Chime is a US financial services company that offers a variety of online banking services. Their core offering consists of a no fee, no minimum checking account. After setting up direct deposit, users can unlock access to a variety of credit features such as overdraft coverage, paycheck advance, and a credit builder card.

Since Chime launched in 2014, the business has scaled significantly and become an important service for millions of people:

Cut to early 2025. Chime’s eight million-strong member base has grown rapidly. We’ve developed trusted, primary bank account relationships with more than two-thirds of our members – putting us at the center of their daily finances.

Source: Chime S-1

In this Thesis report, we will break down their S-1 and cover some key elements of Chime’s thesis thus far as they head towards their IPO:

- Market dynamics and TAM – What are the key characteristics of Chime’s target market and how much headroom is left for growth?

- Competitive positioning – How does Chime stack up against competitors and why have over 5.3M people made it their primary bank?

- Customer economics – How do customer acquisition costs, customer lifetime value, and the impact of new products on average revenue per user for this segment guide future strategy and competition?

- What is next – In the face of growing competition, what levers will Chime pull to continue growing the franchise?

Why use Chime?

Chime is the largest neobank in the US for consumers that are low income, low credit score, living paycheck to paycheck, and/or financially underserved. While surveys differ, it is generally accepted that over half of Americans, or around 130M adults, fall into one of the above categories. Chime today has 8.6M users, just a fraction of the market. To better understand why these users are on Chime and why they currently serve only 7% of the addressable market, we need to know what customers are looking for in banking.

Goodwater’s proprietary consumer research covering consumers with household income of <$75K shows that:

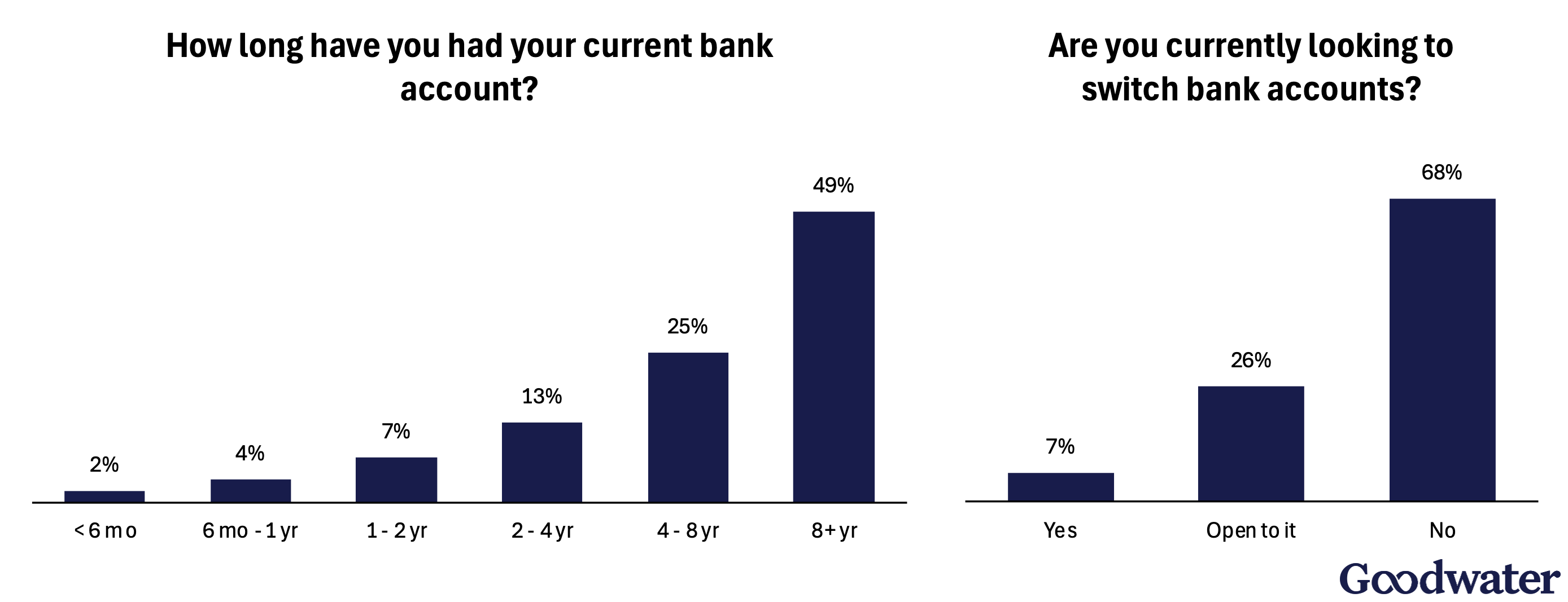

Banking Customers are very Sticky…

Even in this specific income range, banking customers are highly loyal.

Most banking customers have been with their current provider for years and very few are actually looking to switch accounts. 77% of consumers reported being satisfied with their current bank account.

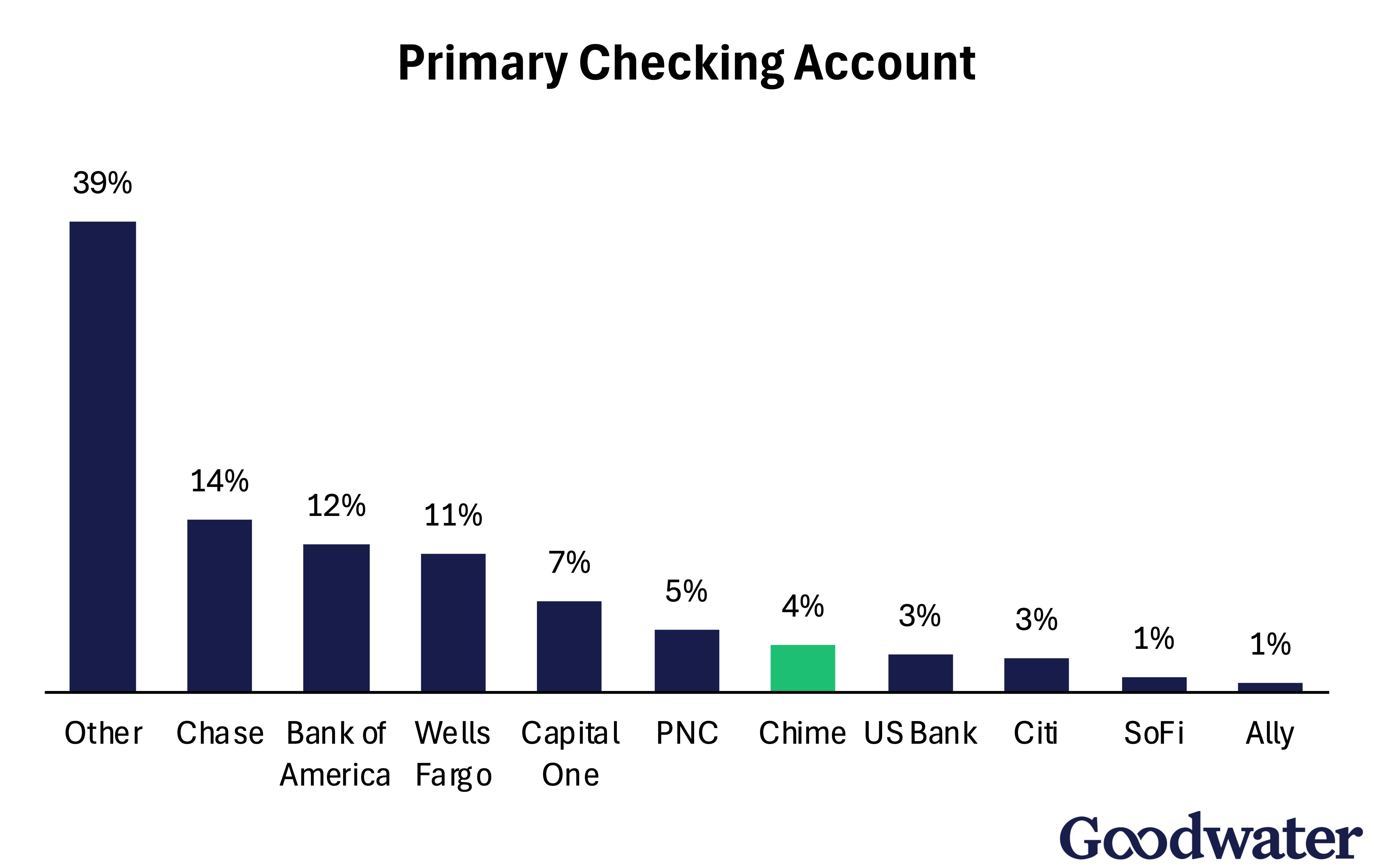

Incumbents still have a large foothold in this fragmented segment, with the top 3 public banks serving as the primary checking account for 37% of our panel. Chime, at 4%, is significantly smaller than the incumbents but still the most successful fintech in this pool.

