have traditional hotels or well-known tourist attractions. In 2011, there were 12 cities with more than 1,000 Airbnb listings each; as of September 30, 2020, over 1,000 cities had more than 1,000 Airbnb listings each.”

The breadth of the rooms available have outstripped even the largest hotel chains, and that’s not even reflective of the diversity of its supply, with its healthy supply of yurts and treehouses (Marriott has a grand total of zero for both):

“…approximately 90,000 cabins, 40,000 farms, 24,000 tiny homes, 5,600 boats, 3,500 castles, 2,800 yurts, 2,600 treehouses, 1,600 private islands, 300 lighthouses, and 140 igloos.”

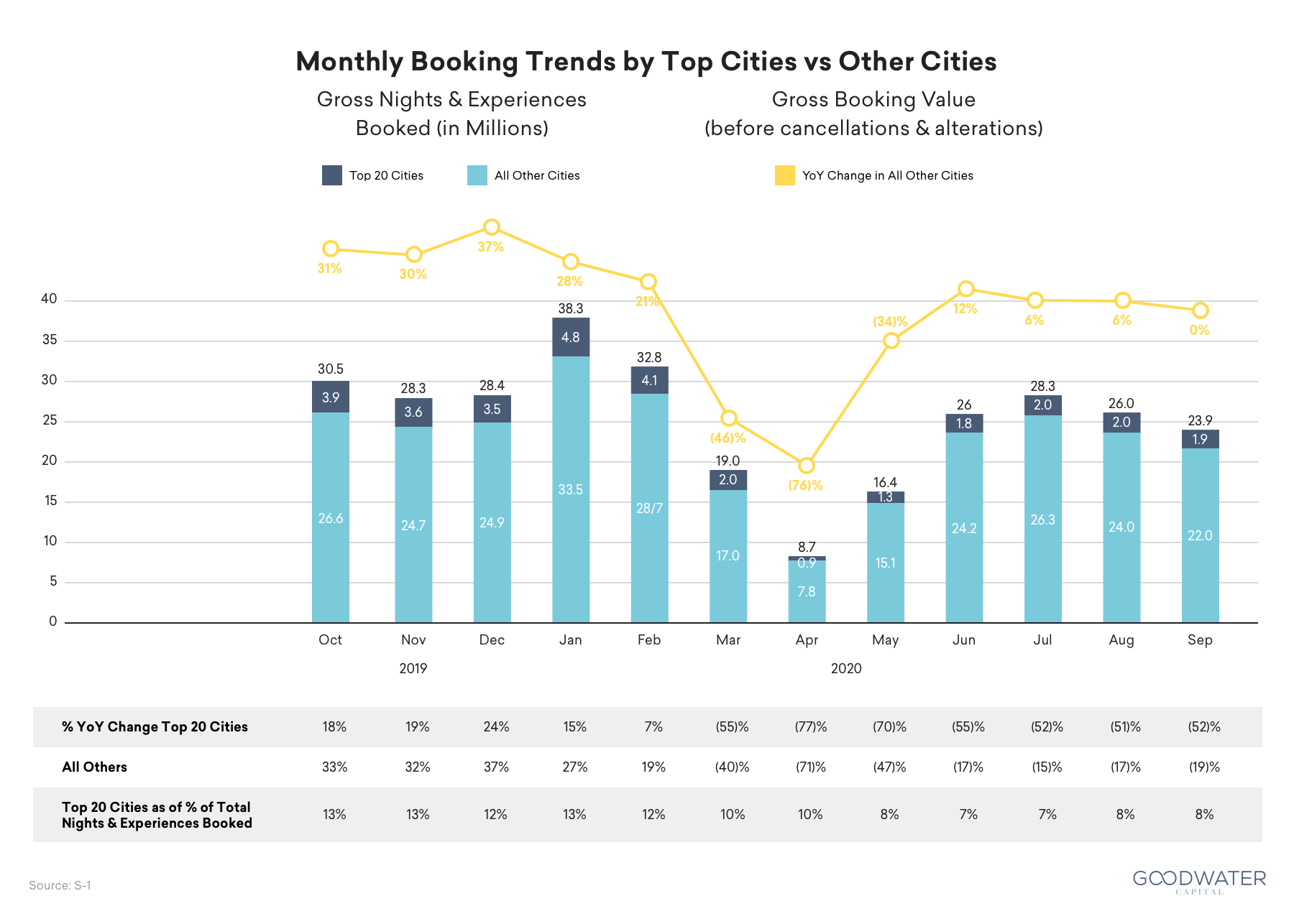

It is this breadth and depth of properties that has been a surprising area of strength for Airbnb, where both pre and post pandemic bookings concentration of the Top 20 cities has always been <15%:

Airbnb does not have the same geographical revenue concentration that the major hotel brands have, where the top 25 cities can account for 45% of all US hotel revenue. Airbnb’s strength isn’t the big markets, but in the long tail of locations that hotel chains have ignored.

The disparity makes sense — a hotel chain needs justification to build a 200-300 room building with a 60-70% occupancy to have any location make economic sense. So it was (and still is) a safe play to load hotels into large cities where it was guaranteed that you’d have enough demand. Cities have also grown in size and complexity, with neighborhoods and attractions now found far afield from the city center, and where these neighborhoods simply cannot support a full-sized hotel. The need for operators to hit operational scale and the inability of many neighborhoods to support a full hotel has left the industry to ignore all of these other locations.

Airbnb turns this formula around, leaving the economics up to the individual property owner while placing discovery of that single yurt in a distant location on the same footing as that 1,000 room building in a major city.

The dispersion across 100,000 cities also means that local regulations, instituted to try and tamp down housing speculation, while attention grabbing, are unlikely to tamp down the long-term growth of the platform — too many localities have too many reasons for embracing Airbnb where the core problem may not be housing speculation.

It’s easy to say that coming out of the 2008 downturn that the timing was right for a marketplace like Airbnb, but ignores the reality that this was another ignored “corner” of the market where larger players from OTAs to hotels had largely ignored as being unimportant. And from their perspective, it was — a market that would take more than a decade to develop and still be a fraction of their total revenue (see below for scale) just wasn’t interesting to them.

Anyone building or evaluating a marketplace should be looking at larger incumbents not with fear, but instead with an eye toward where the incumbents aren’t. Just like the food delivery industry, incumbents’ strategies can leave significant whitespace where seemingly dominant market positions hide dramatically underserved groups of consumers.

But Consumers Are Still the Ones Driving Decisions

With all of these tech platforms, while the innovation is around supply, these are still, at the very core, consumer platforms. We saw a very unique glimpse of that during the start of the COVID-19 pandemic.

COVID-19’s effect on Airbnb was swift, with Gross Booking Value (GBV) actually dropping from $3.5B into negative territory of $(0.9B) in the span of just a month. In an attempt to stabilize the market, the company quickly moved, eventually settling upon a stabilization fund. This, in and of itself, is quite an extraordinary move — imagine if eBay or Craigslist tried to stabilize their markets! Airbnb acted as an active market maker, taking on principal risk for a major disruption in order to help ensure market stability.

But, even as it played the role as market maker, Airbnb had to choose a side: honor the booking policies that were agreed upon with the hosts, or disregard those agreements and make consumers whole in an unprecedented travel environment. In the end, Airbnb chose the consumers, and the stabilization fund was a measure to help compensate hosts for the decision.

Despite the company saying that “Hosting is at the Center”, the unfortunate fact is that consumer outrage would be a much greater risk for the company. As illustrated by the company’s S-1:

“We believe this stability in active listings highlights the high retention of our host community and the resilience of our business model, which does not require us to make significant investments in fixed assets and physical real estate.”

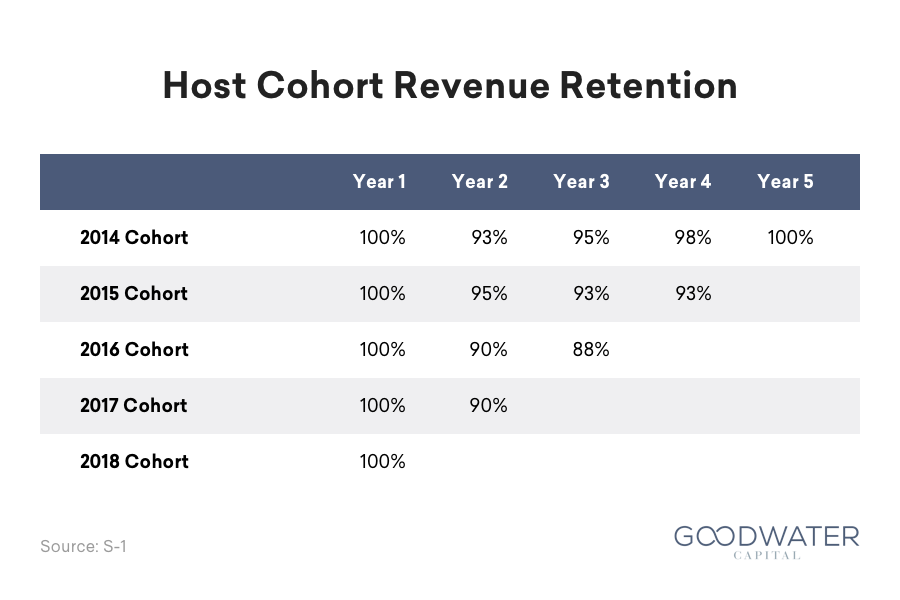

Host retention just isn’t an issue:

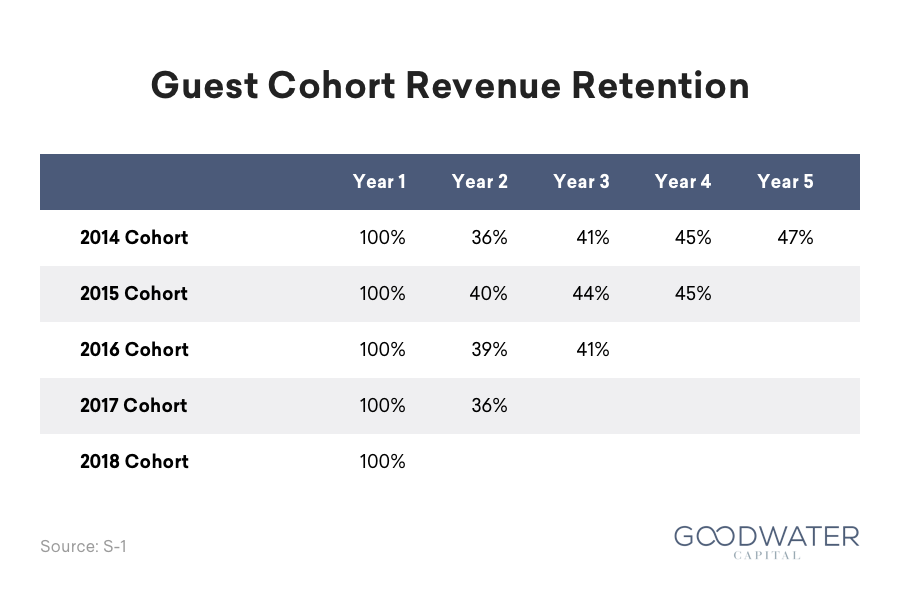

Instead, the challenge remains that consumers are fickle:

Retaining hosts is just easier — once they’re on, it’s very likely that they’re not leaving. Perhaps it’s because there might not be a true competitor out there: Airbnb spends roughly a page listing 29 competitors for consumers, but the section dedicated to competitors for hosts spans a paragraph and lists a grand total of… zero competitors.