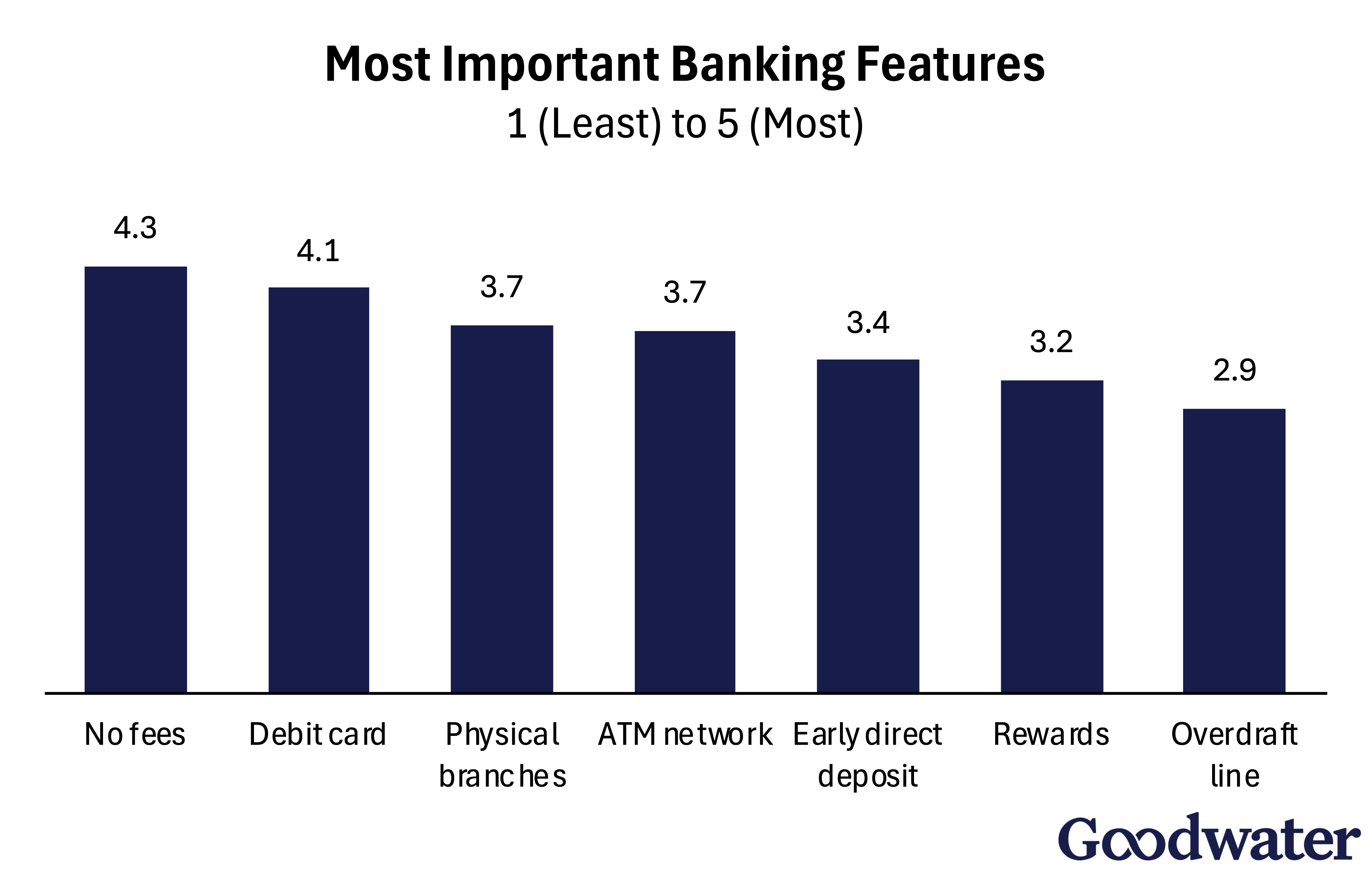

Customer priorities in banking help explain why Chime has not yet taken the market. The features people care most about – no fees, debit card, physical branches, and ATM network – are standard for many banks. 74% of our panel reported paying no fees to their bank. Also, nearly all banks offer a debit card / ATM network and many consumers still care about access to physical branches. The features that Chime has built, like early direct deposit and an overdraft credit line, aren’t the top priorities for consumers.

…Except One Category of Customers

There is, however, one category of consumer that bucks the trend above. This category is the consumer that has frequent short-term cash needs without adequate access to credit.