Maybe it’s not so surprising the decision was made to reverse bookings and provide compensation to hosts, rather than the other way around. Consumers, with their myriad of options and fickle tastes, are the ones being competed for in this market, and a reminder for everyone building marketplaces that creating the right policies for a market requires identifying the more competitive side of the market.

Swift Action and Data Needed to Navigate a Crisis

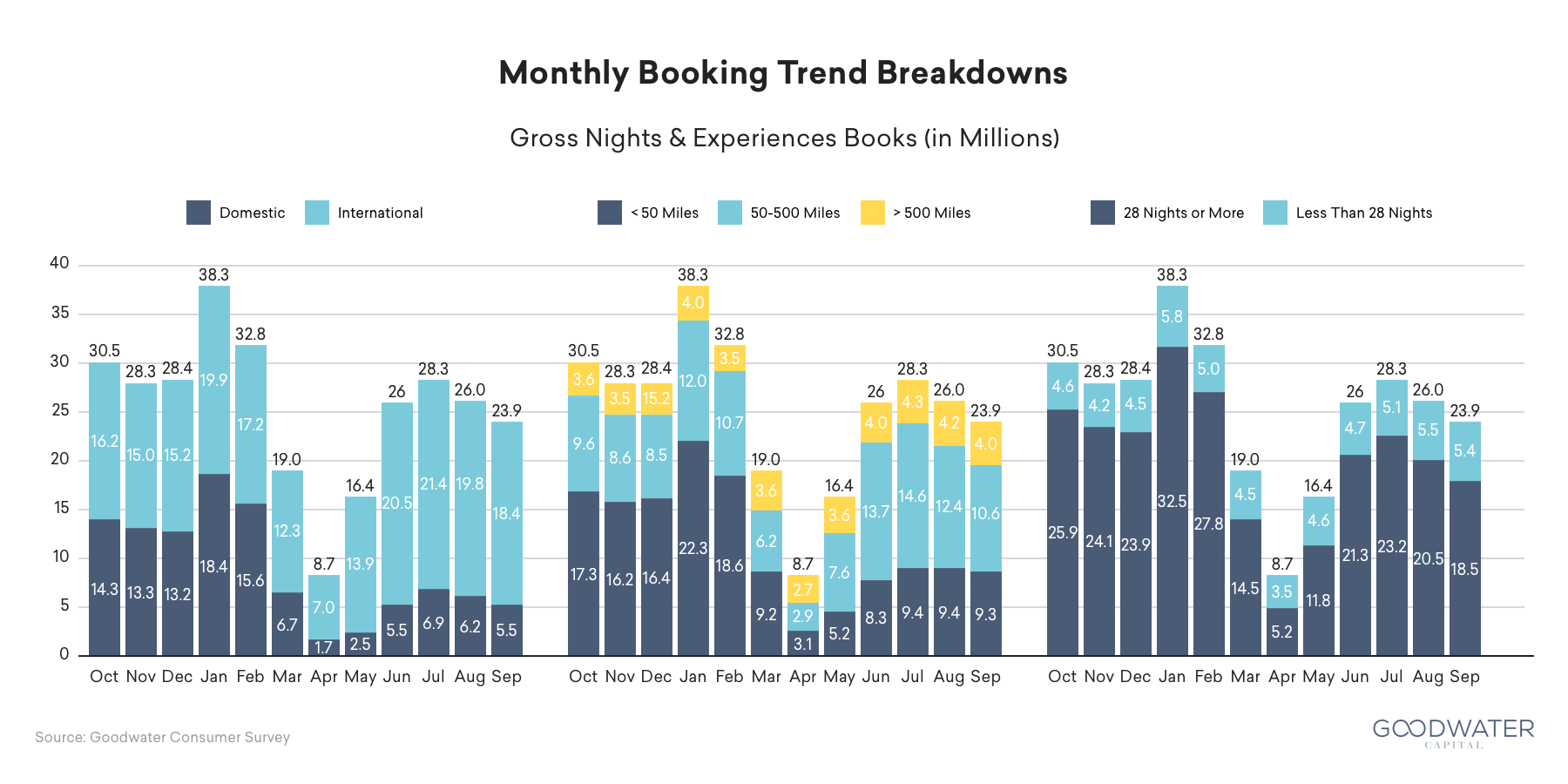

Airbnb has been able to weather the initial COVID-19 shock and recover better than the rest of the industry due partially to its swift action. Airbnb saw the rebound with domestic trips and trips that were longer in length and shorter in distance:

Airbnb’s COVID-19 experience is an important lesson — not only is it a reminder that swift action is needed to reorient products and services, secure financing, and make operational changes to survive in an extraordinary time, but a company needs the data to make those decisions. Data has likely informed the entire design of the website, encouraging consumers to go to nearby locations:

While Vrbo’s is still leading consumers with tiles that lead to national searches:

The Airbnb charts above are interesting looking back, and could be written off as common knowledge with eight months of hindsight, but navigating a crisis in real-time requires having the underlying data to help chart a path.