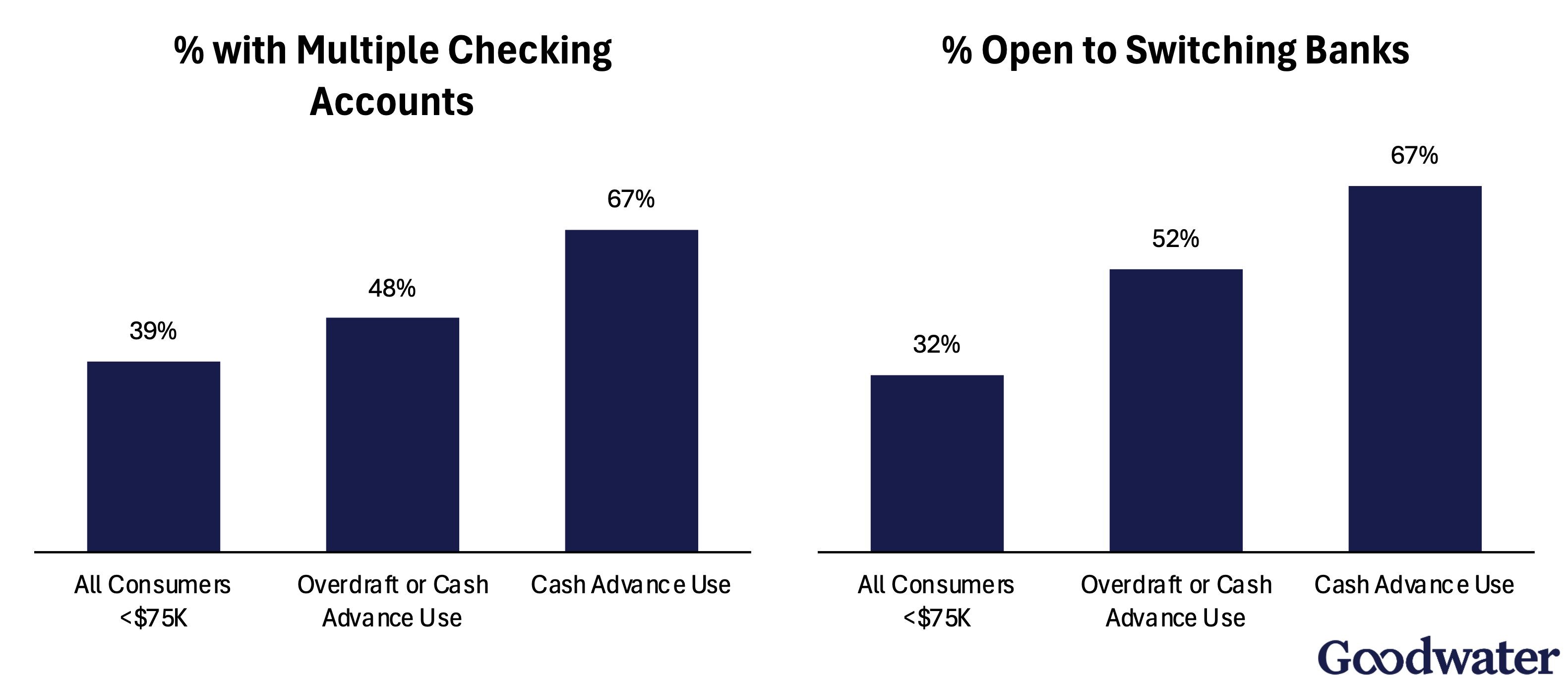

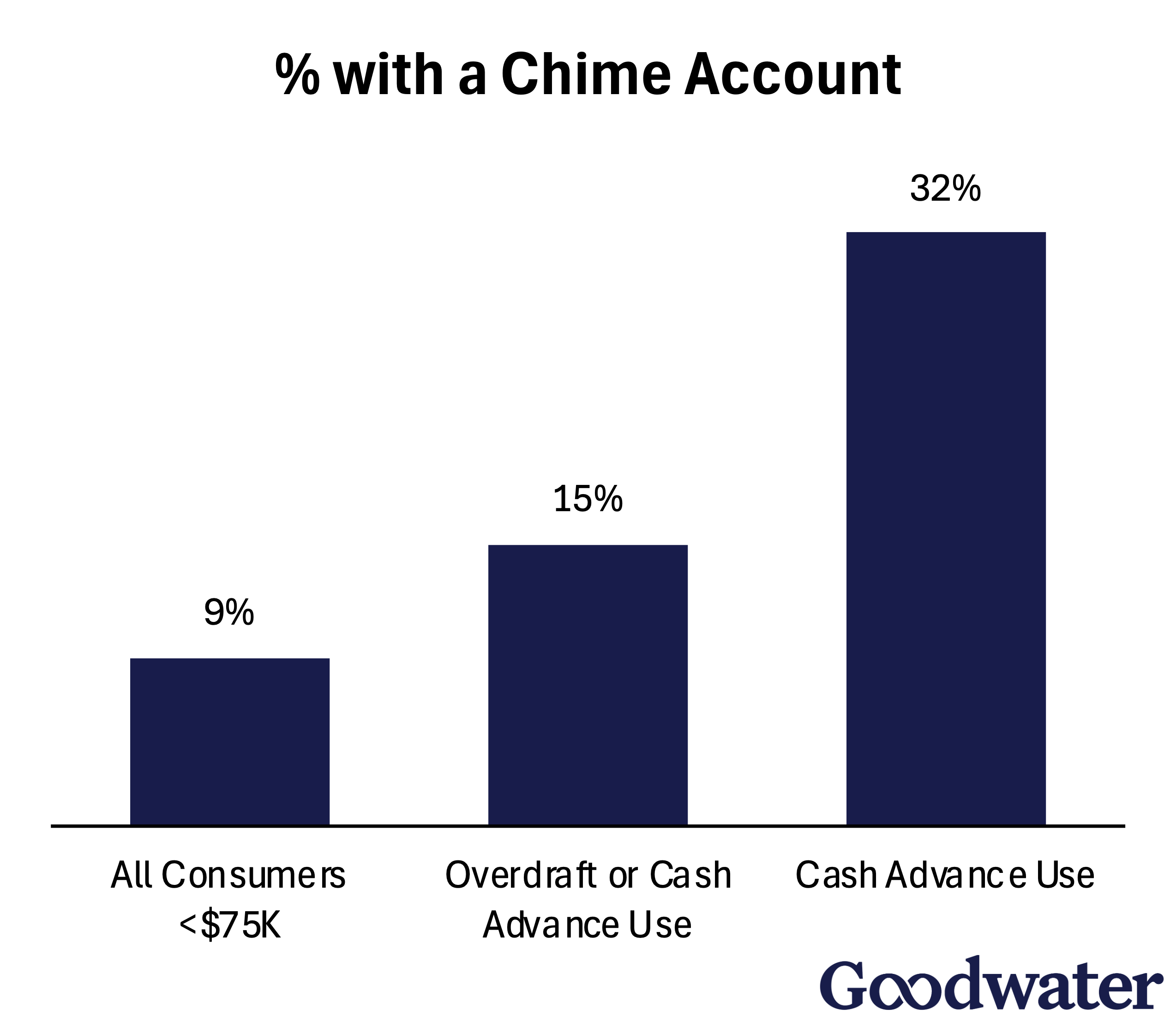

23% of the consumers in our panel overdrafted their bank account or used short-term lending products like cash advance in the past year. 10% of the consumers in our panel used cash advance products, indicating even more intense financial stress. Amongst these consumers, their engagement with banks is quite different:

These consumers are much more likely to have multiple checking accounts and be open to switching banks. They are also much more likely to have a Chime account (this doesn’t necessarily mean they use Chime as their primary bank account):

23% of the 130M adults in Chime’s target audience is nearly 30M people. For this audience, Chime appears to be a much more obvious solution to their needs.

Built for the Consumer with Short-Term Cash Needs

Chime’s core bank account is just a bank account, like any other bank account you can open online in 15 minutes. What sets Chime apart is the set of features and value that they have built on top of the bank account that specifically appeal to users in need of cash. Below are some of the key features of Chime’s offering. They were not necessarily first in any of these features, but when bundled together, they provide a strong value proposition to the needs of the user base.

| Feature | Description | Member Penetration | Early Competition | Competition Today |

|---|---|---|---|---|

|

No fee / no minimum checking Circa: Launch |

Chime has maintained no monthly fees and no minimums in its banking product. | 100% | Banking products from Discover, Charles Schwab, and Ally all already offered no fee / no minimum checking by the time Chime launched. |

Everywhere No fee / no minimum checking is very common today. Only legacy incumbents like Chase still charge monthly fees, but nearly all offer ways to waive the fees through maintaining a balance or transactions |

|

Get Paid Early Circa: 2018 |

Chime’s early pay product allows users to receive direct deposits up to 2 days early. | N.A. | Navy Federal Credit Union (only for those with defense affiliation) launched their 2 day early direct deposit feature in 2011. Alliant also offered the same feature in 2015. |

Everywhere Since Chime rolled out this feature, other fintechs like Varo, Current, and SoFi quickly copied it. Even traditional banks like Capital One and Wells Fargo joined in a few years ago. |

|

SpotMe Circa: 2019 |

SpotMe offers a free overdraft credit facility that enables users to overdraft their bank accounts by up to $200. This product is also accessible through the Credit Builder. | 49% | Payday or cash advance loans are well known and functionally cover a similar need. Other banks also previously offered fee-free micro credit cushions, like Huntington Bank and Varo. None, however, offered both the ease of use and potential credit size as Chime. |

Moderately Available Fintechs like Varo, Current, SoFi, and Dave all offer a fee-free overdraft cushion today. Even larger banks like Ally (CoverDraft) and Capital One 360 (No Fee Overdraft) offer products with similar functionality and limits. |

|

Credit Builder Card Circa: 2020 |

Chime’s Credit Builder is a secured credit card with no credit check and no fees. | 37% | Secured credit cards have been around for a long time. Fintechs focused on building credit, with some through a secured card like Atlas or Self, have also been around for a while. |

Everywhere Secured cards like those from Discover and Capital One, even when not called a “credit builder,” are still common ways for people to get access to and build credit. Many other fintechs and fintech banks offer something similar. |

|

MyPay Circa: 2024 |

MyPay allows eligible users to access up to $500 of their pay before payday with no interest or fees. Note that this is separate from Get Paid Early. | 26% | Plenty of companies such as EarnIn and Branch have offered paycheck advance companies prior to Chime with similar fee structure (free option available, but pay extra for benefits like instant transfer). |

Functionally Everywhere Paycheck advance companies continue to exist. Cash advance also can functionally serve a similar need, albeit at smaller amounts. Banking products that have implemented paycheck advance have been fintechs like Dave, not traditional institutions. |

|

Instant Loans Circa: 2025 |

Instant Loans offers up to $500 at a fixed 29.76% APR. | N.A. | Incumbent banks, neobanks, fintech apps, and local businesses have offered small loans with high interest rates for ages. |

Everywhere Similar products include U.S. Bank’s Simple Loan, Wells Fargo Flex Loan, Bank of America’s Balance Assist, and too many other digital services to count. |

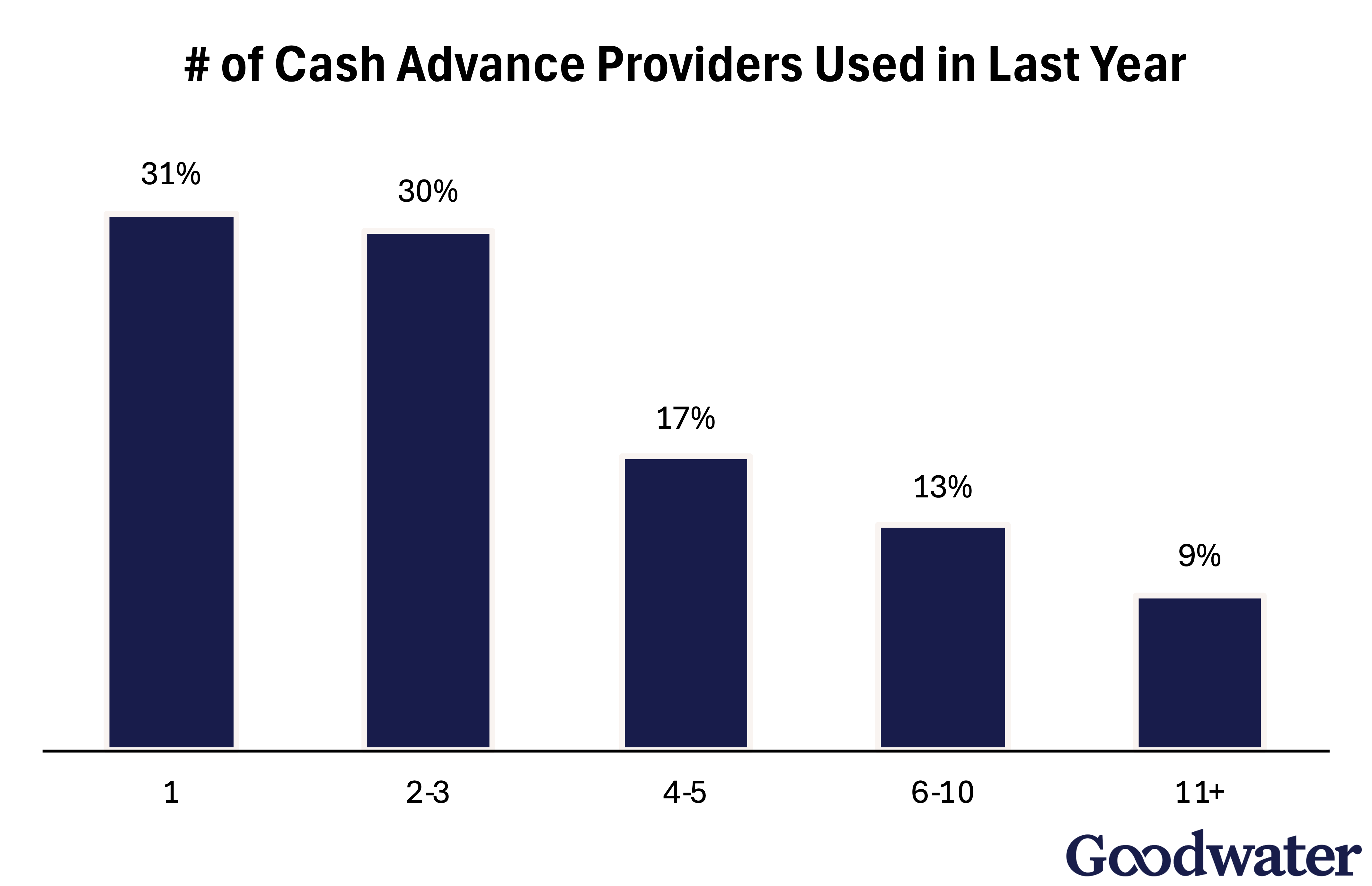

Shrinking Differentiation

Chime’s main features are not unique. They can be easily found or replicated through other services. Additionally, there is nothing stopping a user from using multiple services at the same time to self-bundle the services they need. This is especially prevalent in short-term liquidity services like cash advance. For example, our research indicates that 69% of cash advance users used more than one provider in the past year.

Though competition has closed in, Chime has bundled all of these features elegantly into a single solution. This one stop shop offers a lot of what consumers need (as seen by the strong member penetration of credit features) and does so without charging any recurring subscription or egregious fees*. It is a product that makes sense for the target market and it is logical that it continues to gain share.

Additionally, while the largest consumer banks in the US have adopted some of Chime’s features, they still have decided not to prioritize this market. Understanding why this is the case also reveals important business characteristics of Chime.

*as long as typical fees like out of network ATM fees, ACAT fees, and instant transfer fees aren’t seen as egregious

Implications of the Target Market

Could incumbent banks like Chase, Wells Fargo, or Bank of America choose to compete for these users? Absolutely. Banks like Capital One have proven that non-prime users can be a big business. However, these customers involve three classic trade‑offs we see frequently in fintech:

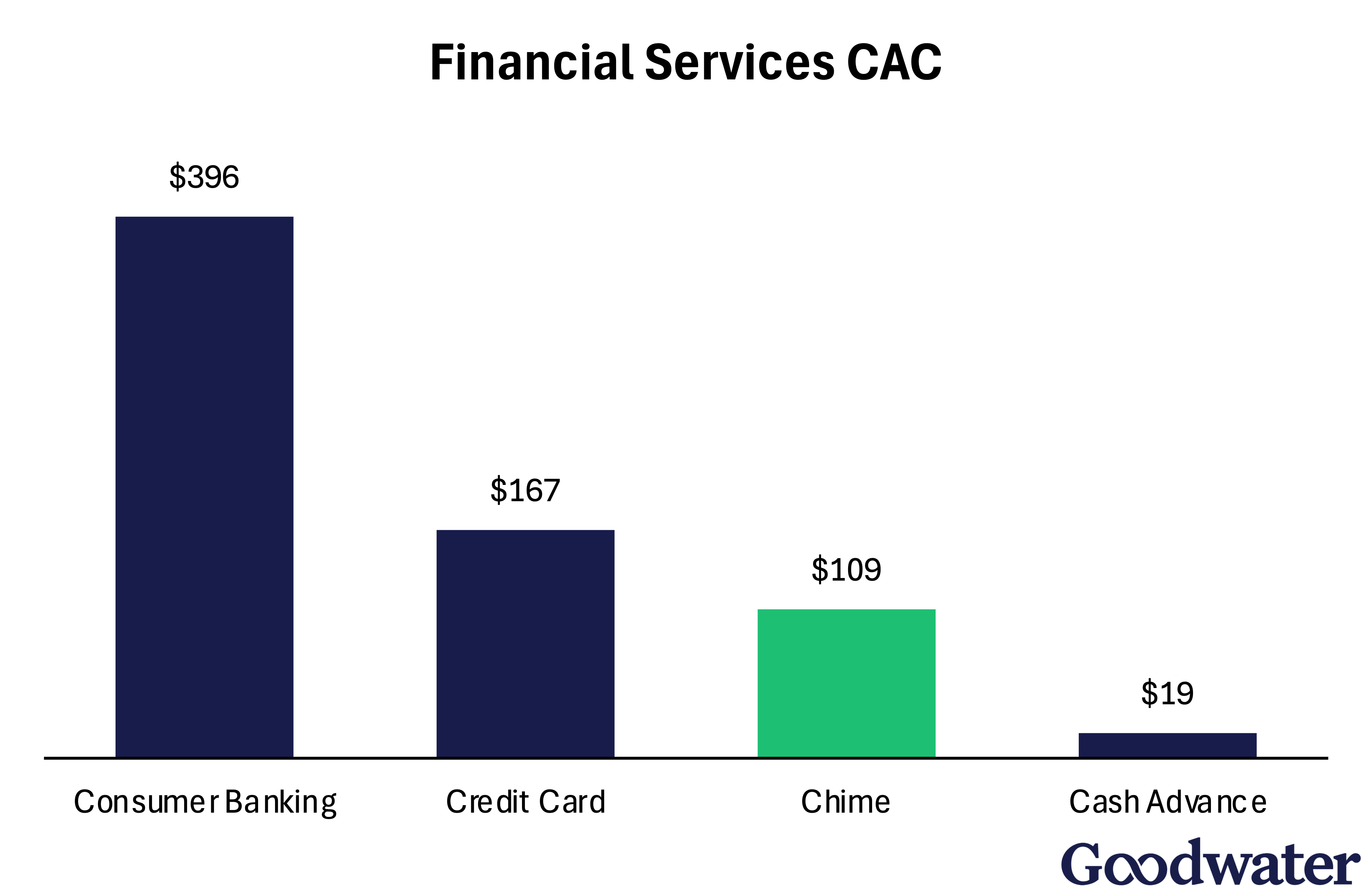

Much, Much Lower Lower Customer Acquisition Costs

Cash advance and other short-term lending products have historically seen incredibly low customer acquisition costs (CAC) compared to other financial services. Earlier on in a company’s journey, it is not uncommon for CACs to be well below $10. Compared with other products like banking or credit cards, most cash advance companies don’t need the same level of depth in KYC, credit checks, or onboarding (e.g. issuing a physical card) when serving new customers. They also serve a customer that is moving with high intent to solve their pain point (near-term cash flow).

Based on Chime’s product, a combination of banking with the value prop of short-term lending, we should expect that their CAC sits in between something like cash advance and a traditional retail bank. Chime reported a CAC of $109, fitting exactly into this profile and showing that they can acquire a new customer for significantly less than incumbents today.

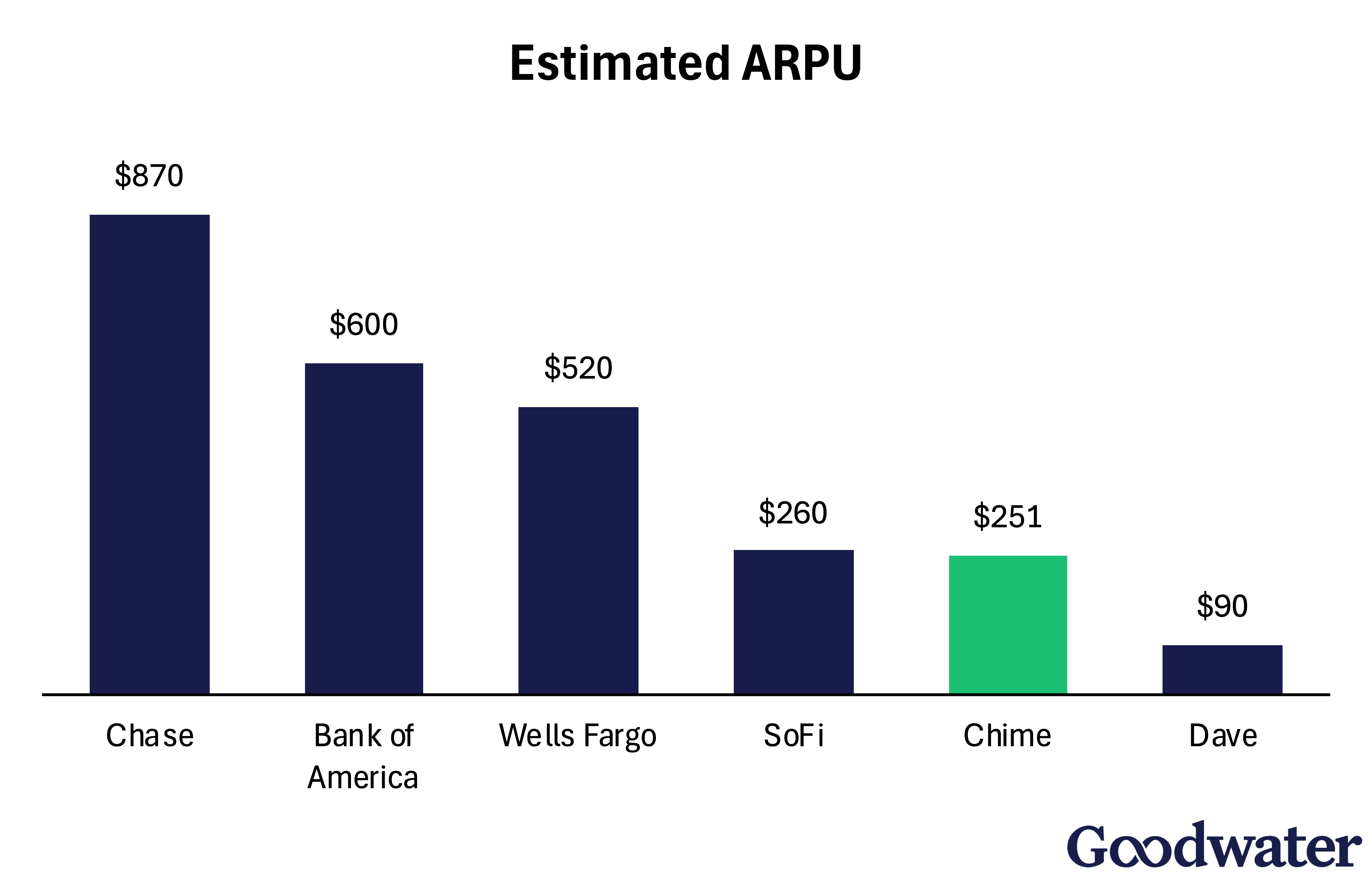

Lower ARPU

When comparing different banking products, there is a meaningful difference in the Annual Revenue Per User.

Traditional retail banks make money by lending deposits and earning interest. Chime takes a different approach, instead focusing heavily on interchange fees (approximately 1.25% of every card swipe). Therefore, they prioritize direct deposit early in the customer journey and encourage users to make Chime their primary transaction account, especially for users who do not maintain a high balance.

Chime will naturally experience lower ARPUs compared to other incumbent banks due to:

- Customer base – Lower income consumers will have both (1) less reliable deposits a bank can use for lending and (2) lower spend that can be monetized through interchange fees.

- Lack of products – Chime is fundamentally a free bank with some cash advance features. It currently doesn’t have the portfolio of interest-bearing products that drive significant revenue for traditional banks.

- Not a bank – In the sponsor model, Chime must share net interest margin and interchange with its partner bank.