Riding a Broader Vacation Rental Trend with a Superior Brand

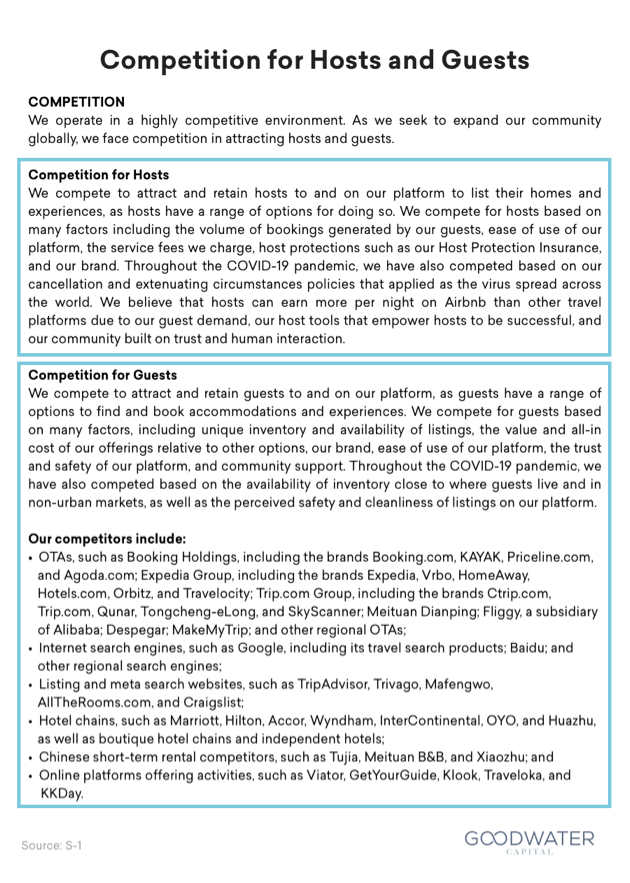

Just as Airbnb’s S-1 indicates, standing out in the travel industry is pretty difficult. While the market is a massive $5T, competition is far too numerous to list on a single page, and all of them are willing to spend to acquire those eyeballs to make their paid acquisition engines run effectively. It’s a daunting landscape even for a player like Airbnb.

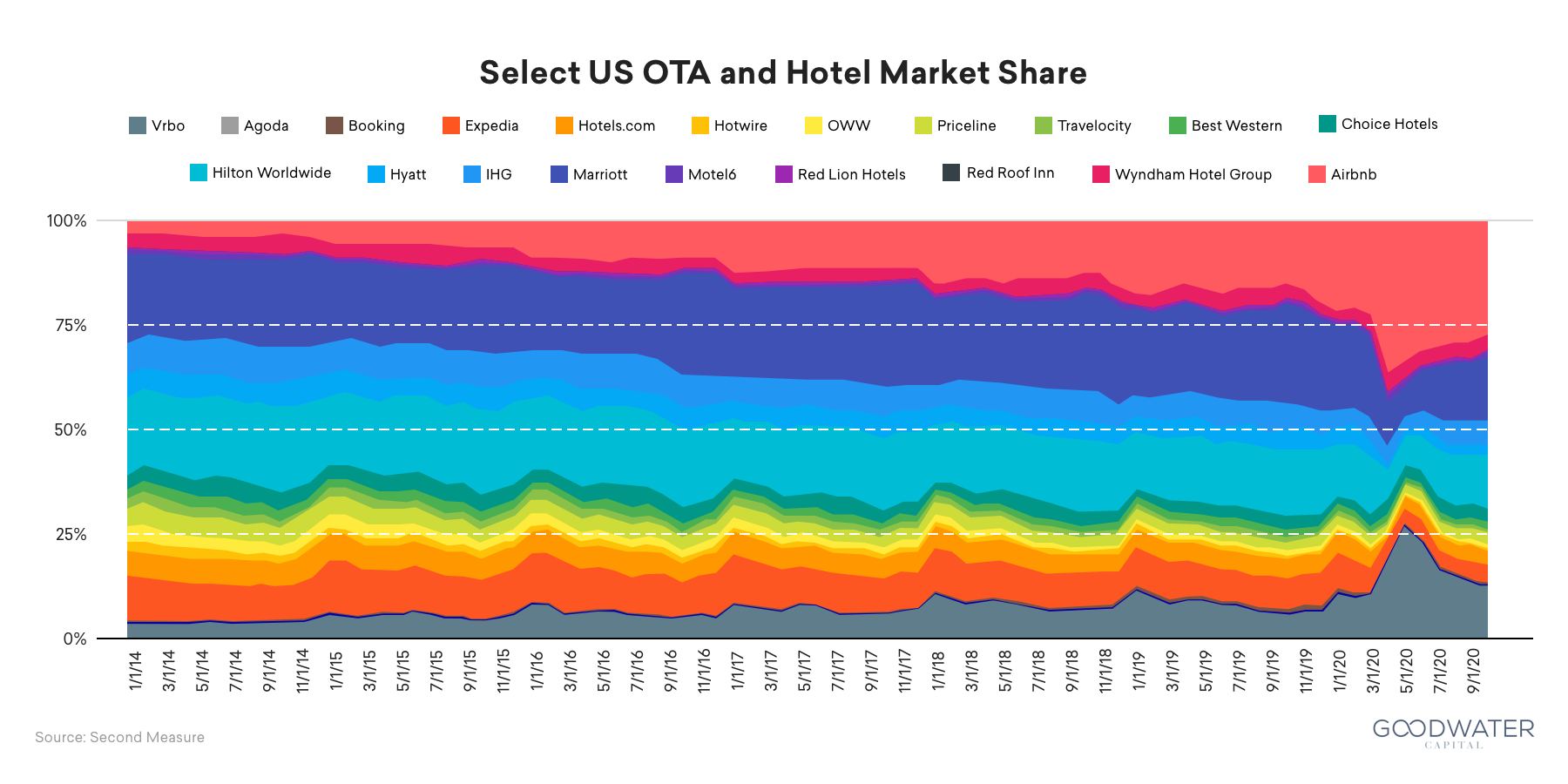

But all signs point to Airbnb successfully competing for those consumers. According to Second Measure data, Airbnb has been a consistent market share gainer for US consumers:

While Airbnb deserves quite a bit of credit for its growth, the data also indicates that it’s also unlocked a broader trend with vacation rentals — Vrbo has also been able to grow faster than the rest of the industry as well.