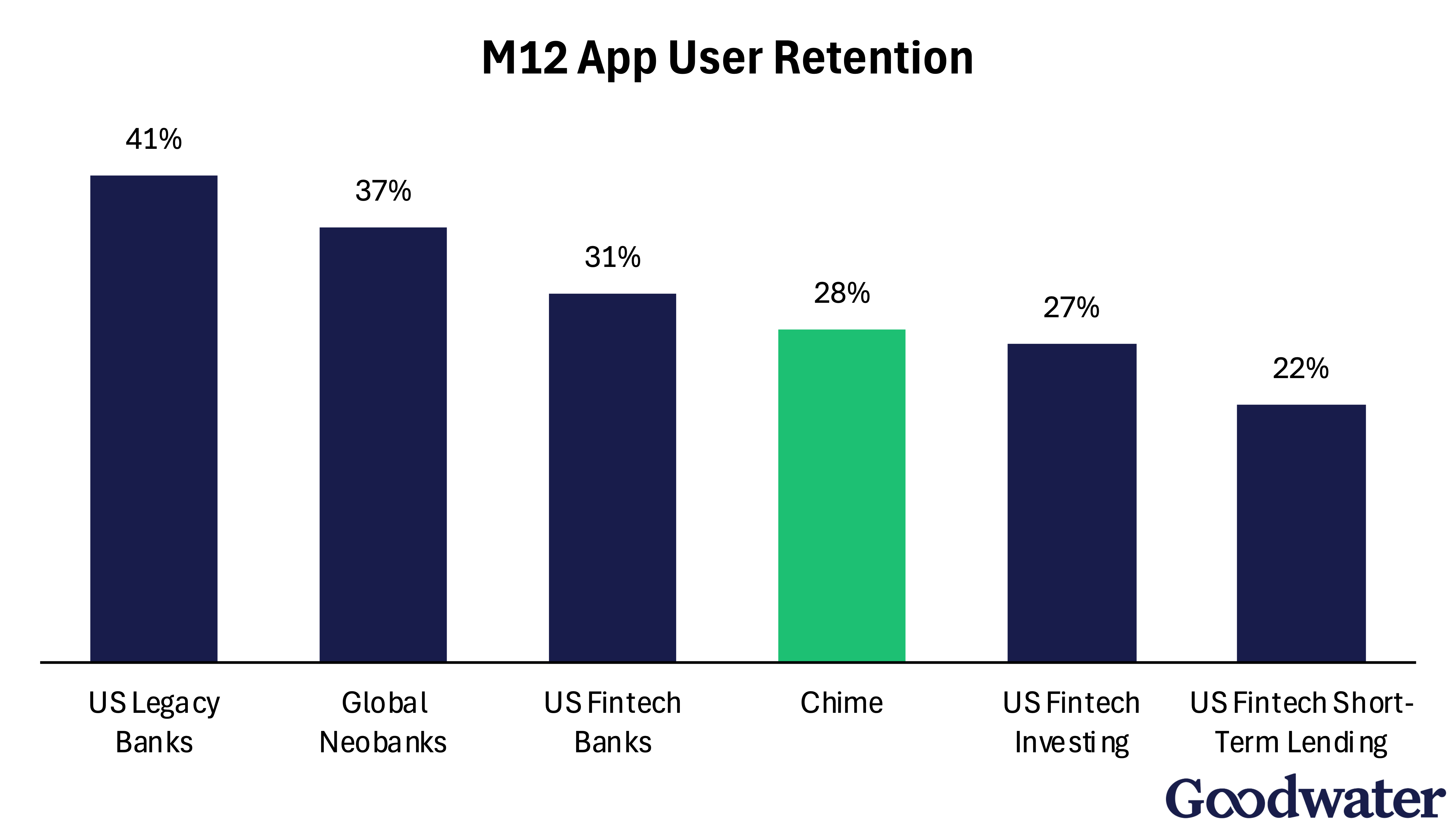

Lower Retention

Different products and different customers can demonstrate vastly different retention profiles, even across the consumer fintech landscape. One of the most important metrics for consumer fintech apps is the retention rate of their product after a year. Since every customer touches their smartphone hundreds of times a day, a fintech app that still still engages their customers after 12 months has likely become a core utility in that user’s life.

Legacy banks (e.g. Chase, Bank of America) have the highest retention. Expansive product portfolios, trust built over decades, and an omni-channel presence have made it such that users are likely to be retained. On the flip side, fintechs that offer short-term lending like cash advance, have much lower retention. This shouldn’t come as a surprise – no one wants to be stuck using these products forever. They want to move upwards financially and if they can accomplish that, there is no reason to stick around. If they are unable to move upwards, then there is also a chance that they will churn due to default.

Conceptually, Chime has elements of both. By offering a banking product, they naturally command higher retention. However, key components of their value proposition and user base are closer to fintech short-term lending. This explains their M12 retention figure of 28%, which sits between the banks and short-term lenders.

Taking all of these factors into account, we should expect that Chime has lower customer lifetime value (CLTV) than its upmarket banking competitors, driven by both lower ARPU and lower retention. However, Chime’s massively lower CAC could offset this enough such that CAC paybacks are faster for them than other banks, enabling their growth. But acquisition costs for the marginal new user almost always go up over time as a company reaches scale and competition develops. Thus, Chime must lean into other avenues of growth. This frame of reference helps us understand how the business has evolved in recent years.

Recent Performance

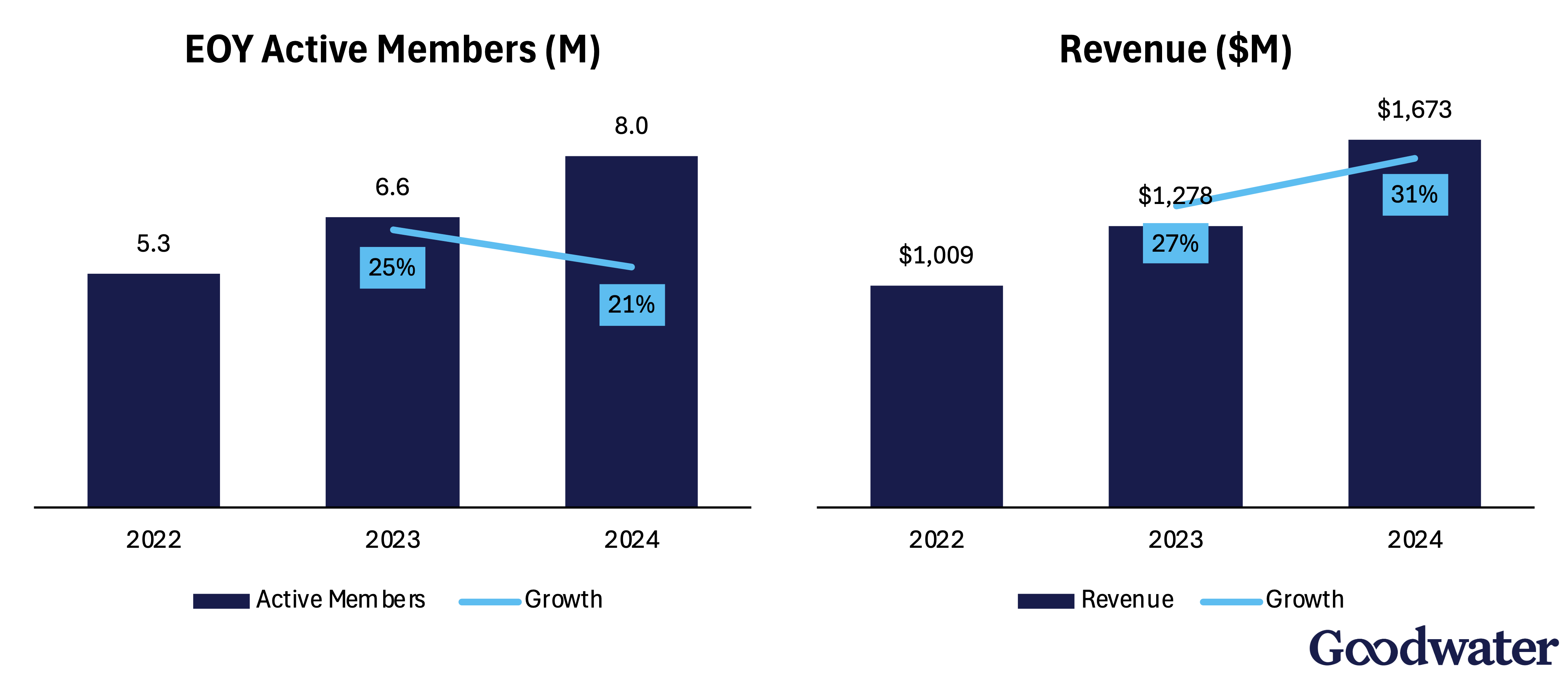

Changing Growth Dynamics

Chime has seen fairly consistent user growth in the past 3 years, managing to achieve 21% YoY growth in 2024. Revenue has grown faster, at 31%, demonstrating that the value of each user is increasing on the platform.

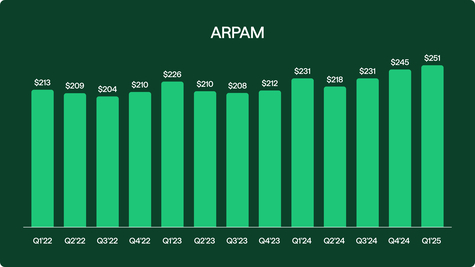

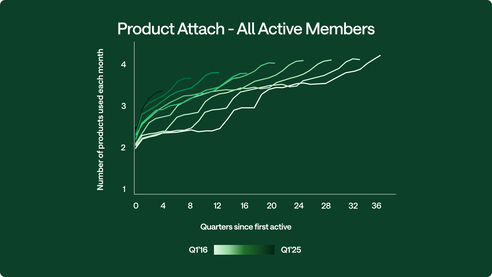

Chime’s average revenue per active member (ARPAM) has seen a steady increase in the past year. Most impressive (and a clear indicator of their current focus) is the product attach rate over time.