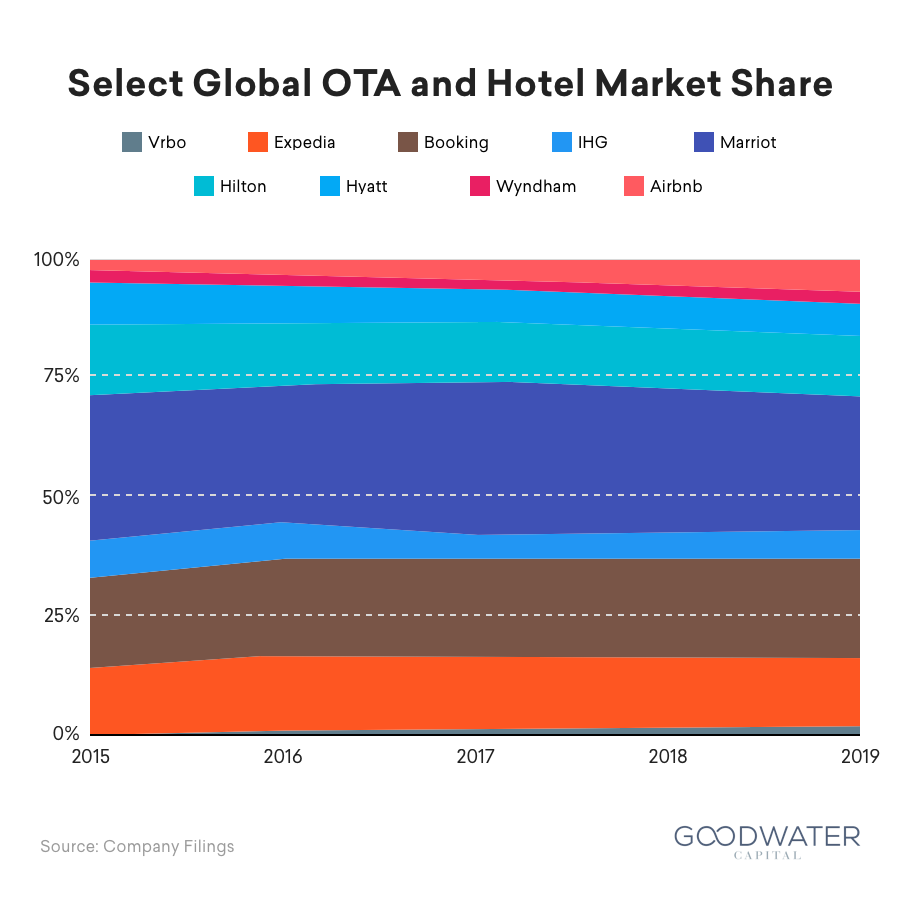

But that’s just US data. If we take a look at overall reported revenues from the public players, we get an appropriate scale as to the landscape worldwide:

While growing, Airbnb (as well as Vrbo) is still tiny! Even after a decade of strong growth, it is still dwarfed by its largest competitors. It is an appreciation at the sheer size of the opportunity but also the challenge that lies ahead — the Airbnb brand needs to stand out in a crowded field to consumers across the globe.

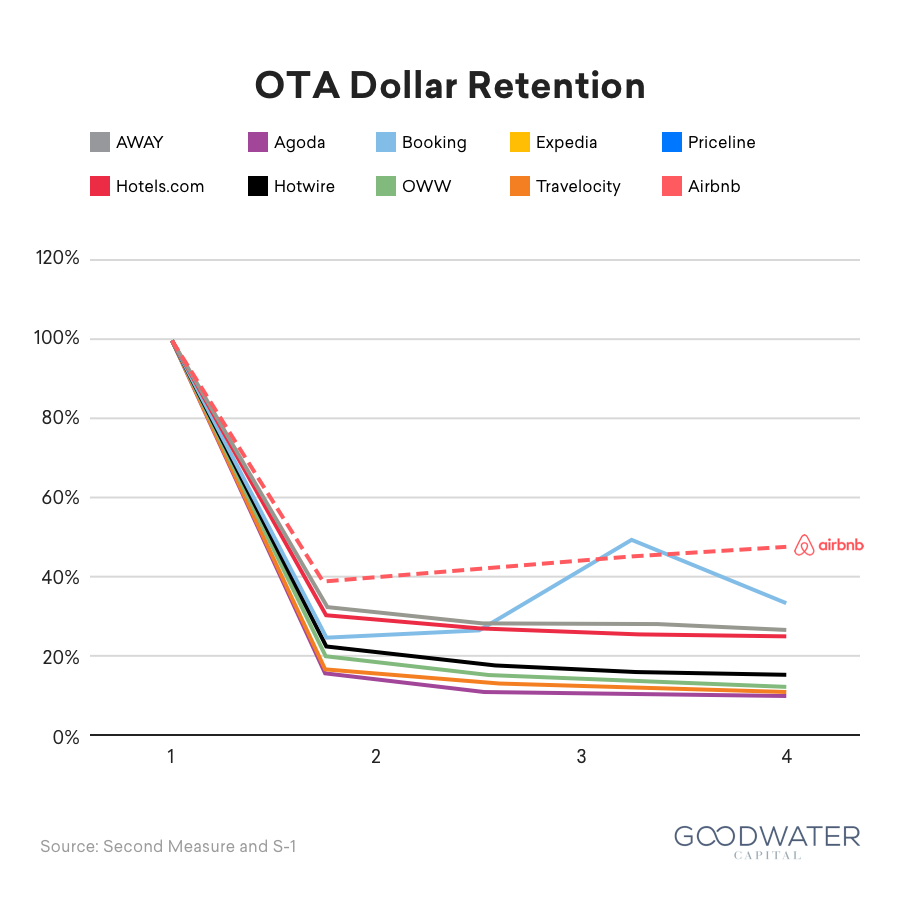

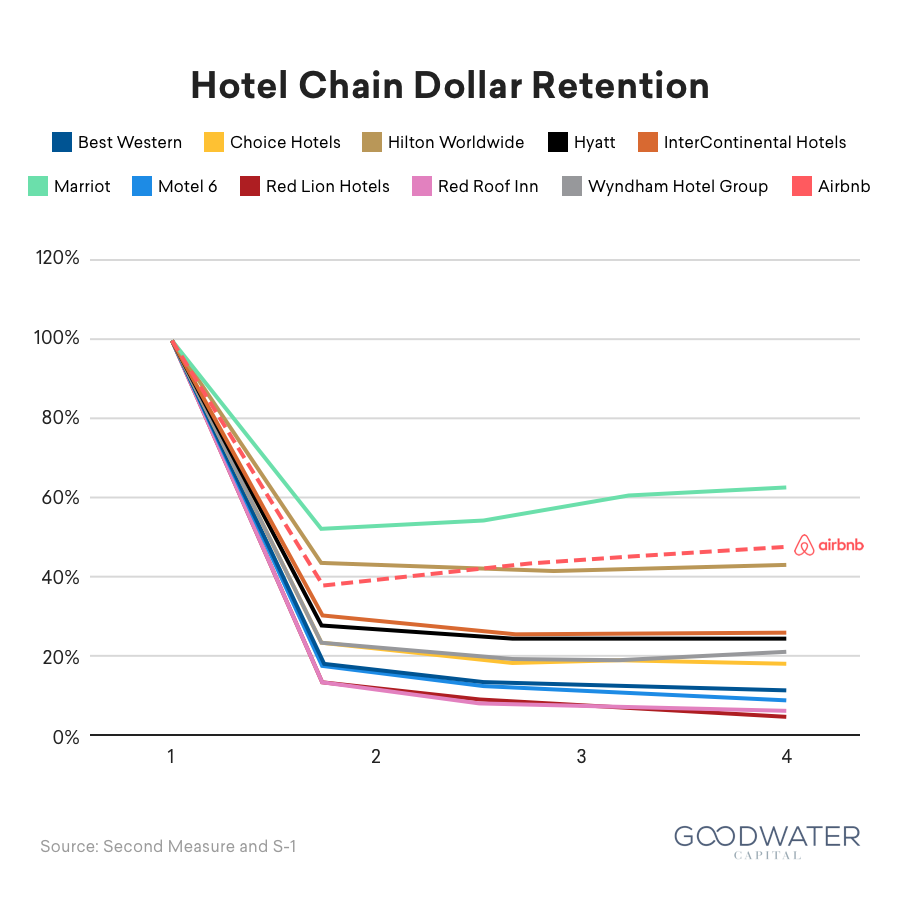

There are signs that the company has been able to stand out. Within the US, Airbnb has the highest dollar retention of the major online travel agencies (OTAs). Even when compared with hotels, Airbnb also continues to stack up well where it holds its own among the largest hotel chains.

It is even more remarkable that Airbnb is a supply-less platform, where it owns none of the buildings, controls none of the employees, and directs none of the property or room design, but still manages to have higher dollar retention than most of the major OTAs and hotels!

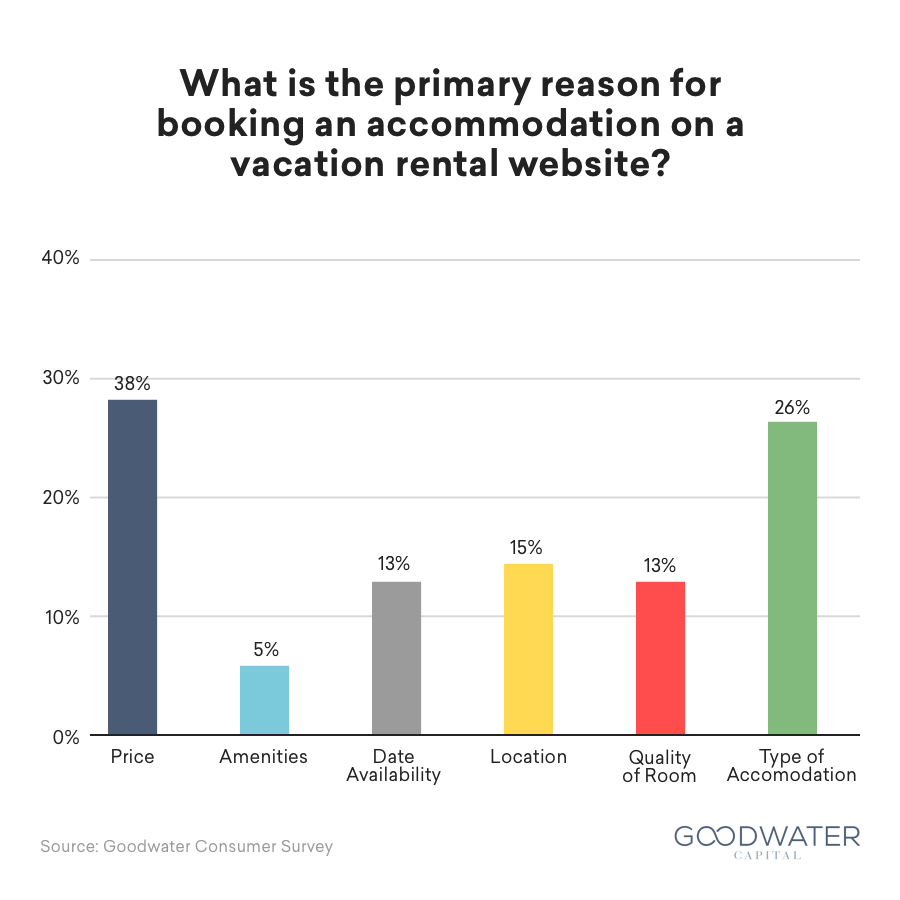

At the very core of many travel accommodations is a relatively commoditized experience — yes, there are quite a few levels of service and price points, and you can probably tell the difference between a Four Seasons and a regular room, but do you really know what a room at the Springhill Suites or Canopy brings? The portfolio of brands strategy that attempts to appeal to different demographics at different price points is papering over a larger deficiency with the model: they’re trying to sell differentiation when the physical rooms themselves are largely standard.