Increased Focus on Cross-Selling

Chime has expanded its product portfolio over time and been successful in getting its user base to use these new products. A typical user is now using more than 3 products just one year into their Chime journey. This diversification is being reflected in the company’s revenue. In 2023, non-payments revenue (including ATM fees, instant transfer fees, interest, etc.) was just 20% of total revenue. These sources are now 28% as of Q1 2025 and will presumably continue to grow.

Another way to understand Chime’s propensity for cross-selling is through user metrics. Typically, platforms that command high frequency from users have higher success in cross-selling. Global fintech leaders such as Nubank, Toss, Monzo, and Revolut have high cross-sell ability due to massive engagement with core features.

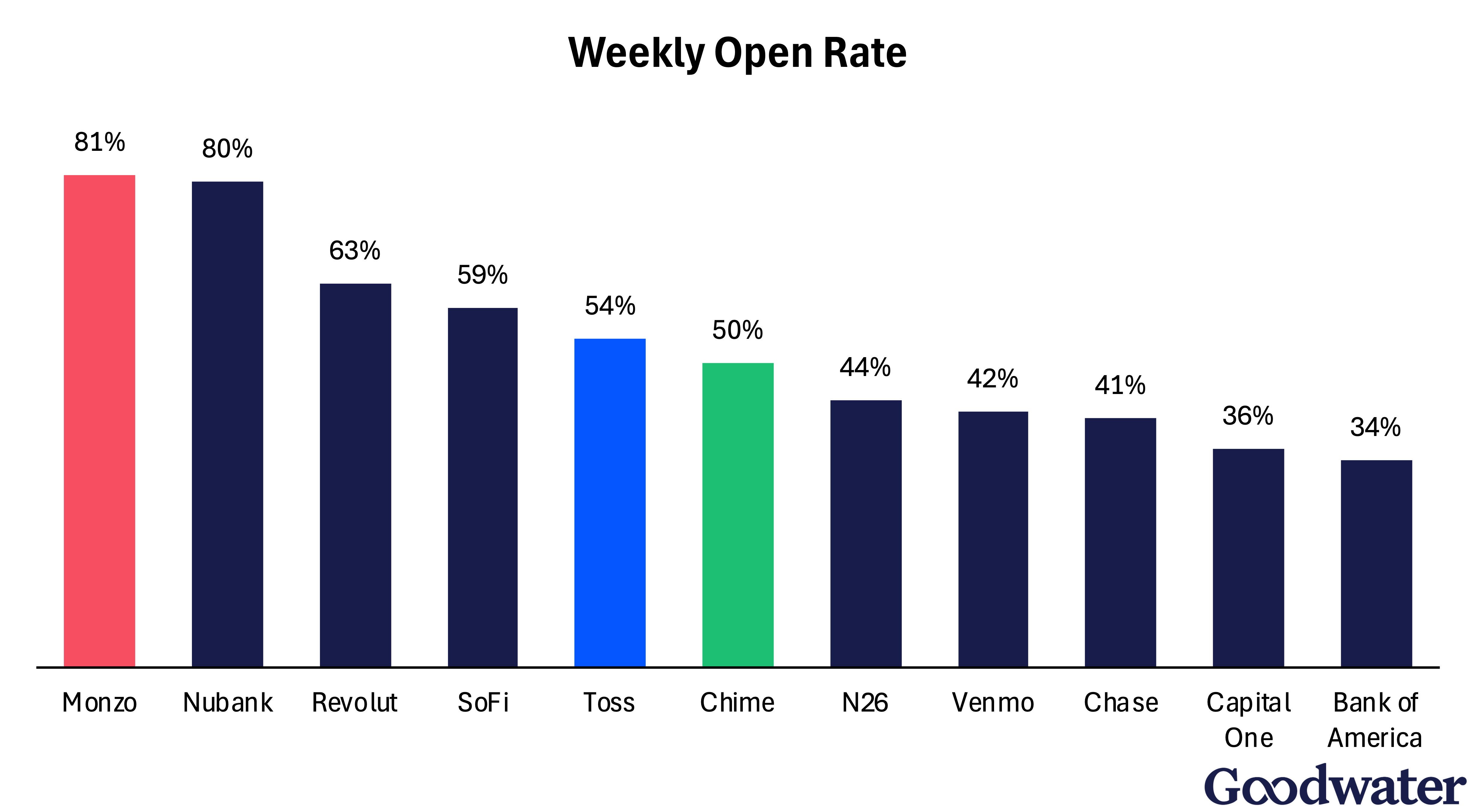

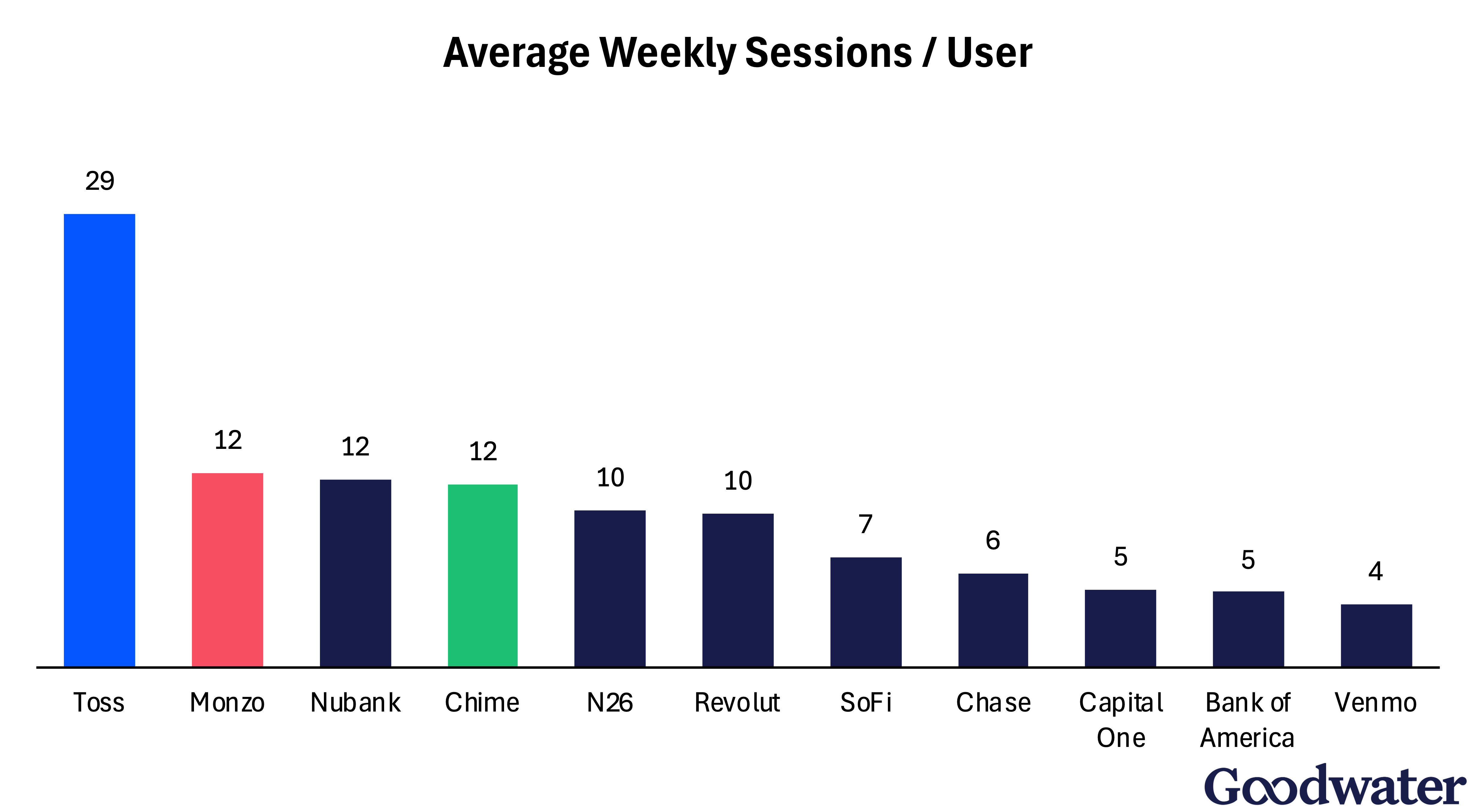

Digital banking products see much higher engagement from their user base than traditional banks.

Weekly open rate gives us a sense as to the fraction of the install base that interacts with a platform on a given week. Monzo and Nubank have some of the highest rates of weekly interaction out of all fintech companies. Though Chime has a lower weekly open rate, it still has a substantial advantage over its legacy competition.

Average weekly sessions per user tells us how frequently an active user interacts with the platform in a given week. Toss, thanks to its large feature set including banking, P2P payments, investing, insurance, credit, and more, is a clear outlier here. It has more than double the weekly sessions as the next highest frequency fintech platform. Excluding Toss, Chime is amongst the platforms with the highest weekly interactions per active user.

Put together, Chime has successfully built a platform where users engage much more frequently than some of its direct competition. Considering that 26% of active members are already using a product launched just last year (MyPay), it would seem that their cross-sell mechanism is working.

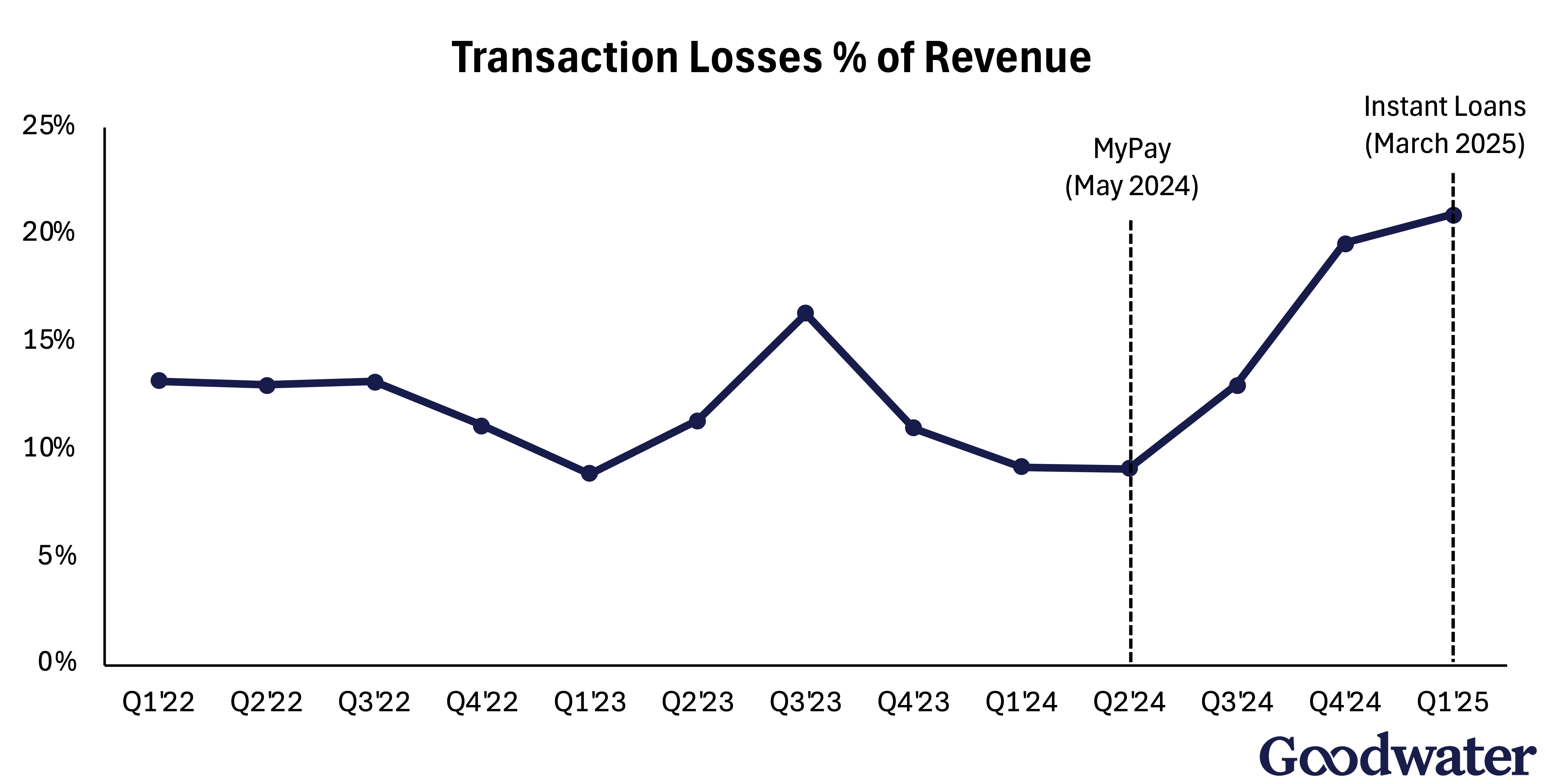

A Cautionary Tale

With all of these successes in new lending products, the company will need to grow a new muscle in loan underwriting. From the S-1, the company notes that “following the launches of MyPay and Instant Loans, we expect that transaction margin will remain flat or decrease further” due to the credit risk and losses associated with the product. Transaction losses have already increased steadily since the launch of MyPay. Instant Loans could only accelerate that further and Chime wouldn’t be the first fintech to face underwriting challenges as they go upwards in loan size.

What is next for Chime?

In order to continue compounding its financial performance and growing its franchise, Chime can potentially move in several directions:

Complete the Financial Services Journey

On March 21st, 2025, Chime launched its first interest-bearing product, Instant Loans. This product allows users to take out a 3 month installment loan of up to $500 with a fixed interest rate of $5 for every $100 borrowed. This is likely the best indicator of the direction the company is heading.

There are a lot of products a Chime customer likely is looking for, whether that is an unsecured credit card, personal loan, or car loan. Chime’s “best” customer – the one that makes the most money, spends the most, and doesn’t incur any losses for the company – has nowhere to go with the current Chime product portfolio. Retaining these users with new loan products can be key to increasing ARPU, long-term retention, and margins, driving up CLTV.

Become a Bank

Obtaining a bank charter offers Chime more flexibility in the products they offer and lowers the cost of doing so. Typically, working with a partner bank means that (1) a portion of interchange revenue / deposit interest must be shared with the banking partner and (2) lending of customer deposits is not allowed. A banking charter will give Chime some cost reductions on their existing business, but what may be more impactful is how it can reduce cost of capital, which gets more important as Chime extends into other lending products.

There are costs associated with becoming a chartered bank and it is a process that takes a meaningful amount of time and capital. Additionally, Chime states four times in their S-1 that they are a “technology company, not a bank.” We believe obtaining a charter is worth doing long-term but it is not a foregone conclusion for them.

Go Upmarket

Chime could go further upmarket, offering products that appeal to prime credit / higher income users. Clearly, these products are high retention and profitable for the financial institutions that offer them today.

However, they will face stiff competition and it could be misguided for the company to move in this direction. Prime credit and higher income consumers don’t have substantial pain points in financial services that are unsolved by current providers. They also tend to be very loyal to their existing financial services providers, which means high switching costs and CACs for a new entrant like Chime. The only way upstarts have been able to compete in this category is by giving up margin to incentivize customers, and that historically hasn’t gone well.

Conclusion

Chime has built something remarkable. They’ve built an ideal product for a segment of lower-income customers that many banks begrudgingly service. They offer these customers a great experience and have built a profitable business in the process. Plenty of other fintechs have attempted and failed to accomplish what Chime has been able to.

Looking ahead, Chime is facing several pressures. Competition in this space, particularly in short-term lending, has intensified from every direction. Their customers are also structurally less loyal and less profitable. As the company moves to higher ARPU products, they need to build new capabilities (e.g. loan underwriting) that competitors have mastered.

But Chime still has many opportunities ahead. By our measure, less than 10% of their addressable market are active members. Growing economic headwinds could increase the number of users looking for a product like Chime, making it easier for them to acquire customers. Chime has also already solved the hardest challenge (building their initial user base) and future product expansions can leverage that position to offer more profitable products. No matter the levers they decide to pull for growth, we can expect that the Chime team will continue to leverage their understanding of the Chime customer and open new doors.