But I do know what Airbnb gives me: either 1) an affordable accommodation, or 2) a unique property, all of which have been vetted by other travelers. I’m also guaranteed to find a place (and/or host) that appeals to me in any location around the world.

Airbnb wasn’t first in the vacation rental space (Homeaway and Vrbo was), but it has managed to build a brand that resonates more than the major hotel chains despite the diversity of its supply (or perhaps it’s because of this diversity). And it is that brand, built off its uniqueness of supply, that is helping to drive best-in-class performance when compared to its major competitors.

Unit Economics Are Just as Competitive as Other Marketplaces

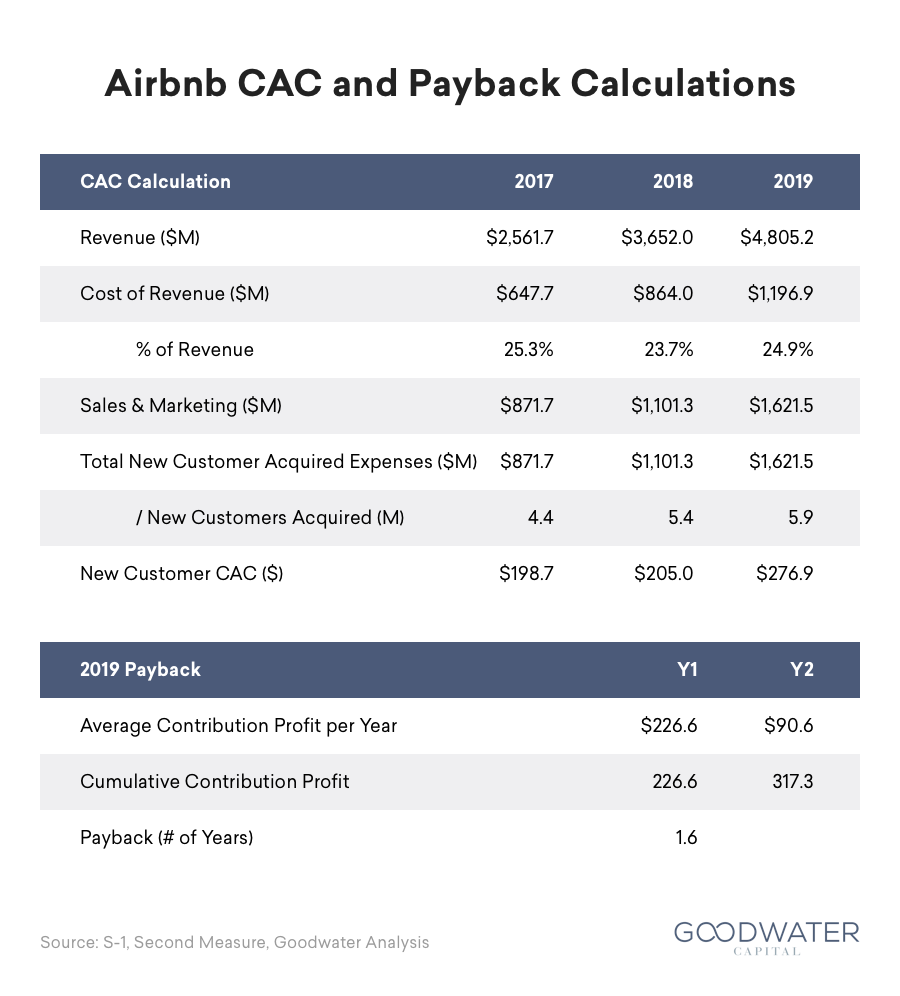

Like a few other marketplaces that have recently made their public markets debut (Uber, Lyft, DoorDash), there are also headlines with Airbnb in terms of elevated amounts of marketing spend. The implied CACs bear this picture out, with 2019 being a year where CACs increased +35% and where the company increased advertising spend to $1.1B up from $666M:

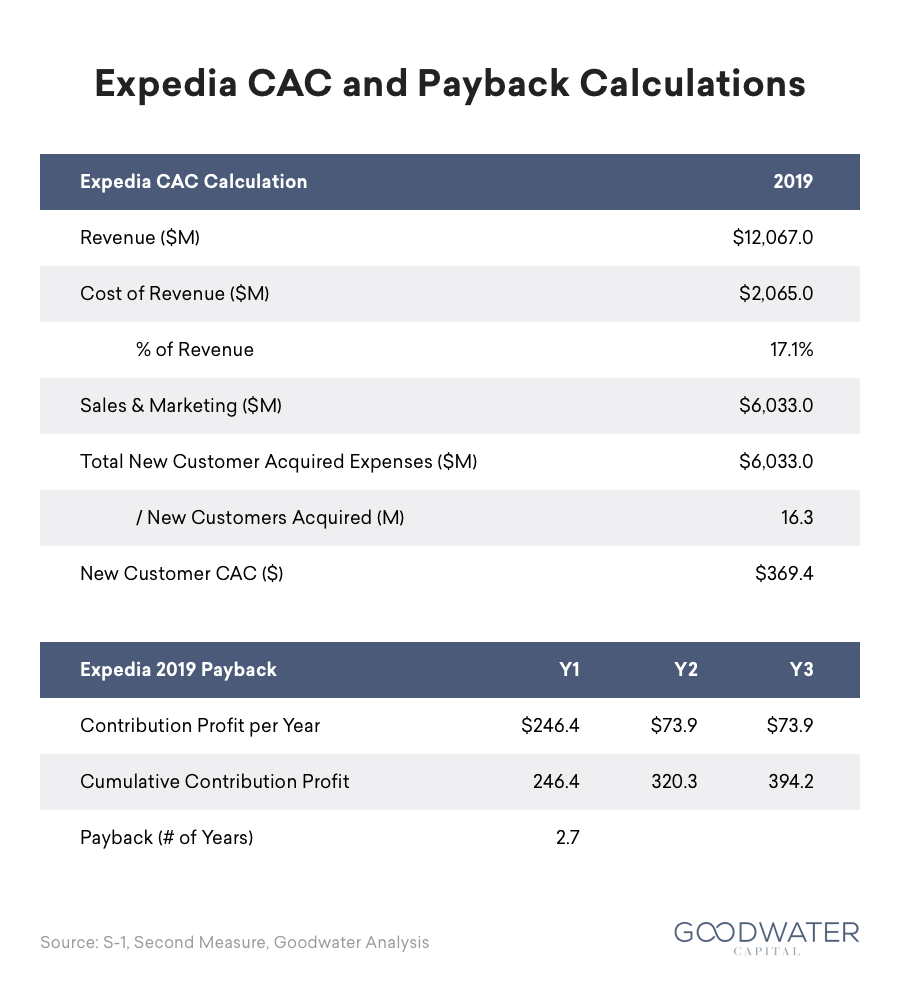

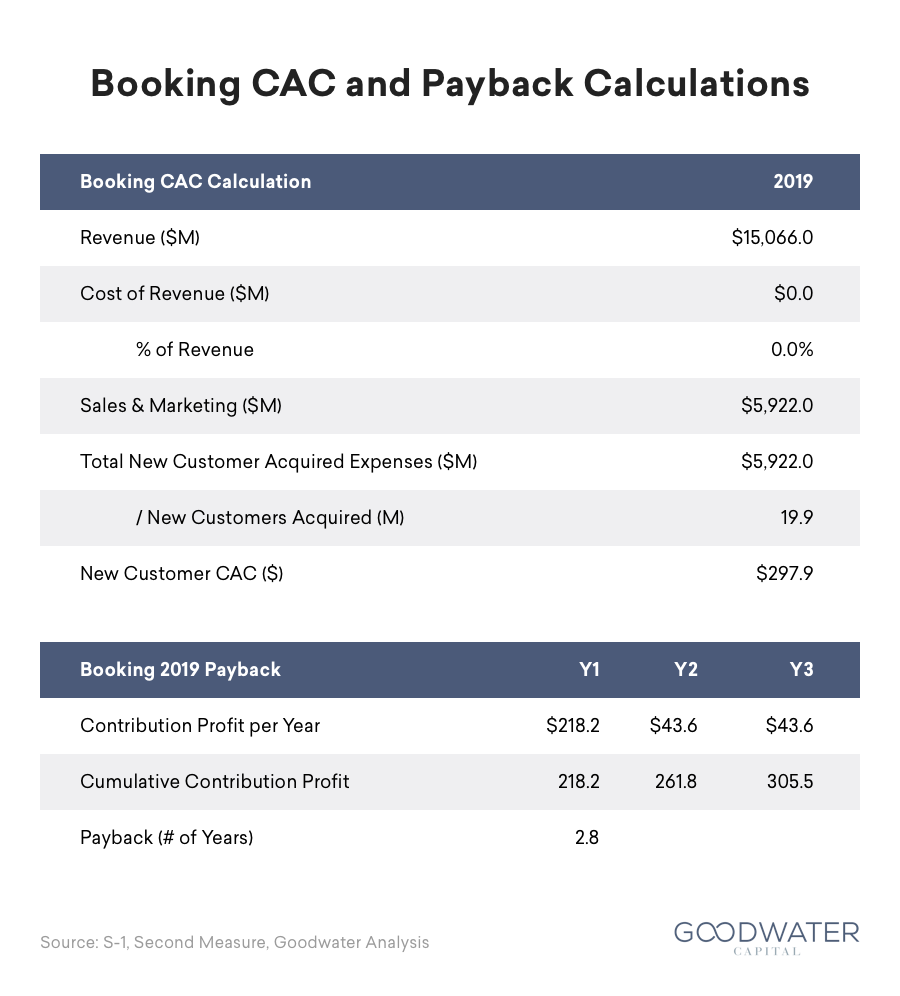

However, this still masks the overall point that despite the elevated levels of spend, economics are still better than the major OTAs like Booking and Expedia:

While the company’s spending in 2019 has been “elevated”, the above comparison actually indicates that the company still retains a significant advantage over its competitors – a sign that the product offering is clearly resonating in consumer minds. The company has the opportunity to increase spending when a more favorable travel environment appears.

A Decade Later and Counting

It’s easy to get lost in how much COVID-19 has created a lost year for both the travel industry and Airbnb, but the S-1 is a reminder to take a step back and look at how the company has helped to jumpstart the vacation rental industry. Airbnb has come a long way since its start a decade ago – from a single shared room at a design conference to a platform that spans more than 5.6M listings and 100,000+ locations. While the upcoming IPO marks a significant milestone, all signs point to even more changes yet to come for the vacation rental industry and the company that helped to define it.